Macroeconomics and financial markets

In the US NY stock market on the 23rd, the Dow rose $108.82 (0.33%) from the previous day and the Nasdaq rebounded $82.33 (0.72%).

Since it fell sharply by about 700 dollars on the 21st, there is a view that it is a rebound against the background of a pause in the rise of US long-term interest rates.

On the other hand, the Minutes of the Federal Open Market Committee (FOMC) issued a cautious outlook, stating, “We are not yet convinced of the effects of curbing inflation,” while almost all participants agreed that a slowdown in the pace of interest rate hikes would be appropriate. I supported the recognition that there is.

In recent years, due to the upside of several economic indicators such as the employment statistics, the US Federal Open Market Committee (FOMC) forecast for an interest rate hike of 0.50bps in March has risen to about 25%, and the market has strengthened its wait-and-see trend. ing.

connection:NY Dow and Nasdaq rebound, announcement of revised figures for US quarterly GDP and personal consumption expenditure, etc. | 24th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.25% from the previous day to $23,982.

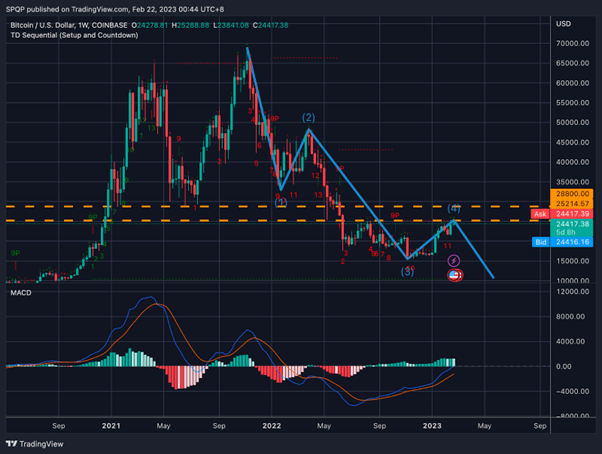

BTC/USD daily

The daily correlation coefficient between BTC and the S&P 500 turned negative (negative correlation) for the first time since the FTX collapse in November 2022. Will Clemente (@WClementeIII), an on-chain analyst, pointed out:

Bitcoin’s daily correlation to the S&P flipping negative for the first time since the FTX collapse pic.twitter.com/W4z0ePkxLR

—Will Clemente (@WClementeIII) February 21, 2023

Most recently, macroeconomic indicators such as the U.S. Federal Open Market Committee (FOMC) and the CPI (U.S. Consumer Price Index) showed large movements in stock indices, and a strong positive correlation was observed with virtual currency markets such as bitcoin. tended to be

QCP Capital market analysis

Crypto asset (virtual currency) trading company QCP Capital posted the latest report on the 22nd.

Regarding Bitcoin (BTC), he said that among different risk financial assets (cross assets) such as stocks and gold (gold), the most remarkable rebound has been seen since the beginning of the year.

Orange: BTC, Yellow: Nasdaq, Purple: Gold (QCP Capital)

In the technical analysis of the price, he pointed out the possibility of forming a “double top” against the return high in August 2022 and the low in May 2022. The correction wave of the Elliott wave is continuing.

The Elliott Wave is a period of 8 waves, 5 rising waves and 3 falling waves.

connection:Explanation of technical analysis “Elliot Wave” that you want to keep in mind for beginners

QCP Capital believes that the neckline of $28,800 to $30,000 will serve as a strong upward resistance at the bottom of the bull market in 2021, and it is valid to count “5 waves” until this line breaks. Indicated. Bitcoin’s momentum, meanwhile, is stronger than Ethereum’s.

QCP Capital

Regarding the macro economy, attention tends to be focused on the Fed (Federal Reserve System)’s further interest rate hikes and quantitative tightening (QT). He pointed out that it also worked positively on the crypto asset market.

Following the change of the governor of the Bank of Japan for the first time in 10 years, he said that he will keep an eye on changes in the monetary easing policy at the Bank of Japan meeting and China’s CPI (consumer price index) in the coming months. Signs that the People’s Bank of China (PBOC) will be forced to slow down its stimulus measures may appear after the second quarter, and if that happens, it will be negative for the crypto asset market.

According to QCP Capital’s forecast at the end of last year, the US financial authorities raised the Federal Funds (FF) interest rate to 5.5% and expected to maintain it until the fourth quarter (October to December 2023). He warned that stock prices could hit new lows in a situation called “stagflation,” in which recession and inflation progress at the same time.

connection:QCP Capital analyzes cryptocurrency market landscape in 2023

altcoin market

The price of Optimism (OP), a scaling solution for Ethereum (ETH) that utilizes technology, following the announcement of its own L2 (Layer 2) network “Base” by Coinbase, the largest crypto asset (virtual currency) exchange in the United States. was temporarily up 18% from the previous day.

OP’s trading volume jumped to $754 million in the past 24 hours, up from $458 million as of Thursday.

1/  We’re excited to announce @BuildOnBase.

We’re excited to announce @BuildOnBase.

Base is an Ethereum L2 that offers a secure, low-cost, developer-friendly way for anyone, anywhere, to build decentralized apps.

Our goal with Base is to make onchain the next online and onboard 1B+ users into the cryptoeconomy. pic.twitter.com/RmwZFJzGGs

— Coinbase (@coinbase) February 23, 2023

In addition to providing a network that is safe, inexpensive, and easy for dApps (decentralized application) developers to use, “Base” provides access to other L1 blockchains such as Solana (SOL), allowing users to participate in the crypto asset ecosystem. The goal is to function as a bridge to draw in.

The testnet environment has already been launched, and the roadmap for the mainnet launch is expected to be published within the next few weeks.

connection:Coinbase to Launch Ethereum’s Own L2 Network ‘Base’

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin and US Stock Correlation Turns Negative, QCP Capital Suggests Long-term Downtrend Continues appeared first on Our Bitcoin News.

2 years ago

137

2 years ago

137

English (US) ·

English (US) ·