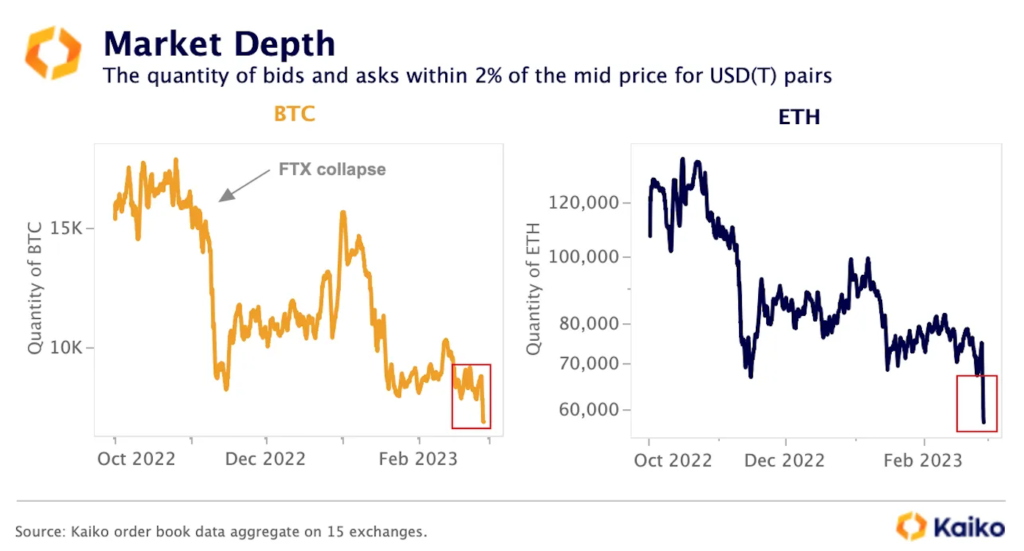

Liquidity in the Bitcoin (BTC) and Ethereum (ETH) markets continues to decline, making it more worrying than it was three months ago. As such, traders are concerned about sharp price volatility in the cryptocurrency market.

Liquidity refers to the market’s ability to absorb large buy and sell orders at a stable price. A commonly used metric to assess the liquidity situation is the 2% market depth, i.e. the volume of buy and sell orders that are within 2% of the median price or the average of the bid and ask prices.

The greater the thickness, the more liquid the asset is said to be, and vice versa.

Data from Paris-based cryptocurrency data provider Kaiko shows that the 2% depth of the Bitcoin-USDT pair on 15 centralized exchanges is lower than immediately after the FTX collapse in November, the lowest since May 2022. It turned out to be depressed to the low 6800 BTC. This is a significant drop from October’s 15,000-plus BTC level. Ethereum’s 2% depth is 57,000 ETH, more than halved since October.

“Lower liquidity means more drastic moves, especially for altcoins,” said Matthew Dibb, chief investment officer at Astronaut Capital.

“Some charts, such as the recent STX, have ‘compromised’ as funds looking to trade larger sizes are forced to implement TWAP strategies over longer time periods (days to weeks),” said Dibb. It looks like,” he added.

A time-weighted average price (TWAP) strategy is a well-known algorithmic strategy that focuses on bringing the average execution price closer to the time-weighted average price of an asset. In other words, breaking large orders into smaller orders and executing them at regular intervals minimizes the impact on market movements and reduces slippage.

Slippage refers to the difference between the expected price at the time of trading and the price at which the transaction is actually executed. Slippage usually occurs when markets are illiquid or volatile.

“But realistically, reduced market depth means that most large funds are not participating at the same level as before due to slippage,” said Dibb. The move by large institutional investors currently offloading the coin will have profound implications for the market, he added.

Bitcoin and Ethereum 2% Depth Still Below November 2022 (Kaiko)

Bitcoin and Ethereum 2% Depth Still Below November 2022 (Kaiko)This drop in market depth occurred amidst lower volatility expectations in the Bitcoin market. According to Griffin Ardern, volatility trader at crypto manager Blofin, this kind of situation often leads to sudden volatility explosions.

The Bitcoin Volatility Index (BVIN), which measures implied volatility over the next 30 days, has fallen to 56.39, its lowest since at least early 2021, according to CryptoCompare data.

According to data tracked by Amberdata, Bitcoin’s 7-day diversified risk premium, the difference between 7-day implied volatility and 7-day realized volatility, has turned negative. This suggests that short-term volatility expectations are underestimated.

“It creates an environment conducive to high volatility,” Ardern said. Market volatility will be amplified,” he added.

A market maker maintains a market-neutral portfolio by always standing on the other side of an investor’s trades, buying and selling underlying assets as prices fluctuate. Their hedging activity is known to affect Bitcoin’s spot market price, which could have a significant impact given the lack of market depth right now.

Liquidity in the cryptocurrency market began to dry up in mid-November, following the collapses of Alameda Research and FTX in November. Alameda was a prominent market maker providing billions of dollars of liquidity for small and large tokens. As a result, several arbitrage and high-frequency trading firms have collapsed and prominent market makers like Genesis have been hit.

“I think the FTX debacle affected every major market maker to one degree or another,” said Dick Lo, founder and CEO of TDX Strategies. “As a result, some liquidity providers have reduced or halted their market-making activities as part of their efforts to mitigate risk.”

“There is also a move to move positions to decentralized exchanges (DEXs) to minimize counterparty risk, and trading volumes on popular decentralized exchanges like GMX are increasing,” said Lawrence. added Mr.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Kaiko

|Original: Crypto Traders Worried About Continued Liquidity Thinning in Bitcoin and Ether

The post Bitcoin and Ethereum Continue to Decline in Liquidity ─ Traders Concerned About Rapid Volatility | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

119

2 years ago

119

English (US) ·

English (US) ·