- Bitcoin and Ethereum underperformed MKR and XLM in the CMI rankings this week.

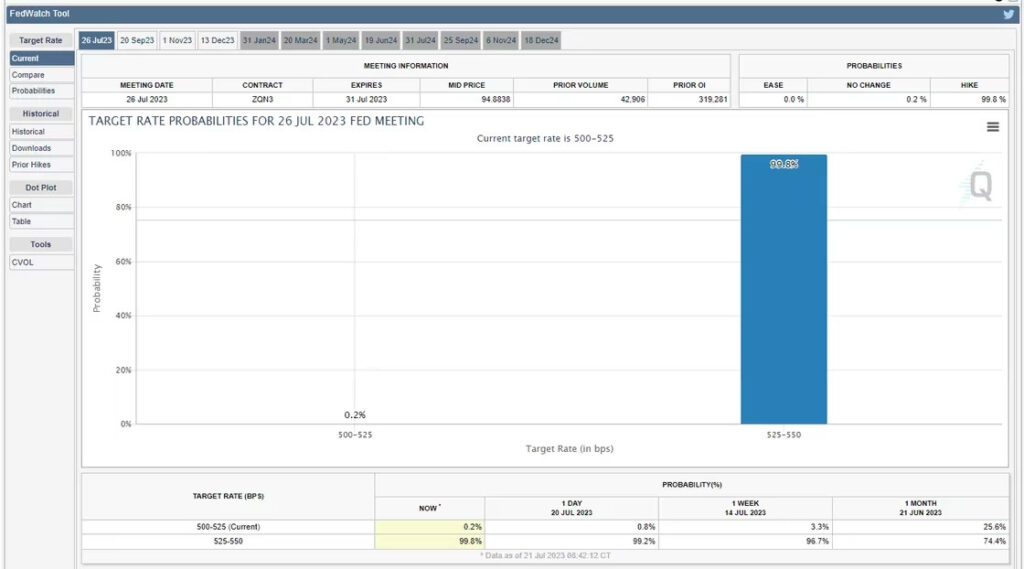

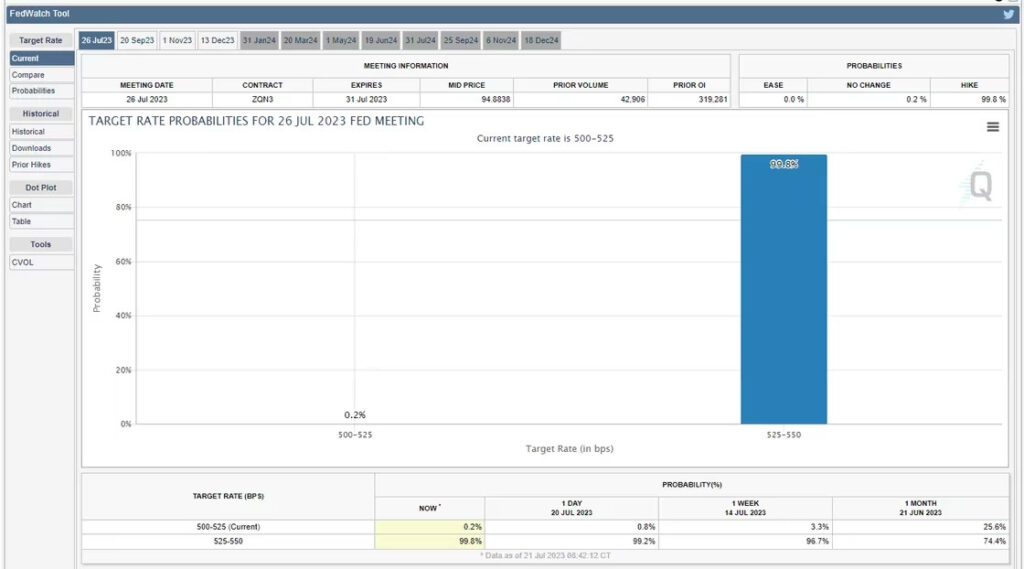

- A 25 basis point rate hike is widely expected in the market, but the focus will be on the Fed’s interest rate decision next week.

price movements stagnant

Bitcoin (BTC) continues its month-long stagnation, trading below 2% for the fourth consecutive week. Directionally, it fell 1.3% this week after gaining 0.3% last week. With 10 days left in July, Bitcoin is likely to see its second monthly decline in 2023.

Ethereum (ETH) gained 3.24% last week and fell 1.63% this week. The direction is the same as Bitcoin, but the range of price movements is wider. Ethereum has yet to see a monthly decline this year, but needs to break above $1,934 over the next 10 days to sustain its year-to-date monthly gains. July has historically been a strong month for digital assets.

Lower performance than other crypto assets

Bitcoin and Ethereum ranked 26th and 29th, respectively, when comparing seven-day performance among crypto assets (virtual currencies) with a market capitalization of more than $1 billion (about 140 billion yen).

Weekly top is a lending platform maker (MKR). It has risen more than 30% in the last seven days and more than 120% since the beginning of the year. Closely correlated with XRP (XRP), Stellar Lumens (XLM) also performed well, up more than 20%. XLM is up 117% year-to-date.

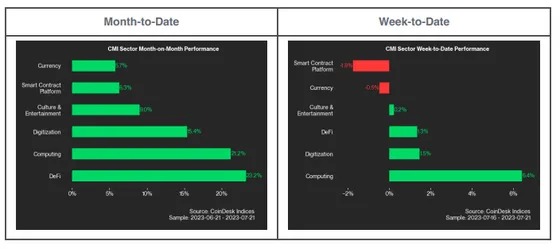

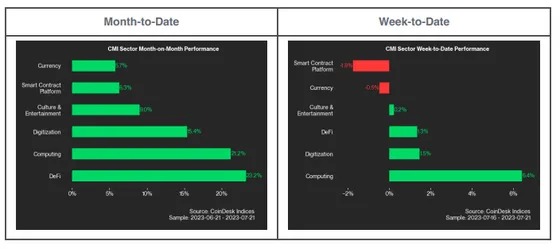

In the CoinDesk Market Indices (CMI) weekly rankings by sector, XLM topped the currency sector and MKR topped the decentralized finance (DeFi) sector.

CMI’s currency and DeFi sectors underperformed overall this week, ending the week with DeFi up 1.3% and the currency sector down 0.5%. The computing sector performed the best this week, up 6.4%.

A key component of the computing sector is Chainlink (LINK), an Oracle network that acts as a bridge between on-chain and off-chain environments. It’s up 45% year-to-date, but it’s up nearly 20% this week.

CMI’s weakest weekly performance was in the smart contract platform sector. This is due to poor performance of Proof of Work (PoW) Ethereum blockchain native token “ETHW” and MultiversX native token “EGLD”.

Focus on Fed policy rate announcement

Next week, attention will be focused on the Federal Reserve Board’s policy interest rate announcement scheduled for the 26th.

The Chicago Mercantile Exchange’s (CME) FedWatch tool currently gives a 99.8% chance that the central bank will raise rates by 25 basis points.

Fed Chairman Jerome Powell’s comments after the interest rate announcement will also be watched. Given recent macroeconomic data, Fed Chairman Powell is likely to repeat his comments from last month that, while inflation is declining, it is still unacceptably high and the Fed needs to renew its tightening stance.

|Translation: CoinDeskJAPAN

|Editing: Rinan Hayashi

|Image: Shutterstock

|Original: Bitcoin, Ether Headed Toward Losing Months in Usually Upbeat July

The post Bitcoin and Ethereum, declining trend in July, which was strong in the past | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

138

1 year ago

138

English (US) ·

English (US) ·