Bitcoin (BTC) is showing signs of strength, rebounding from key support levels fueled by positive on-chain data. As institutional interest picks up, including inflows to Bitcoin ETFs, the cryptocurrency is aiming for a rally towards $60,000.

With reduced selling pressure from miners and a tightening supply on exchanges, the bullish momentum builds amid macroeconomic uncertainty, with US inflation data and the upcoming presidential election in focus.

Positive on-chain data signals bullish sentiment for Bitcoin

At the time of writing, Bitcoin is trading at $58,110.17, with a 2.5% increase over the past 24 hours. It remains comfortably above the 100-hour Simple Moving Average and has cleared key resistance at $57,500.

Immediate resistance now stands at $58,500, with a potential breakthrough pushing the price toward the psychological $60,000 mark.

While investors remain cautious as the upcoming US Consumer Price Index (CPI) report could introduce volatility to the market, recent on-chain data indicates a bullish outlook for Bitcoin (BTC) as it consolidates gains above $58,000 and eyes further upside.

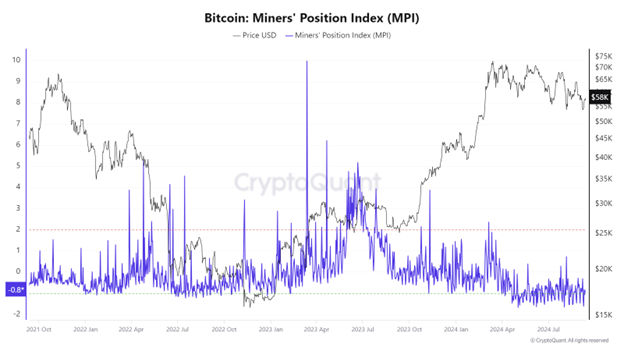

One of the key on-chain pointers behind the current optimism is the behaviour of miners, who have significantly reduced selling pressure.

The Miners’ Position Index (MPI) is currently at -0.82 according to CryptoQuant data, signaling confidence from miners as they hold onto their assets, contributing to reduced supply on exchanges.

Source: CryptoQuant’s Bitcoin MPI data

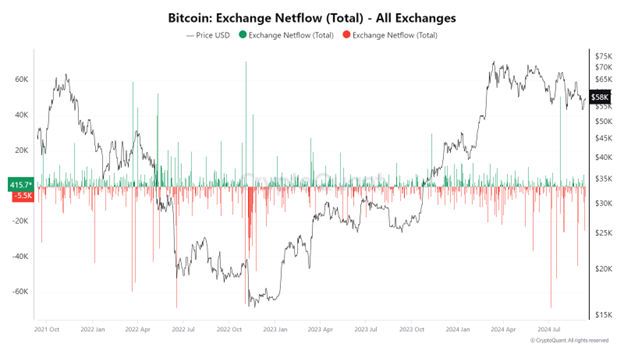

Source: CryptoQuant’s Bitcoin MPI dataMoreover, exchange flow data is showing a negative balance, which implies that more Bitcoin is leaving exchanges than entering, suggesting that investors are accumulating rather than selling.

A decline in exchange-held Bitcoin of around 2% in the past few days reinforces this bullish narrative.

Source: CryptoQuant’s Bitcoin Exchange Netflow data

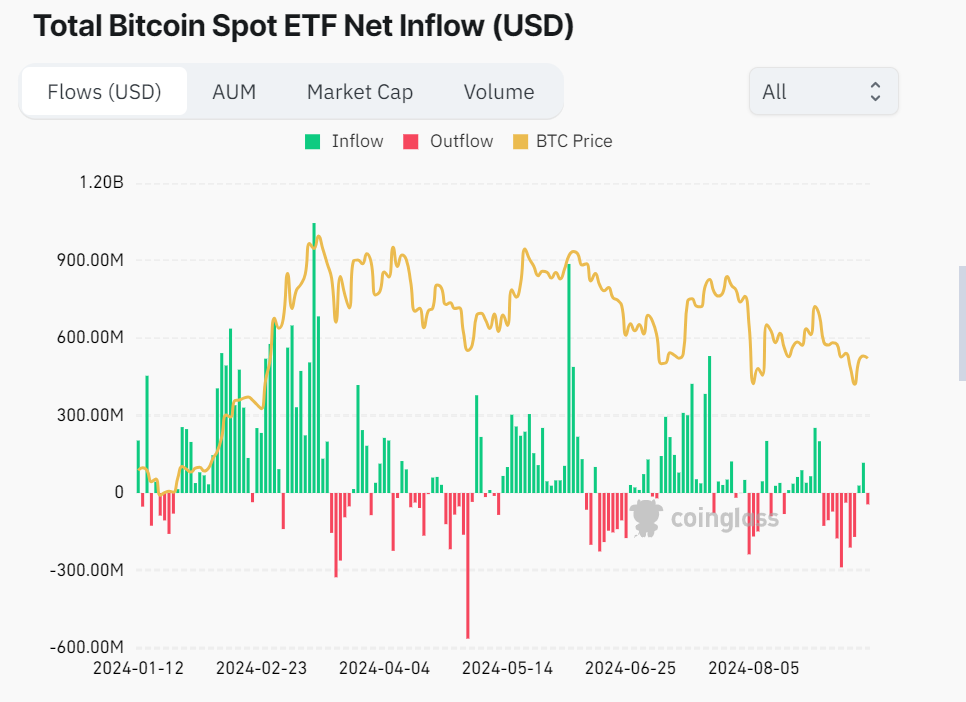

Source: CryptoQuant’s Bitcoin Exchange Netflow dataThe reduced supply is coupled with a surge in demand, as seen by two consecutive days of huge inflows into US Bitcoin Spot ETFs, totalling $117 million although this seems to have broken seen there have been some significant outflows today.

Source: Coinglass

Source: CoinglassThese inflows signal an improvement in market sentiment and reflect increasing institutional interest, adding upward pressure on the price.

Election uncertainty and macroeconomic factors

While on-chain data remains positive, external macroeconomic and political factors could influence Bitcoin’s short-term price action. The upcoming US presidential election has caused a growing partisan sentiment in the cryptocurrency space.

Many investors believe that a victory by former President Donald Trump could provide a short-term price boost, possibly pushing Bitcoin to a new all-time high near $80,000, while a Kamala Harris win could introduce some initial sell pressure.

However, despite this speculation, many experts, including Steven Lubka of Swan Bitcoin, argue that Bitcoin’s long-term prospects are tied more to fiscal and monetary policy than political outcomes.

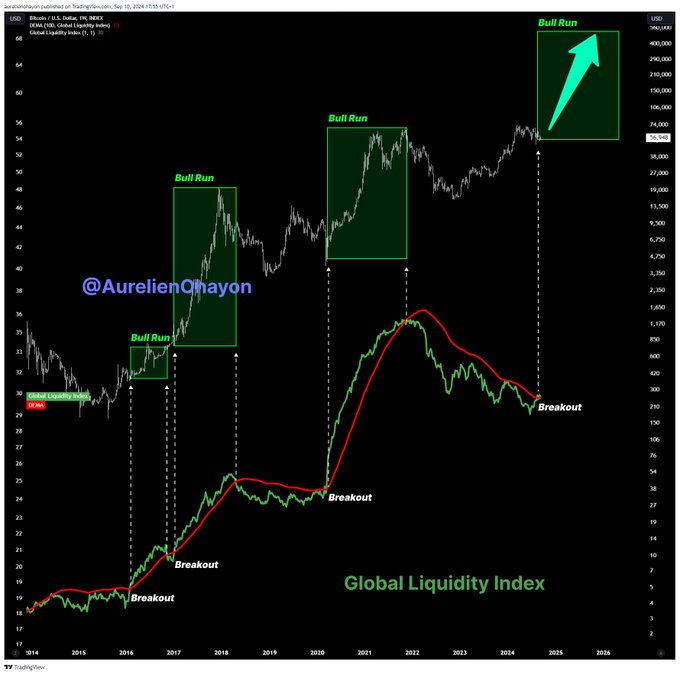

Others like Aurelien Ohayon are optimistic that Bitcoin is on cause for a major bull run citing “Global Liquidity Index breakout.”

#BITCOIN BULL RUN BEGINS 🔥🔥🔥 Every time there’s a Global Liquidity Index breakout, a Bull Run begins.

Additionally, the broader macroeconomic landscape remains a factor. The US Federal Reserve’s decisions on interest rates are closely watched, with analysts suggesting that Bitcoin could benefit from a potential rate cut later this year.

The August CPI report is a key metric for gauging inflation and could either dampen or accelerate Bitcoin’s momentum.

Investors are watching closely as inflation data could influence the Fed’s stance on monetary policy, impacting the broader crypto market.

Overall, Bitcoin’s resilience amid macroeconomic uncertainty and its strong on-chain fundamentals suggest that it is well-positioned for continued gains.

With a focus on key resistance levels and the potential for further institutional inflows, the stage is set for Bitcoin to make a push toward $60,000 in the coming weeks.

The post Bitcoin (BTC) rebounds amid positive on-chain data, target at $60K appeared first on Invezz

English (US) ·

English (US) ·