Virtual currency market of this week (2/4 (Sat) – 2/9 (Fri))

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

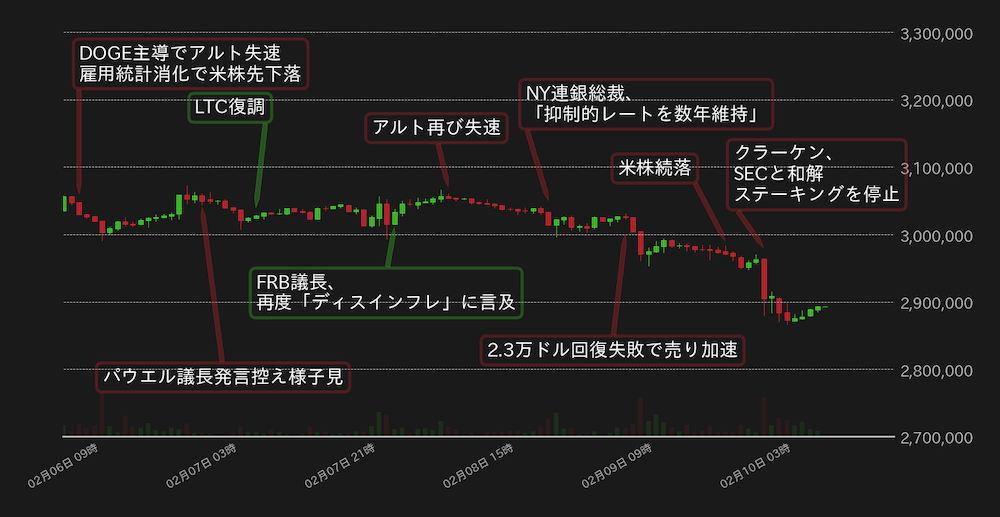

Weekly report from 2/4 (Sat) to 2/9 (Fri):

This week’s Bitcoin (BTC) vs. Yen exchange rate has weighed on its topside, and has fallen from a consolidation around 3 million yen.

Following last week’s US employment statistics, which were stronger than market expectations, the BTC market started with a slightly heavy topside due to the drop in US stocks at the beginning of the week. continued to trend steadily.

Under these circumstances, the US Federal Reserve (Fed) Chairman Jerome Powell’s remarks at the Washington, D.C. Economic Club on the 7th were imminent, and the market was in a wait-and-see mood, but the Fed chairman reiterated that “disinflation has begun.” and the market was relieved.

In this way, the BTC market recovered to 3.06 million yen, but from the middle of the week, the altcoin market stalled and the return could be suppressed, said Williams, President of the Federal Reserve Bank of New York, saying, (a few years)”, accelerating risk-off.

On the 9th, it failed to recover to $23,000 in dollar terms, accelerating its decline. In addition, yields rose in the U.S. market on this day as demand for Treasury bonds was sluggish. In addition, Alphabet (GOOGL) stock weighed on the market after bard’s launch event blunder, weighing on BTC’s topside.

In the morning of the 10th, Kraken, which was suspected of violating the Securities and Exchange Act over its staking service, made a settlement with the US Securities and Exchange Commission (SEC) and suspended the service, leading to a wide range of altcoin-led brands. It was sold, and BTC also expanded its low price further, breaking 2.9 million yen.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

BTC endured strong employment statistics and successfully passed Chairman Powell’s remarks, but the negative factors unique to crypto assets (virtual currencies) weighed on a wide range of stocks. It seems that funds have flowed into some liquid staking that claims to be decentralized, but there are many overseas exchanges that offer staking, and concerns about the future impact are smoldering.

Under these circumstances, the US consumer price index (CPI) for January will be announced next week. The rise in the BTC market in January can be said to have been sparked by the slowdown in wage growth in the employment statistics and the decline in the CPI, which is drawing attention. The US CPI has been decelerating by more than 0.5 percentage points year-on-year for three consecutive months since October.

It is difficult to assume that January’s CPI will be higher year-on-year than December, but we should pay attention to a slowdown in the pace of deceleration and an increase compared to the previous month.

Although the BTC market has been consolidating and declining, against the dollar, it has recently stopped declining near the November high. It can be said that the Kraken and SEC incidents have a large impact on PoS stocks, and BTC, which is the representative of PoW, can be easily supported by buying at such a turning point in the chart.

As mentioned above, there is a possibility that next week’s CPI will be a negative surprise, but as has been pointed out before, there is a concentration of technically important support around $20,000, which is a psychological milestone, and the market will collapse sharply. We believe that expansion can be avoided.

[Fig. 2: BTC vs. USD chart (daily)]Source: Created from Glassnode

connection:bitbank_markets official website

Last report:Despite the risk-on mood of Bitcoin, the upward trend momentum has receded

The post Bitcoin decline led by Alto, can a big collapse be avoided | Contribution by bitbank analyst appeared first on Our Bitcoin News.

2 years ago

156

2 years ago

156

English (US) ·

English (US) ·