Bitcoin (BTC) is under downward pressure on March 31 as billions of dollars worth of options expire and some traders place bearish bets on WBTC, the Ethereum-based wrapped version of traded.

Bitcoin, the number one cryptocurrency by market capitalization, failed to sustain above $29,000 on March 30, falling 1% in European time, according to CoinDesk data. totaled $27,546. At 0800 UTC, Deribit, the world’s largest crypto asset options exchange by trading volume and open interest, was worth more than $4 billion. Settled bitcoin options.

Bitcoin broke below $28,000 ahead of quarterly option expiration. (CoinDesk/Highcharts.com)

Bitcoin broke below $28,000 ahead of quarterly option expiration. (CoinDesk/Highcharts.com)Griffin Ardern, a volatility trader at crypto manager Blofin, told CoinDesk: “This price drop has been driven by the impact of deliveries and settlements, market makers selling spot and contracts to remain market neutral. It is likely,” he said.

Market makers create buy and sell orders to provide liquidity and generate income through bid-ask spreads while maintaining neutral exposure. They are always on the other side of the investor, often trading the underlying crypto assets in the spot market or buying and selling perpetual futures to balance bullish/bearish exposure in the options market.

Circumstantial evidence supports Ardern’s claims. Bitcoin fell from $28,100 to $27,546 in the hour ending 8:00 UTC. Deribit has settled quarterly options contracts at 8:00 UTC.

Anonymous Analyst’sChart tweeted by @52kskewshows that the cumulative volume delta (CVD) of the deribit-based perpetual futures market plummets negatively prior to settlement time. A positive CVD means that buyers are moving a lot, and a negative CVD means that sellers are moving aggressively.

$BTC Deribit market data

Deribit CVD & Delta showing the price impact of option expiry.

Typically occurs when large options open interest is near expiry & books need to be balanced out (delta neutral or hedged) https://t.co/J8M1NFgcti pic.twitter.com/0m7o9OQns9

— Skew Δ (@52kskew) March 31, 2023

Selling short what you borrowed?

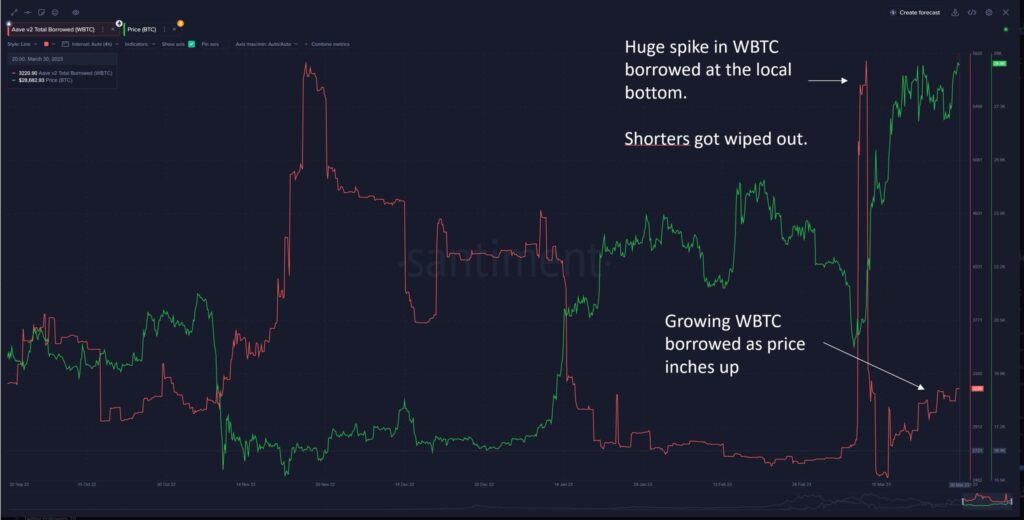

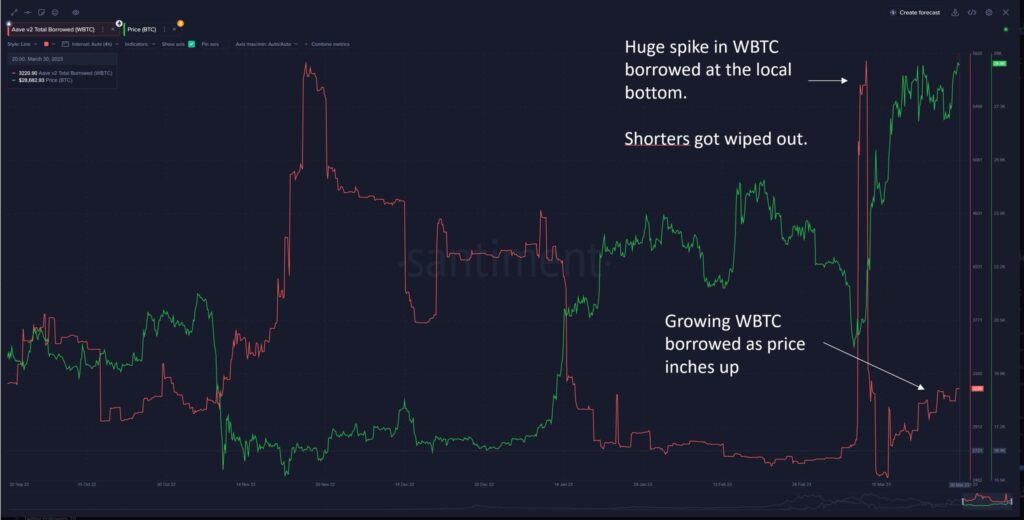

Selling borrowed WBTC, or shorting, may have played a supporting role in driving down prices. WBTC is the largest wrapped version of Bitcoin on Ethereum, the largest smart contract blockchain, and can be exchanged one-for-one with BTC.

The number of WBTC borrowed from the dominant decentralized lending protocol Aave has jumped 29% to 3,220 BTC in two weeks, according to data from Switzerland-based blockchain data firm Santiment.

Traders sometimes show a bearish view on Bitcoin by shorting WBTC tokens borrowed from DeFi platforms like Abe.

“It’s not too out of the ordinary to see WBTC’s cautious borrowing, but it also looks like people have started shorting,” Santiment said in a market update.

The growing number of WBTCs borrowed from Abe is evidence of renewed interest in making indirect bearish bets on Bitcoin. (Santiment)

The growing number of WBTCs borrowed from Abe is evidence of renewed interest in making indirect bearish bets on Bitcoin. (Santiment)Santiment noted that the peak in the amount of WBTC borrowed from Abe coincided with a trough in the price of Bitcoin.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: CoinDesk/Highcharts.com

|Original: Bitcoin Drops Below $28K as Options Expire, Traders Borrow WBTC From Aave

The post Bitcoin breaks below $ 28,000, partly due to option expiration | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

191

2 years ago

191

English (US) ·

English (US) ·