Macroeconomics and financial markets

In the US NY stock market on the 8th, the Dow was down $58 (0.18%) from the previous day, while the Nasdaq, which is centered on high-tech stocks, was up $45 (0.4%), ending the trade somewhat rebounding.

As inflation (price rises) remains at a high level and concerns about prolonged monetary tightening are growing again, there is a deep-rooted sense of caution about a hard landing for the economy. The ADP Employment Report released on the same day also exceeded market expectations, giving an impression of the firmness of the labor market.

With the employment report on Friday, the US consumer price index (CPI) on the 14th, and the US Federal Open Market Committee (FOMC) meeting on the 22nd, the wait-and-see trend is likely to strengthen.

connection:US stocks NY Dow continues to fall Chairman Powell emphasizes that “nothing has been decided” regarding interest rate hike | 9th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

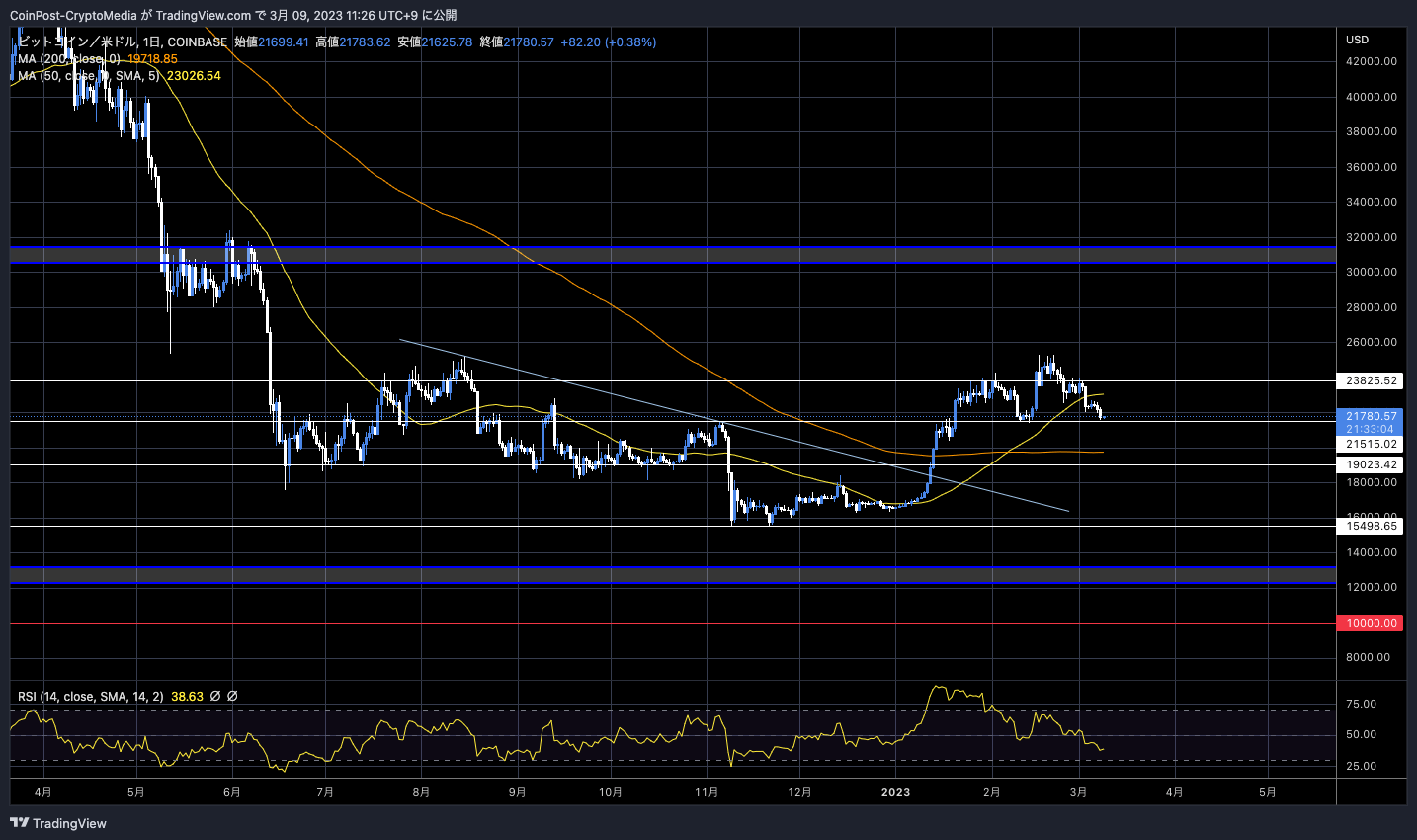

In the crypto asset (virtual currency) market, Bitcoin fell 1.75% from the previous day to $21,783.

BTC/USD daily

In the current market, market participants are easily influenced by major economic indicators and remarks by key figures, and it can be said that bitcoin’s price movement lacks independence, just following the dollar index and the US stock index. If the price seems to break below the $21,500 support line (lower support line), there is a risk that the price will fall further to the lower end of the range (1BTC = $18,000 to $19,000) that was in dispute before the FTX collapse.

Inflation indicators have remained at a high level recently, and the hawkish remarks of the Fed (Federal Reserve) have led investors to become more risk-averse in the financial market as a whole. There is a conspicuous shortage of funds, such as falling across the board.

The share price of the parent company (holding company) Silvergate Capital plummeted in after-hours trading due to the suspension of business and the announcement of the liquidation of Silvergate Bank through the 9th, and the Wall Street Journal reported that the major US bank JP Markets were also weighed down by reports that Morgan Chase would end its “banking relationship” with cryptocurrency exchange Gemini. Gemini denies this.

Silvergate Bank announced on the 2nd that it would not be able to submit its annual report, including financial statements, on time.

Due to the bankruptcy of major exchange FTX in November last year, the assets under custody of customers at Silvergate decreased sharply, and the loss on asset sales increased, increasing the possibility that the capital adequacy ratio would fall below the stipulated capital adequacy ratio. The capital adequacy ratio is the ratio of net assets to total capital, and is one of the indicators of a company’s financial soundness.

detail:Cryptocurrency Provider Silvergate Capital Announces Liquidation of Banking Business

Mt.Gox pays off BTC for 9 years

Mt.Gox’s largest creditor, the Mt.Gox Investment Fund (MGIF), has not sold Bitcoin due to be repaid by September, Bloomberg reports. He indicated a policy of holding. said a source familiar with the matter.

Mt.Gox is a cryptocurrency exchange that went bankrupt in February 2014 after causing a cryptocurrency fraud incident worth approximately 48 billion yen (the rate at the time).

In November 2017, when the virtual currency bubble occurred, the Tokyo District Court decided to cancel the bankruptcy proceedings in order to maximize creditor profits, and instead of returning cash at the bankruptcy rate, it was possible to distribute BTC as it is. Moved to procedures under the Civil Rehabilitation Law. In October 2009, the “revitalization plan” was approved.

Combined with Bitcoinica, the two major creditors who have also chosen “early lump sum repayment” and are said to indicate their intention to continue holding bitcoin, there is concern about selling pressure of about 30,000 BTC, which is equivalent to about 20% of the total scheduled repayment amount. retreated.

Bitcoinica is a New Zealand-based cryptocurrency exchange that used to hold Mt.Gox accounts (now closed). MGIF is a division of Fortress Investment Group, a U.S. investment company affiliated with the SoftBank Group.

According to the notice of change, after the changed registration deadline of March 10, “we will promptly make payments to creditors,” and there is a possibility that the money will be returned in stages as soon as the procedures are completed. The maturity date is set for September 30, 2023.

According to a Tokyo District Court report, since September 2017, bankruptcy trustee Kobayashi of Mt.Gox has sold cryptocurrencies to secure enough cash to repay creditors. In mass sales after 2018, the downward trend phase (1 BTC = around 8,000 to 10,000 dollars) after the bursting of the virtual currency bubble repeatedly generated selling pressure equivalent to tens of billions of yen, which caused investors’ antipathy. Controversial.

As of September 2019, it has been reported that it has about 69 billion yen in cash and deposits, as well as 141,686 bitcoins (BTC) and 142,846 bitcoin cash (BCH). Some of them may be headed for “profit taking” over the next nine years.

As of March 2011, the BTC price was 3 million yen (approximately $22,000), while the Bitcoin price at the time of the bankruptcy was approximately $800. It is a calculation that a large amount of unrealized gain is generated due to the influence of

On the other hand, according to the Nihon Keizai Shimbun article in February 2014, 127,000 customers were affected by the bankruptcy of Mt.Gox, which was operated based in Tokyo. Users are believed to be mainly foreign investors. The Japanese ratio is only about 1,000 people, or 0.8%.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin continues to fall as risk aversion strengthens, and fears of selling pressure from large Mt. Gox creditors may recede appeared first on Our Bitcoin News.

2 years ago

180

2 years ago

180

English (US) ·

English (US) ·