Macroeconomics and financial markets

In the US NY stock market on the 8th, the Dow Jones Industrial Average fell 55 dollars (0.2%) from the previous day, and the Nasdaq Index closed at 21.5 points (0.2%) higher than the previous weekend.

connection:Nasdaq rises slightly ahead of CPI, Buffett is bullish on Japanese stocks | 9th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.3% from the previous day to $ 27,616.

BTC/USD daily

With the release of indicators such as the CPI (US Consumer Price Index) on the 10th and the US Producer Price Index (PPI) on the 11th, market adjustment selling took precedence.

Among the major alts with the highest market capitalization, XRP, Dogecoin (DOGE), Polygon (MATIC), and Solana (SOL) are all 5-10% weaker than the previous week.

Most recently, funds have been flowing into memecoins led by Pepe Token (PEPE), and as of the 7th, PEPE’s daily trading volume was $2.37 billion, more than three times that of XRP, the fourth place.

If you remove the stables $PEPE is still #3 in daily volume at 2.37 billion behind #Bitcoin and #Ethereum $XRP is #4 with .71 billion pic.twitter.com/DSLqwbhFtG

—Big Dawg (@thecryptodawg) May 7, 2023

The bankruptcy filing of Bittrex, a long-established crypto asset (virtual currency) exchange in the United States, also contributed to the deterioration of market sentiment. Filed for Chapter 11 bankruptcy in federal court in Delaware. Total debt is between $500 million and $1 billion.

Bittrex was sued by the U.S. SEC (Securities and Exchange Commission) for violating securities laws in April this year, and the global version of Bittrex Global will continue to provide services to customers outside the U.S.

connection:Cryptocurrency exchange Bittrex files for bankruptcy in the US

Regarding the drop in the Bitcoin and altcoin markets, there is also the view that rising Bitcoin transaction fees and transaction congestion led major cryptocurrency (virtual currency) exchanges such as Binance to suspend remittances, triggering risk-averse selling. be.

BREAKING: #Binance outflow data confirms largest withdrawal in it’s history, over 162,000 $BTC has left the exchange, valued at over $4.6 Billion.

Are Whales/Insiders jumping ships? pic.twitter.com/QSXYAEvHkt

— WhaleWire (@WhaleWire) May 7, 2023

The number of pending outstanding transactions in mempool reached the equivalent of half a million as of yesterday.

On the other hand, with the rapid spread of Bitcoin NFT (non-fungible token) called Ordinals Protocol (Inscriptions) and “BRC-20 (Bitcoin Request for Comment)” token, miner profits have increased significantly. there is

The market capitalization of the BRC-20 token has reached an estimated $1.6 billion, but many experts are sounding the alarm because it is an experimental system.

On the 7th, the transaction fee of some miners temporarily reached 6.7 BTC, exceeding the block reward amount.

BITCOIN TX FEES > BLOCK SUBSIDY pic.twitter.com/BQ64pHtAsg

— pourteaux (不说中文 arc) (@pourteaux) May 7, 2023

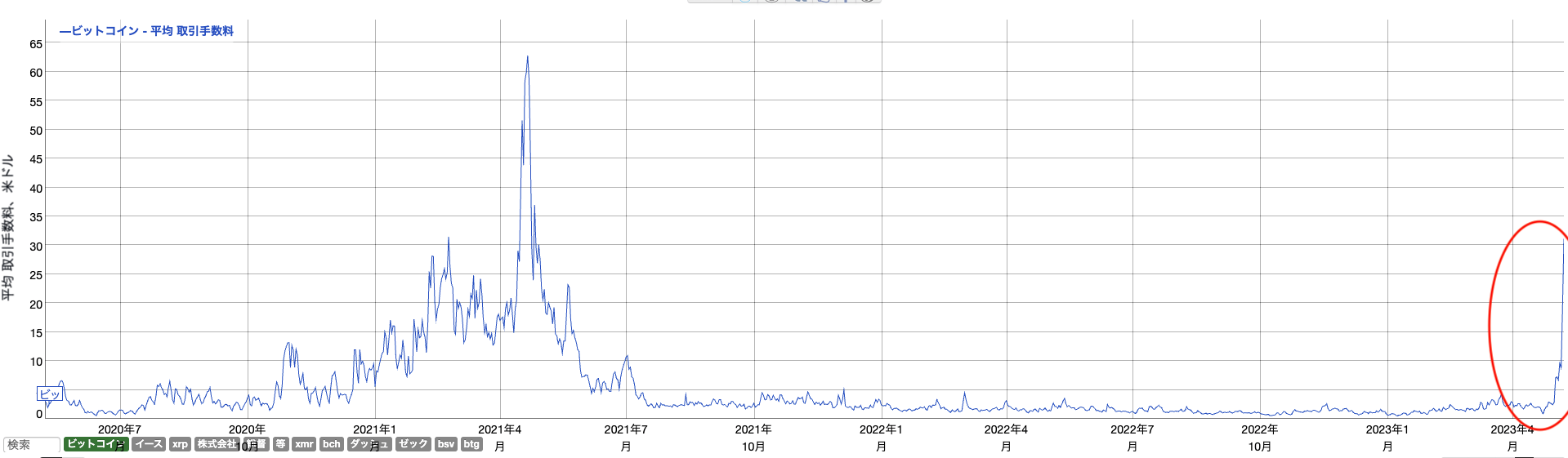

According to data from BitInfoCharts, the average transaction fee on the Bitcoin network has soared to the $20-30 range (3,000-4,000 yen), the highest level since May 2021. Until last week, the average Bitcoin transaction fee was around 1/10.

bitinfo charts

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Regarding the recent surge in Ethereum transaction fees (Gas), some point out that the Meme Coin boom is taking advantage of the revitalization of “MEV (Miner Extractable Value)”.

In order to maximize the profit of arbitrage (arbitrage trading), it uses front-running and sandwich attacks that interrupt the execution order of other traders’ buying and selling orders on the decentralized exchange.

Problems have resurfaced, with the contract price being at a disadvantage and increasing the slippage and increasing gas costs.

A MEV bot is eating your lunch.

jaredfromsubway.eth MEV bot is the top gas ETH spender in the last 24H, spending 455ETH ($950k) and using 7% of total gas of the network

In the last 2 months it spent more than 3.720ETH ($7M) in gas fees and performed more than 180k transactions pic.twitter.com/IGMJY7skkq

— sealaunch.xyz (@SeaLaunch_) April 18, 2023

connection:Contributing to the improvement of Ethereum’s gas price rise, the actual situation of the research and development organization Flashbots

connection:Bitcoin remittance clogging becomes serious, Ethereum foundation sells ETH

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin continues to fall, virtual currency transaction fee problem emerges appeared first on Our Bitcoin News.

2 years ago

124

2 years ago

124

English (US) ·

English (US) ·