Virtual currency market this week from 5/27 (Sat) to 6/2 (Fri)

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 5/27 (Sat) to 6/2 (Fri):

Bitcoin (BTC) vs. the yen fell back this week, wiping out last week’s gains as of noon on June 2nd.

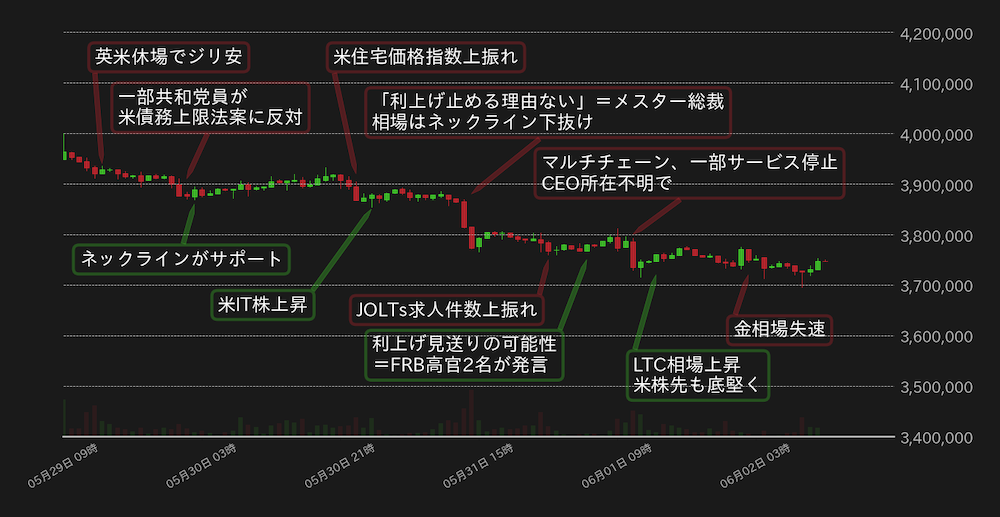

With the U.K. and U.S. markets on holiday at the beginning of the week, with thin trading and weak sales, some Republican conservatives have voiced concerns over the U.S. debt ceiling bill that was reached a tentative agreement between U.S. President Biden and Speaker of the House McCarthy over the weekend. When voices of opposition were raised, a sense of caution spread over the outcome of the bill’s vote in the House of Representatives, and the market price fell below 3.9 million yen.

After that, the double-bottomed neck sign that broke on the weekend supported the BTC market, but the upside of the US housing price index in March weighed on the market, failing to recover 3.9 million yen. On mid-Wednesday in Asia, BTC fell sharply below the neckline after Cleveland Fed President Mester said there was “no compelling reason to stop rate hikes.” rice field.

As a result, BTC’s weekend breakout was a hoax, and the dollar-denominated Ichimoku Kinko Hyo reversal of the three roles was shown. In addition, the bridge protocol multi-chain announced that it had lost contact with its CEO and could not find its whereabouts, and suspended some services, which worsened sentiment and BTC fell to around 3.7 million yen.

After that, while the litecoin (LTC) market and US stocks strengthened, the price struggled in the mid-3.7 million yen range.

Figure 1: BTC vs Yen chart (1 hour) Source: Created from bitbank.cc

A tentative deal was reported last Sunday over the US debt ceiling, and the bill passed the House early Thursday morning. At the time of writing this article, it is reported that the Senate has passed a bill, and the BTC market has turned from a slight loosening to a slightly tightening.

Last week, he said that he would be cautious of the possibility of an additional interest rate hike in June. However, he made remarks in support of the postponement of the interest rate hike in June, and put downward pressure on US bond yields in addition to resolving the debt ceiling problem.

BTC’s topside has been weighed down this week due to worsening technical sentiment, but US fundamentals can be said to be on the side of the market, and it is not surprising that the price may stop falling soon. However, whether or not there will be an additional interest rate hike in June will continue to depend on future economic indicators. Note the consumer price index (CPI) results.

connection:bitbank_markets official website

Last report:Bitcoin stays flat, is there limited room for upside?

The post Bitcoin declines due to worsening sentiment, hopes for bottoming out against the backdrop of US funds | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·