Macroeconomics and financial markets

Last weekend, on the 24th, the Dow Jones Industrial Average closed down 145 points (0.37%) from the previous day, and the Nasdaq index closed down 130 points (0.82%).

On the Tokyo stock market, the Nikkei Stock Average was down 14.5 yen from the previous day.

connection:Why Sumitomo Mitsui Card Platinum Preferred is rapidly gaining popularity as a new NISA savings investment

Virtual currency market conditions

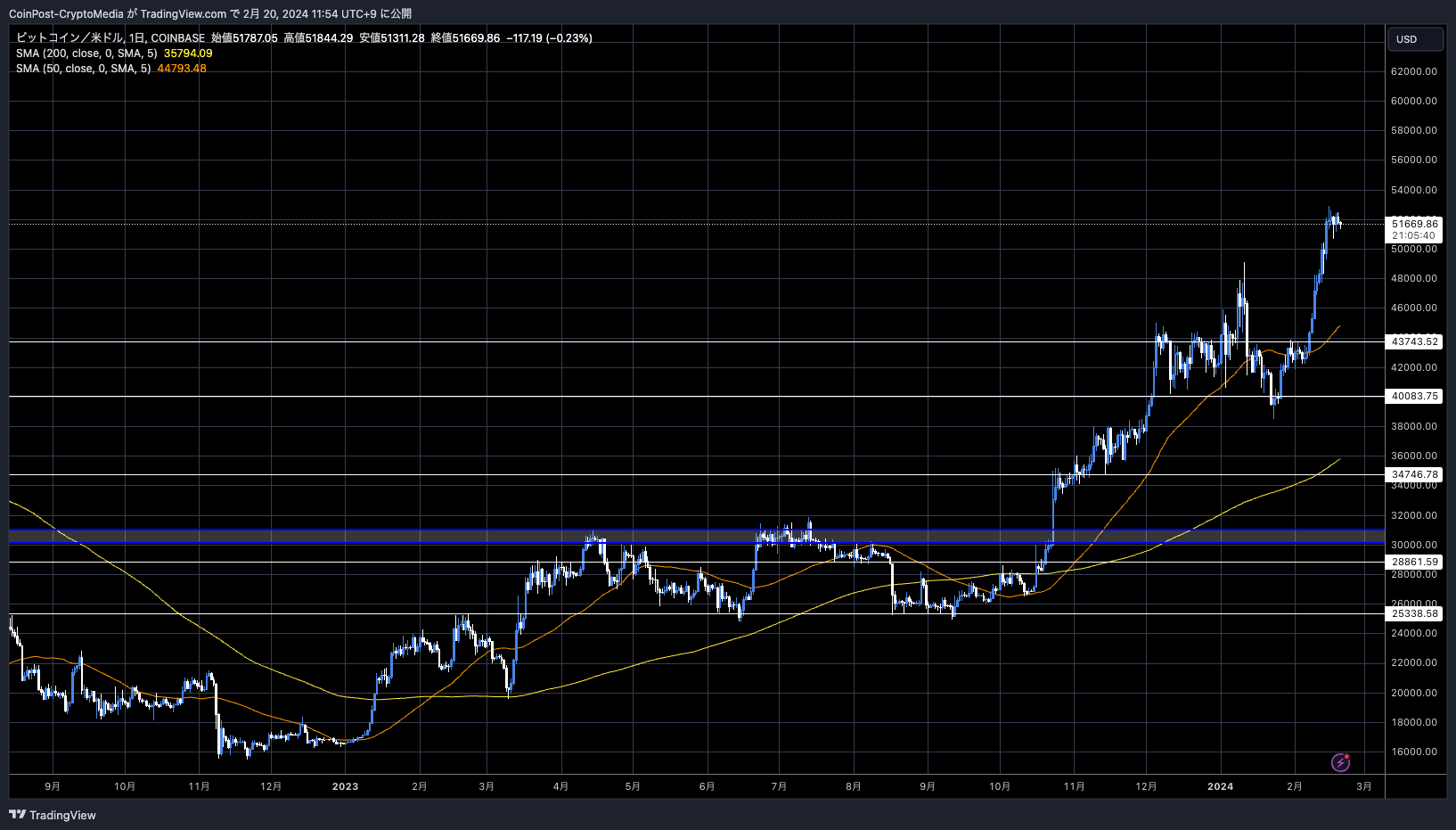

In the crypto asset (virtual currency) market, Bitcoin (BTC) rose 0.7% from the previous day to 1 BTC = $51,567.

BTC/USD daily

Among the major alts, Ethereum (ETH) rose 2.8%, XRP rose 1.4%, and Solana (SOL) rose 3.2%.

CoinPost app (heat map function)

Michaël van de Poppe mentioned the nature of the market, which tends to go against popular psychology. He points out that “market sentiment tends to overshoot and is often wrong,'' and if the market subsequently enters a correction phase, the correction could be as much as 40%. It is said that

The #Bitcoin chart looks great as the momentum is massive.

I'm expecting a short-term correction before a final push to $54-58K and then we're likely done with this current pre-halving run. pic.twitter.com/sq9GWn0N8M

— Michaël van de Poppe (@CryptoMichNL) February 19, 2024

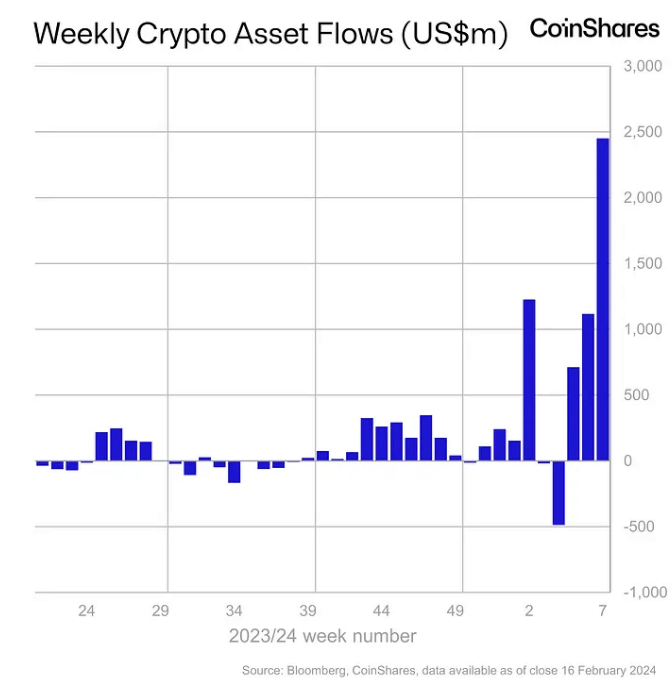

Net inflows into exchange-traded investment products (ETPs) hit a record $2.45 billion last week, according to asset manager CoinShares' weekly report.

CoinShares

99% of this is from Bitcoin spot ETFs (exchange traded funds) listed in the United States. BlackRock and Fidelity Bitcoin ETFs stand out, accounting for a whopping $2.3 billion in last week's inflows.

While inflows are accelerating, the outflow of Grayscale's investment trust Bitcoin Trust (GBTC) is $623 million, which is likely to be a positive for the market.

Along with this, the amount of assets under management has returned to the bull market level of December 2021.

connection:What is Bitcoin halving?Outlook for 2024 based on past market price fluctuations

Related: Points to note about virtual currency IEOs Domestic and international examples and how to participate

altcoin market

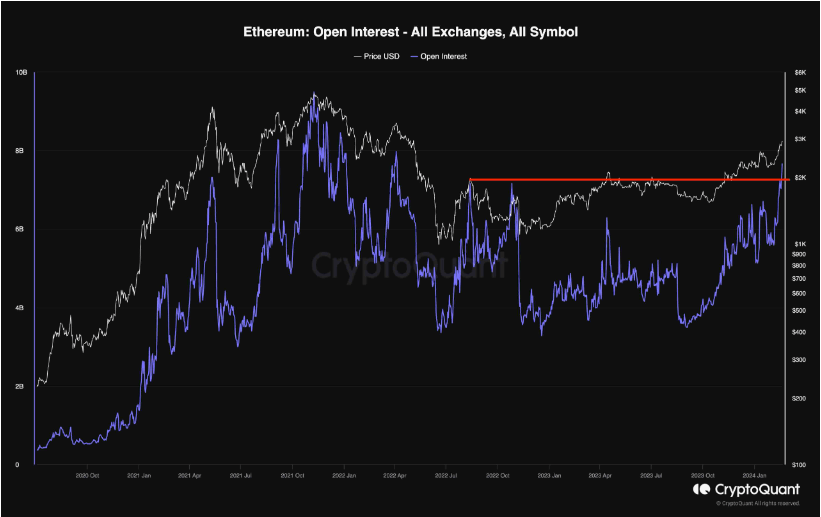

Ethereum (ETH) has been on the rise since early December 2023, but CryptoQuant analysts pointed out that the futures market is overheated.

OI (open interest), which is a factor in increasing volatility (price volatility), has reached the highest level in the past two years. When OI accumulates, a chain of stop-loss cuts (forced liquidations) is likely to occur when prices fall.

CryptoQuant (purple line: OI transition)

Behind the rise in ETH prices are the upcoming Ethereum Dencun update in March of this year, which aims to reduce layer 2 transaction fees, and expectations for the approval of the Ethereum spot ETF.

connection:Ethereum next upgrade Dencun, mainnet launch on March 13th

Investment company Bernstein has pointed out in a research report that “Ethereum ETF is likely to be approved within this year,'' pegging the approval probability by May of this year at about 50%, and predicting approval within 12 months. See it for sure.

Applications for Ethereum ETFs have been filed with the US SEC (Securities and Exchange Commission) by major asset management companies including BlackRock and Fidelity.

Among other stocks, Pixel (PIXEL), a pixel art-like blockchain game based on Ronin (RON), soared. The listing on Binance, the largest crypto asset (virtual currency) exchange, and the announcement of handling on the Binance launch pool are likely to be factors.

connection:Binance newly lists Ronin Chain's game “Pixels” token 20% higher

Related: Explaining the advantages of staking and accumulation services and the advantages of virtual currency exchange “SBI VC Trade”

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin and Ethereum futures markets are trading in the $50,000 range, with signs of overheating appeared first on Our Bitcoin News.

1 year ago

109

1 year ago

109

English (US) ·

English (US) ·