Macroeconomics and financial markets

In the US NY stock market on the 21st, the Dow Jones Industrial Average fell by $102 (0.3%) from the previous day, falling for three consecutive days. The Nasdaq Index closed 165 points (1.2%) lower.

connection:IT and high-tech stocks fall overall in response to Chairman Powell’s hawk remarks Virtual currency-related stocks continue to rise | 22nd Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

In his testimony to Congress at the monetary policy hearings, Chairman Powell reiterated his view that further interest rate hikes within the year would be appropriate, as in the press conference after the FOMC, suggesting the possibility of resuming interest rate hikes at the FOMC after July.

On the other hand, in the crypto asset (virtual currency) market, in response to a series of problems surrounding stable coins whose value is backed by the US dollar, it has been decided that the issuance and use of stable coins (considered as a form of money) Strong supervision by the central bank is necessary,” he said.

When asked about the impact of cryptocurrencies on the U.S. economy, he said, “As a new asset class, they have a degree of sustainability.”

connection:Fed Chairman Jerome Powell: Stablecoins need to be overseen by central banks

Virtual currency market

In the crypto asset (virtual currency) market, the Bitcoin price continued to rise to 1 BTC = $ 30,193, up 4.5% from the previous day.

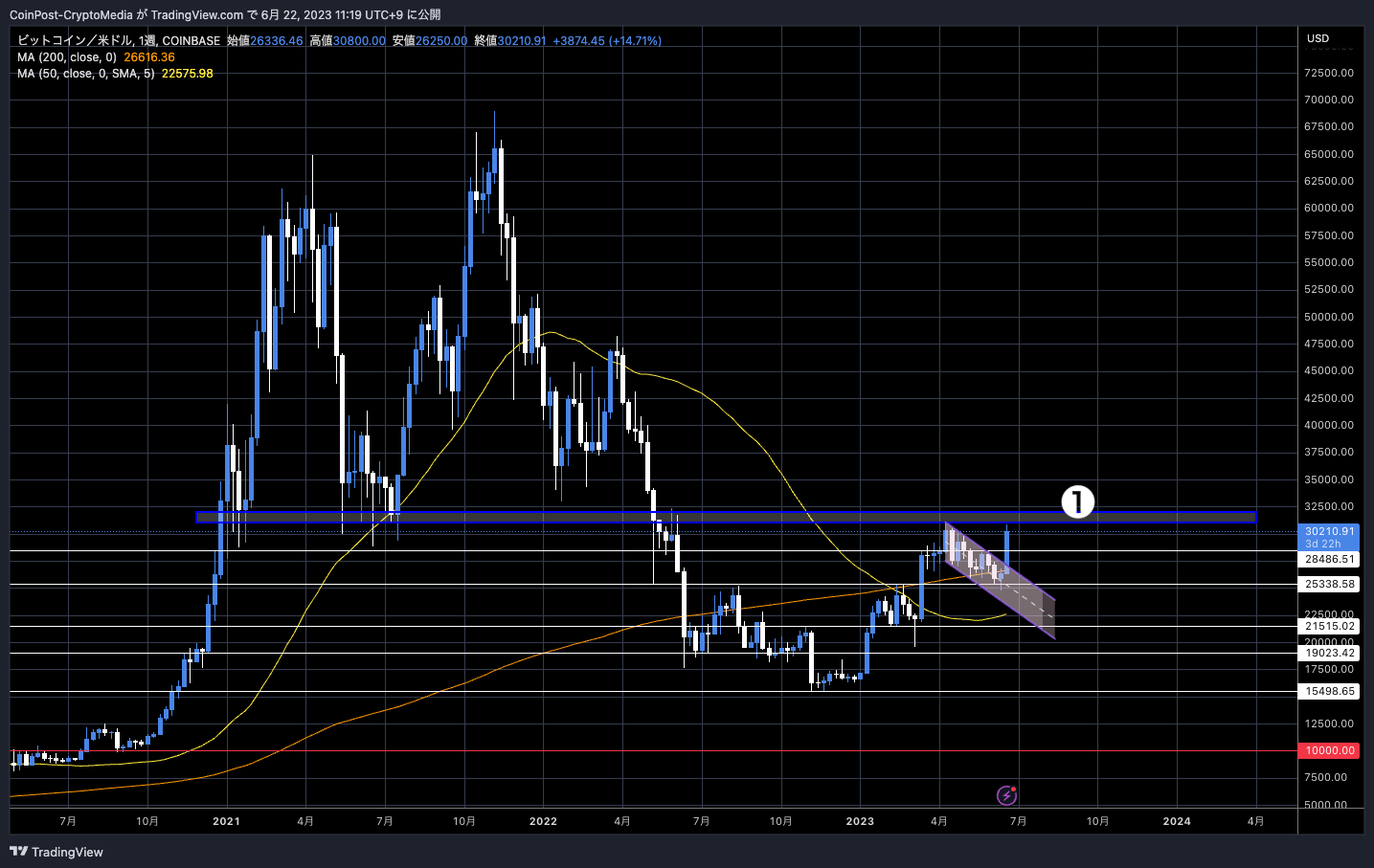

BTC/USD daily

Although the price fell temporarily at $30,800/mt, it continued to strengthen, led by spot buying. If the price rises above the major resistance line of $31,000 to $32,000 (①), a trend reversal toward the next year’s halving will be in sight.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

The U.S. SEC (Securities and Exchange Commission) has so far approved all Bitcoin ETF (Exchange Traded Fund) applications by numerous companies such as VanEck and 21Shares, citing the lack of transparency and management systems as well as market manipulation concerns. There is a history of rejection in the process.

But this time, BlackRock, the largest asset manager with $9 trillion in assets under management, made the move. Considering its track record, influence, and political power, expectations are rising that there is a good chance that a physical Bitcoin ETF will be approved for the first time, pushing up the crypto asset (virtual currency) market.

According to Eric Balchunas, senior ETF analyst at Bloomberg, BlackRock has had 575 exchange-traded funds (ETFs) approved and only one disapproved.

Fun fact: BlackRock’s record of getting ETFs approved by the SEC is 575-1. That’s another reason this is so big, they don’t play around. https://t.co/f7YIhGRmLf

— Eric Balchunas (@EricBalchunas) June 16, 2023

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

Three new companies, Valkyrie, Invesco, and WisdomTree, have also applied for Bitcoin ETFs. It is designed to respond to the “lack of monitoring sharing agreements with regulated markets related to physical bitcoins,” which the SEC has cited as the reason for rejecting the application, raising expectations for approval.

connection:Bitcoin spot ETF, 3 new companies apply again in response to SEC concerns

In addition, the launch of EDX Markets, a digital asset exchange funded by US Wall Street companies such as Citadel, Fidelity, and Charles Schwab, was also well received in the US.

connection:EDX Markets, a virtual currency exchange funded by Wall Street Financial, opens in the United States

The products handled are Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and Litecoin (LTC). In addition to BCH soaring 28% higher than the previous day, LTC rose 7.2% and ETH rose 5.7%, which is about to be halved around August this year.

connection:Litecoin Halving Scheduled Around August 7th, On-Chain Data Suggests Major Investor Trends

The U.S. national debt hit $32 trillion as of Wednesday, $10 trillion more than four years ago. There is a consensus that the US debt situation is likely to deteriorate further over the next decade.

It’s official: US National Debt hits $32 trillion for the first time, $10 trillion higher than where it stood 4 years ago (45% increase). pic.twitter.com/idvFZ8JpbM

— Charlie Bilello (@charliebilello) June 17, 2023

If financial and economic uncertainties increase in the future, there is a view that interest in Bitcoin will increase more and more as an alternative asset with a high supply limit and high scarcity that is not subject to interference from centralization.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin continues to rise and recovers to the $30,000 level, BCH rises 28% from the previous day appeared first on Our Bitcoin News.

2 years ago

134

2 years ago

134

![Story [IP] skyrockets 35%, outshines Bitcoin and Ethereum – How?](https://ambcrypto.com/wp-content/uploads/2025/08/Chandan-2025-08-31T163248.671_11zon.jpg)

English (US) ·

English (US) ·