Macroeconomics and financial markets

In the US NY stock market on the 1st, the Dow Jones Industrial Average fell 46 dollars (0.14%) from the previous day, and the Nasdaq Index closed at 13.9 points (0.11%).

California financial regulators announced the bankruptcy of First Republic Bank and the acquisition of JPMorgan Chase Bank. Subject to administration of the Federal Deposit Insurance Corporation (FDIC).

It was the largest US bank failure since the Lehman Shock in 2008. It had assets of about $210 billion (28 trillion yen) at the end of last year, but the JP Morgan takeover announcement did not shake the market as excessive caution about the financial system receded. President Biden is trying to calm the situation by saying, “All depositors, including small and medium-sized enterprises, will be protected.”

However, over the past two months, Silvergate Bank and Silicon Valley Bank have failed one after another, and the unprecedented pace of interest rate hikes by the Federal Reserve (Fed) has gone out of control, bringing great uncertainty to the financial industry. It’s clear there is. The background is that the value of securities held by banks, such as huge unrealized losses on bonds, has become apparent, leading to customers’ credit concerns such as large-scale deposit outflows.

First Republic Bank, whose customer base consisted mainly of the wealthy, appears to have run out of cash due to a flood of large deposit withdrawals due to recent financial instability.

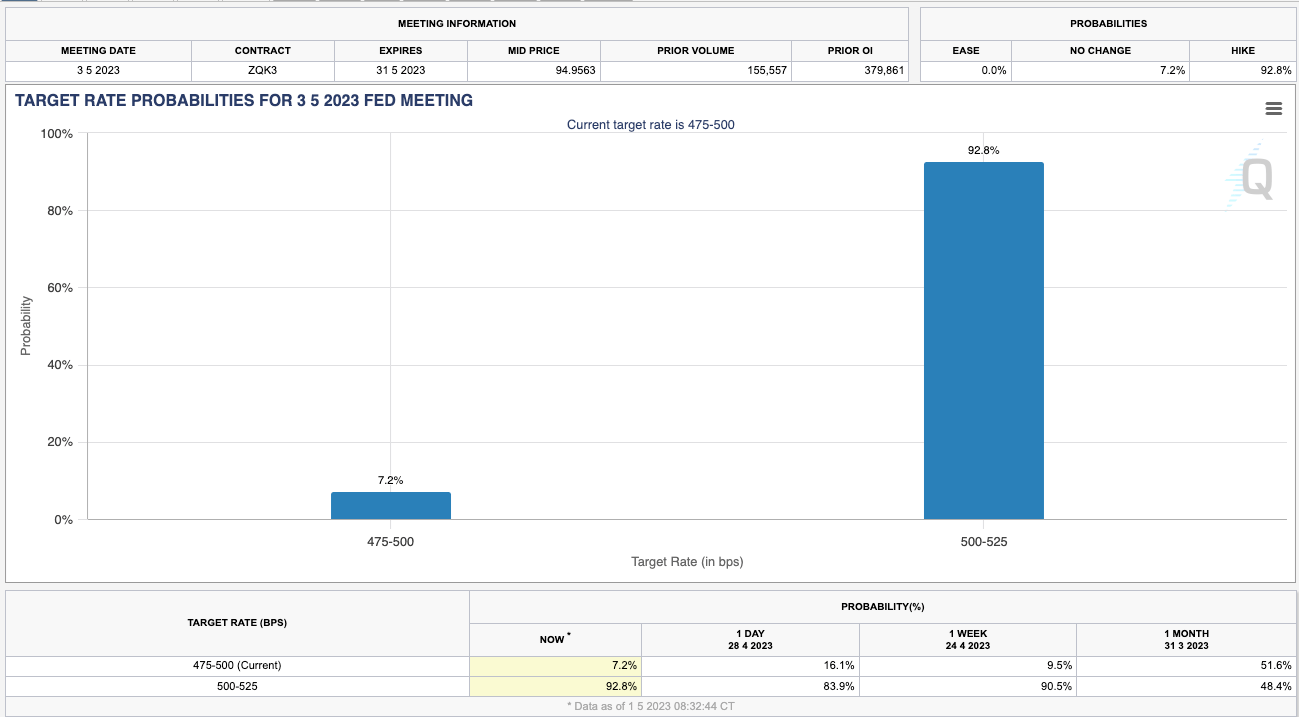

According to the FedWatch Tool of the CME (US Chicago Mercantile Exchange), the interest rate futures market is pricing in another rate hike (0.25bps) by the US Federal Open Market Committee (FOMC) in May by 92.8%.

CME FedWatch

Under these circumstances, interest in the content of Chairman Powell’s post-FOMC press conference is growing rapidly, and whether or not the next meeting will indicate the end of the rate hike cycle will be a watershed moment.

If it suggests the possibility of an interest rate cut (monetary easing) during this fiscal year, the stock and crypto asset (virtual currency) markets are likely to turn risk-on, but the gap between the market and the optimistic market is becoming more and more rumored. There is a strong view that he will maintain his hawkish attitude.

connection:US stocks: Is it a temporary sense of security with the acquisition of First Republic? Pay attention to Apple’s financial results and FOMC interest rate announcement this week |

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

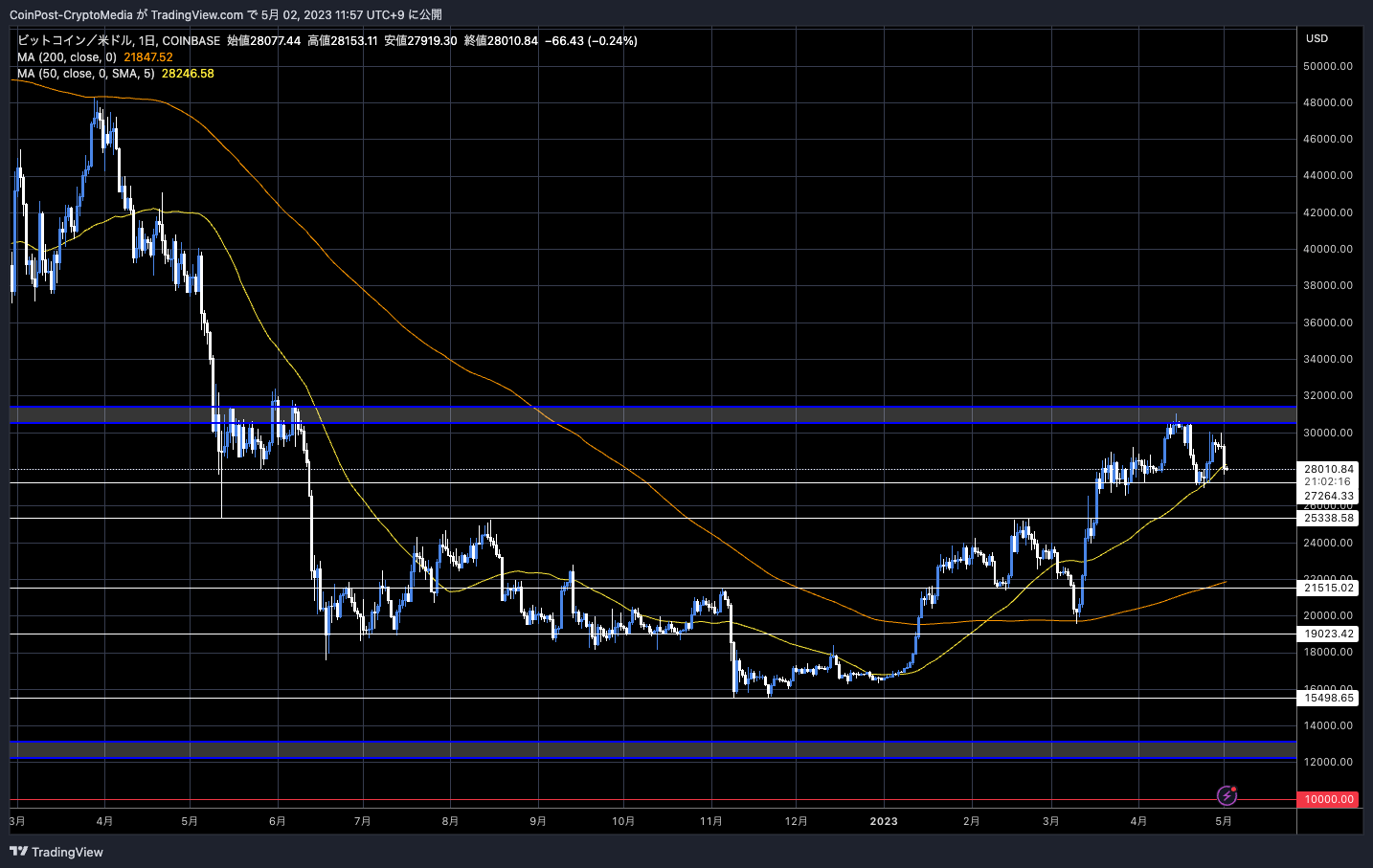

In the crypto asset (virtual currency) market, bitcoin fell 1.89% from the previous day to $28,024.

BTC/USD daily

Position adjustments before the US Federal Open Market Committee (FOMC) overlapped, and 1BTC = $ 30,000 to $ 31,000 has been flipped multiple times at strong resistance. If the price breaks below $27,000, a push to support at $25,200 should be considered.

altcoin market

As for individual stocks, the “PEPE” token, which is inspired by the character “Pepe the Frog” from the internet manga Boy’s CLub, is soaring.

It has no main utility and is a kind of internet meme token like Dogecoin (DOGE) or Shiba Inu.

In 2016, the virtual currency “PEPECASH” with the motif of “Pepe the Frog” also emerged. It was listed on the domestic crypto asset (virtual currency) exchange Zaif, but was delisted in April 2020 when the boom passed.

PEPE is traded on Uniswap, a major DEX (distributed exchange), as well as OKX, Huobi, Gate.io, MEXC, etc. According to the cryptocurrency analysis provider Lookonchain, a very small number of traders have reached 100% in just two weeks. It is believed that the company made a profit of more than 10,000 dollars (approximately 140 million yen), but there are many voices warning against excessively speculative price movements and the risk of pump and dump (price manipulation).

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin continues to fall, FOMC’s attention rises as First Republic Bank collapses appeared first on Our Bitcoin News.

2 years ago

152

2 years ago

152

English (US) ·

English (US) ·