Macroeconomics and financial markets

In the US NY stock market on the 7th of the previous weekend, the Dow Jones Industrial Average dropped 187 dollars (0.55%) from the previous day and fell for three consecutive days, and the Nasdaq Index closed at 18.3 points (0.1%) lower.

Although the resumption of interest rate hikes at the US Federal Open Market Committee (FOMC) on July 25-26 is being priced in, the market’s attention has shifted to September and beyond.

Under such circumstances, there is growing concern that the financial tightening phase will last longer than market expectations due to economic indicators such as firm US employment statistics. Average hourly wages grew faster than expected, indicating high inflationary pressures.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, the Bitcoin price fell 0.67% from the previous day to 1 BTC = $ 30,200.

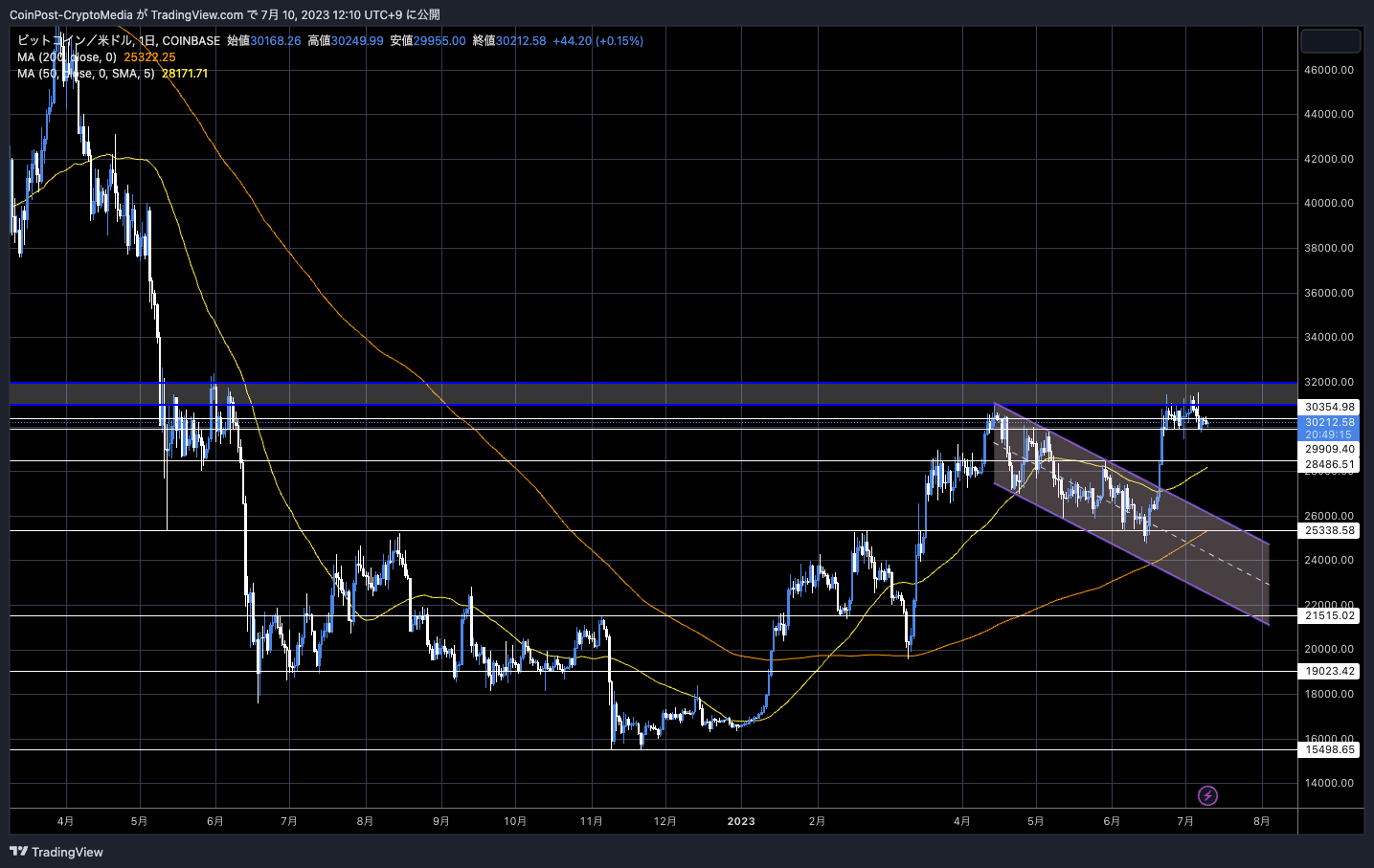

BTC/USD daily

With interest rate hike speculation and overall risky assets such as the US stock index being weak, 1BTC = $30,000 remains firm, but the topside is heavy, and developments lacking direction continue.

connection:Concerns about Fed rate hikes are growing, and the price is likely to drop | Contribution by bitbank analyst

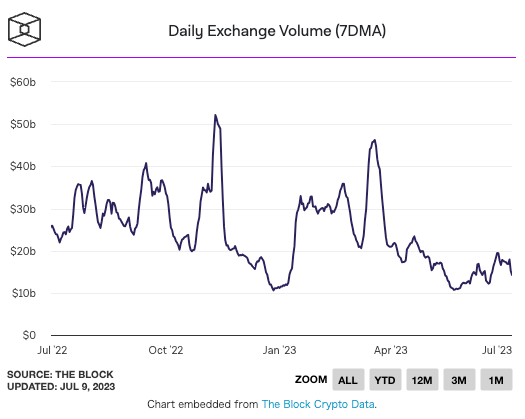

According to data from Block Research presented by The Block, the excitement immediately after the largest asset manager BlackRock filed for a physical Bitcoin exchange-traded fund (ETF) is fading, with the average weekly physical BTC trading volume , down from a recent high of $19.4 billion on June 27 to $14.2 billion as of June 8.

The Block

Since BlackRock submitted an ETF application to the U.S. SEC (Securities and Exchange Commission) on June 15, the price of Bitcoin, which had plummeted due to the SEC’s Binance and Coinbase lawsuits, turned around and rose more than 18%. bottom.

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

According to Glassnode data, bitcoin holdings by corporate and institutional investors active during Asian hours since June increased 9.9% year-on-year, a record high. On the other hand, after BlackRock’s ETF application, the holdings of US companies and institutional investors, which had been in “oversupply” for a long time, turned into excess demand and began to accumulate.

This is a change in the tide in the U.S. cryptocurrency market, where supply dominance (excess outflow) continued due to the collapse of Terra (LUNA) in May last year, the collapse of Three Arrows Capital (3AC), and the collapse of FTX in November last year. It can be seen that the

Wallets holding between 10 and 10,000 BTC have added 71,000 BTC, worth $2.15 billion, since mid-June, according to data from blockchain analytics platform Santiment.

#Bitcoin‘s sharks and whales aren’t showing any signs of slowing down, even with prices beginning to get “boring” in this $30k to $31k range. Since June 17th, 10 to 10k $BTC addresses have accumulated 71k more coins, equating to $2.15 billion. https://t.co/poBVnszbZY pic.twitter.com/XxYsHWCFRL

#Bitcoin‘s sharks and whales aren’t showing any signs of slowing down, even with prices beginning to get “boring” in this $30k to $31k range. Since June 17th, 10 to 10k $BTC addresses have accumulated 71k more coins, equating to $2.15 billion. https://t.co/poBVnszbZY pic.twitter.com/XxYsHWCFRL

—Santiment (@santimentfeed) July 8, 2023

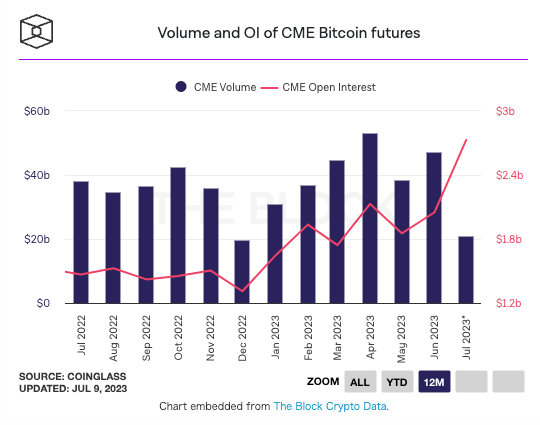

The CME (Chicago Mercantile Exchange) Bitcoin futures market has seen a surge in open interest, reaching $2.7 billion.

The Block

Is debt a tailwind?

“U.S. Treasury issuance has surged by more than $1 trillion since the U.S. debt ceiling was temporarily suspended,” said Bloomberg strategist Mike Novogratz. “This pace of growth in US Treasuries is just insane. Buy Bitcoin (alternative asset),” he said.

That is insane…buy $BTC https://t.co/fxBps2c7xo

— Mike Novogratz (@novogratz) July 8, 2023

Last month, after a series of twists and turns, the U.S. passed a bill to raise the debt ceiling above the legal limit of $31.4 trillion, avoiding an unprecedented U.S. Treasury default.

Data released by the U.S. Congressional Budget Office (CBO) shows that debt to GDP has reached 98.2% of U.S. Treasuries, and continued fiscal deterioration could pose significant risks to the economic outlook. be done.

connection:What is a country’s default (default) | Commentary on the US debt ceiling problem that confused investors

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin direction is uncertain, and on-chain data changes the tide appeared first on Our Bitcoin News.

1 year ago

119

1 year ago

119

English (US) ·

English (US) ·