Macroeconomics and financial markets

On the 5th, in the US New York stock market, the Dow Jones Industrial Average closed down 79.8 points (0.22%) from the previous day, while the Nasdaq Index closed 44.4 points (0.31%) higher.

connection:Cryptocurrency-related stocks such as Marathon continue to rise as Bitcoin continues to grow | 6th Financial Tankan

With the soaring price of Bitcoin (BTC), stocks related to crypto assets (virtual currency) are being looked for in the Japanese and US stock markets.

Canaccord Genuity, a full-service investment bank based in Canada, reports that MicroStrategy stock has outperformed BTC, which is up 19% month-on-month, and is up 23% month-on-month, and is up 104% over the past six months. reached.

Canaccord Genuity has raised its price target on MicroStrategy’s stock to $670, from the previous day’s closing price of $577.

MicroStrategy is backed by business intelligence software and offers a premium to equity investors seeking exposure to Bitcoin while Bitcoin spot ETFs (Exchange Traded Funds) remain unapproved. There is a view that

connection:MicroStrategy’s Bitcoin investment reaches $1 billion in unrealized gains

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price rose 4.8% from the previous day to 1 BTC = $43,829.

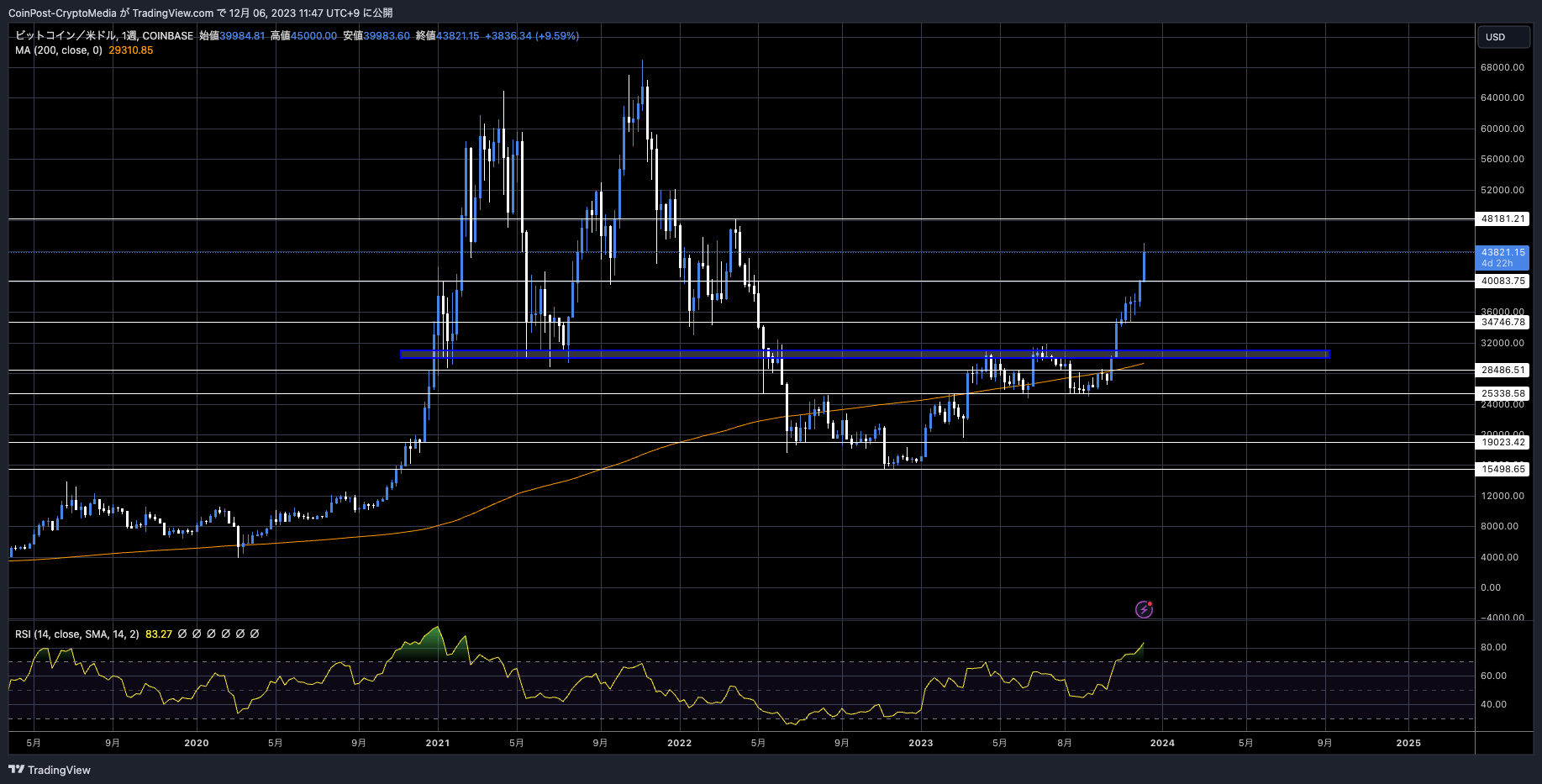

BTC/USD weekly

At the beginning of the week, it remained positive for 8 consecutive weeks and continues to rise.

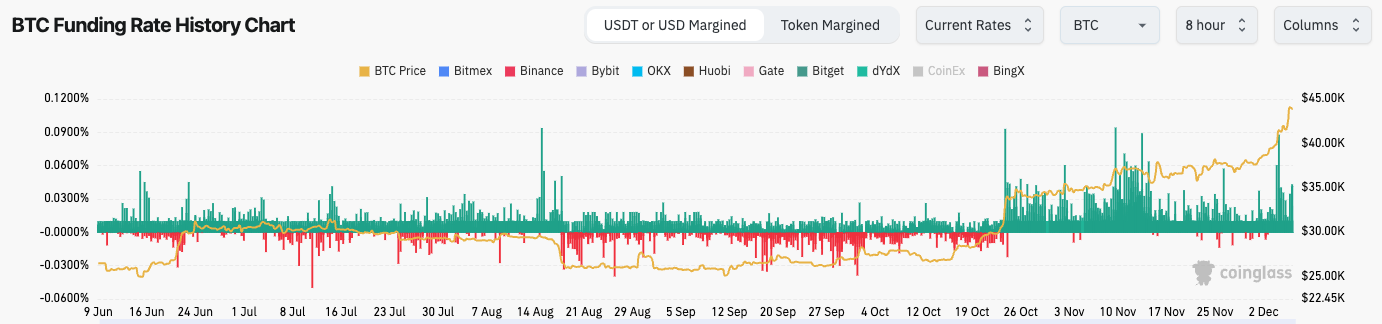

The weekly RSI (relative strength index), which shows investor sentiment, is showing an overbought level, and there is a sense of overheating in the funding rate in the derivatives (financial derivatives) market.

FR trend (coinglass)

There are strong speculations that a Bitcoin ETF (exchange traded fund) will be approved around January 2024, and with the four-year Bitcoin halving coming up next year, there is little incentive to part with physical assets intended for long-term holding. The market has begun to factor in the Federal Reserve’s monetary tightening (interest rate hike), which had caused a significant decline in risk assets since the end of 2022, and the fall in the dollar index has also been a tailwind for stocks and crypto assets (virtual currencies). There is.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

The US SEC (Securities and Exchange Commission), which decides whether applications should be approved, and related companies such as BlackRock, the largest asset management company that applies for Bitcoin ETFs (Exchange Traded Funds), are becoming more active. “It’s just a matter of time,” fueling market expectations.

connection:BlackRock raises $100,000 in seed funding with Bitcoin ETF application

connection:BlackRock and others submit revised version of Bitcoin ETF application, expectations increase for simultaneous SEC approval

altcoin market

With the start of a clear bullish trend, capital circulation can be seen in the altcoin market, which had been selling in the lead up to the end of last month.

Ethereum (ETH) rose 2.8% from the previous day, Solana (SOL) rose 5.8%, Cardano (ADA) rose 5.2%, and Avalanche (AVA) rose 15.3%.

Bitcoin ETF special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

Click here for a list of past market reports

The post Bitcoin continues to rise significantly to $45,000, with high interest in SEC actions regarding “Bitcoin ETF” appeared first on Our Bitcoin News.

1 year ago

150

1 year ago

150

English (US) ·

English (US) ·