The post Bitcoin (BTC) Price Hints Bullish Rebound, Eyes To Hit $66K? appeared first on Coinpedia Fintech News

Irrespective of the consolidated price action, Bitcoin has recorded a new ATH in its hash rate. This indicates more involvement of miners in this technology. Further, the dominance of BTC currently stands at 56.3% and is on the verge of recording a new yearly high.

With this, questions like “Is this the right time to buy Bitcoin?’ and “How high will BTC go this year?” have stormed the internet. Scroll down as we have made a detailed article covering various aspects of Bitcoin just for you.

BTC Price Successfully Retests Its Important Support Zone

After trading under a bearish influence for over a week, the Bitcoin price has recorded a bullish recovery by adding 1.68% in valuation over the past day. Moreover, it has successfully retested its important support zone in the 1D time frame.

This suggests a strong buying pressure for the price of Bitcoin at that point in the market. Moreover, it has been trading within a descending channel pattern since May. Further, it has also formed a symmetric triangle pattern and is on the verge of testing its support trendline. This suggests uncertainty in future price action.

Bitcoin Market Sentiments

The Simple Moving Average (SMA) is on the verge of recording a bullish convergence in the 1D time frame. This indicates an increase in the price action for the star crypto in the market.

Further, the RSI indicator continues hovering below its neutral point. However, the average trendline shows a potential positive crossover. This highlights a high possibility of a bullish bounce back during the upcoming weeks.

Bitcoin Mining Difficulty Increases, Bullish Reversal Incoming?

Amid increased volatility in the crypto market, the Bitcoin hash rate has recorded a new All-time High (ATH) of over 740 exahashes per second (EH/s). The rising difficulty in mining highlights the increased contribution of miners towards the network and to procure more SATS with additional resources.

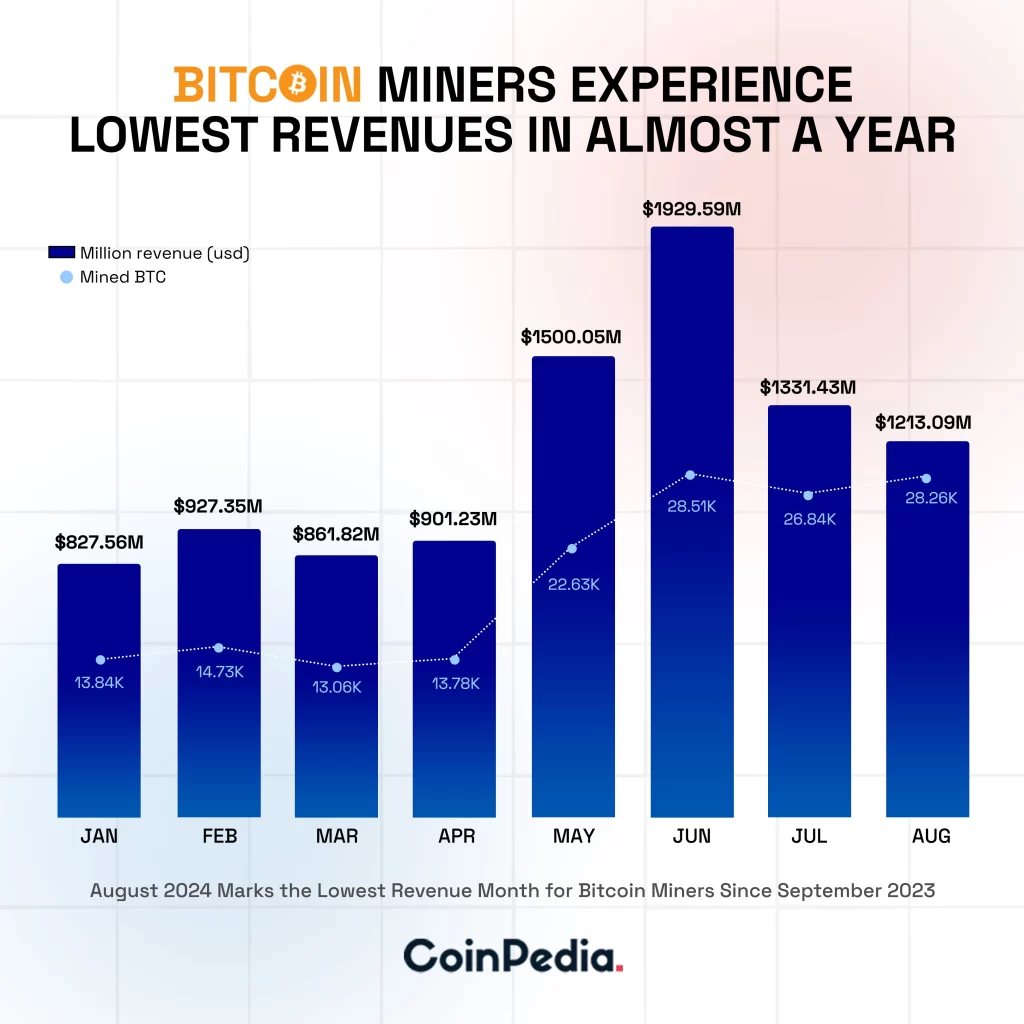

On the other hand, during August, the Bitcoin miners experienced the lowest revenue since September 2023. Reportedly, 28.26K Bitcoins were mined with a revenue of $1,213.09 Million.

Source: CoinPedia

Source: CoinPediaDespite mining 1.42K more BTCs when compared to July, the miners have reported a drop of $118.34 Million, or 8.83% in their revenue. Notably, with the conclusion of August, miners have recorded a drop in revenue for the second consecutive month.

Considering the historic market trend, a rising hash rate and decreased mining revenue indicate a potential accumulation of Bitcoins by long-term investors. Moreover, with increased whale/institution activity, a strong bullish rebound can be expected from BTC in the coming time.

Will BTC Rise Again?

Suppose the market continues gaining momentum, in that case, Bitcoin price will retest its resistance level of $62,000. Pushing its price above that level could set the stage for the largest crypto to head toward its upper high of $66,000 during September.

On the flip side, if a trend reversal occurs, the BTC crypto could drop toward its support level of $58,000. Furthermore, if the bears continue to dominate the market, this could result in it plunging toward its lower support level of $53,500 in the coming time.

Read our Bitcoin (BTC) Price Prediction 2024-2030 for a long-term overview!

11 months ago

40

11 months ago

40

English (US) ·

English (US) ·