Macroeconomics and financial markets

In the US NY stock market on the 9th of the previous weekend, the Dow Jones Industrial Average rose by 43.1 dollars (0.13%) from the previous day, rising for four consecutive days. The Nasdaq Index closed 20.6 points (0.16%) higher.

Although the US debt ceiling problem has been cleared and is on an upward trend, the US consumer price index (CPI) and the US Federal Open Market Committee (FOMC) are about to be announced, and there will be only minor position adjustments. There is a wait-and-see mood.

connection:AI/IT stocks fall due to speculation of additional US interest rate hike in July Arc buys more Coinbase stocks | 8th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 0.23% from the previous day to $25,840.

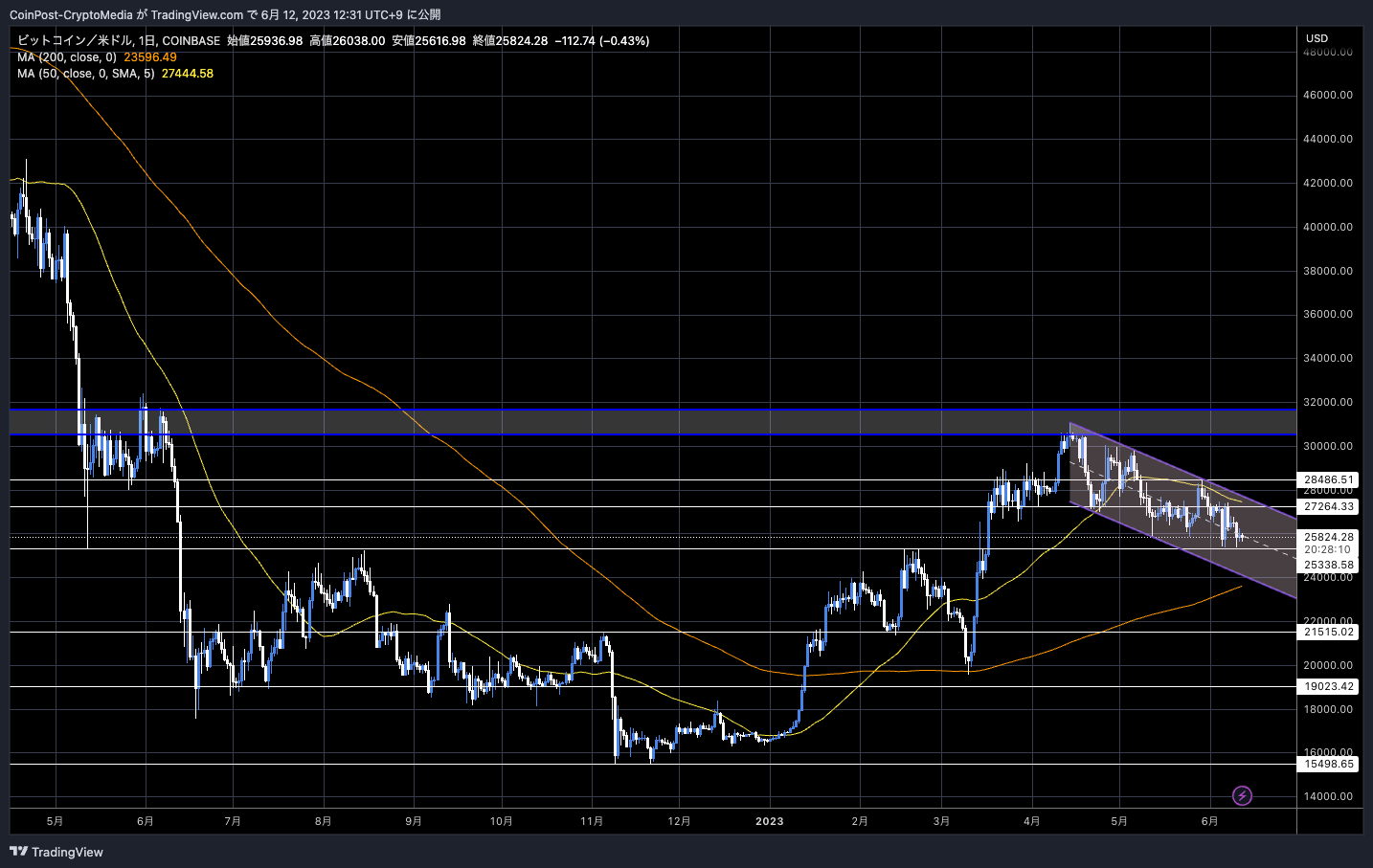

BTC/USD daily

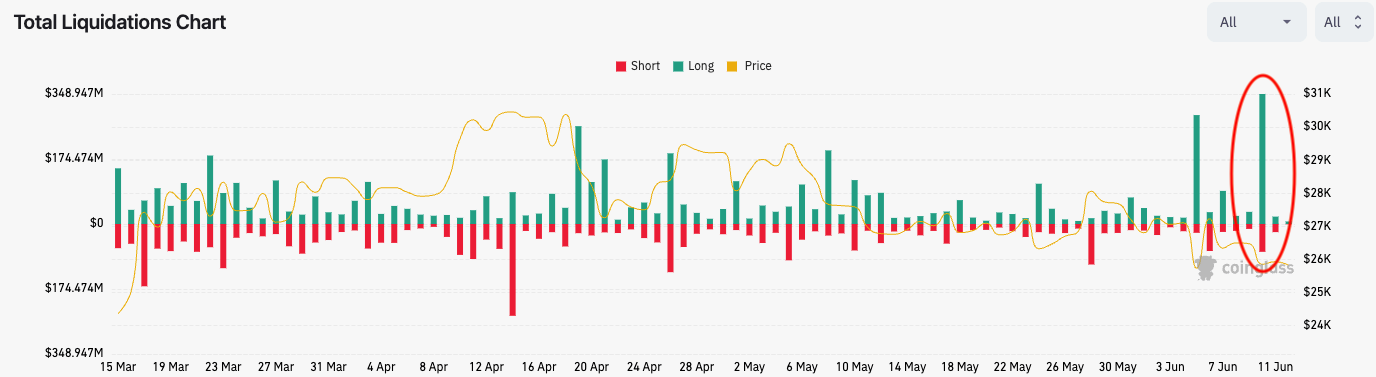

In the futures market, $350 million (about 50 billion yen) of long positions were cut (forced liquidation), the largest in the past three months.

coin glasses

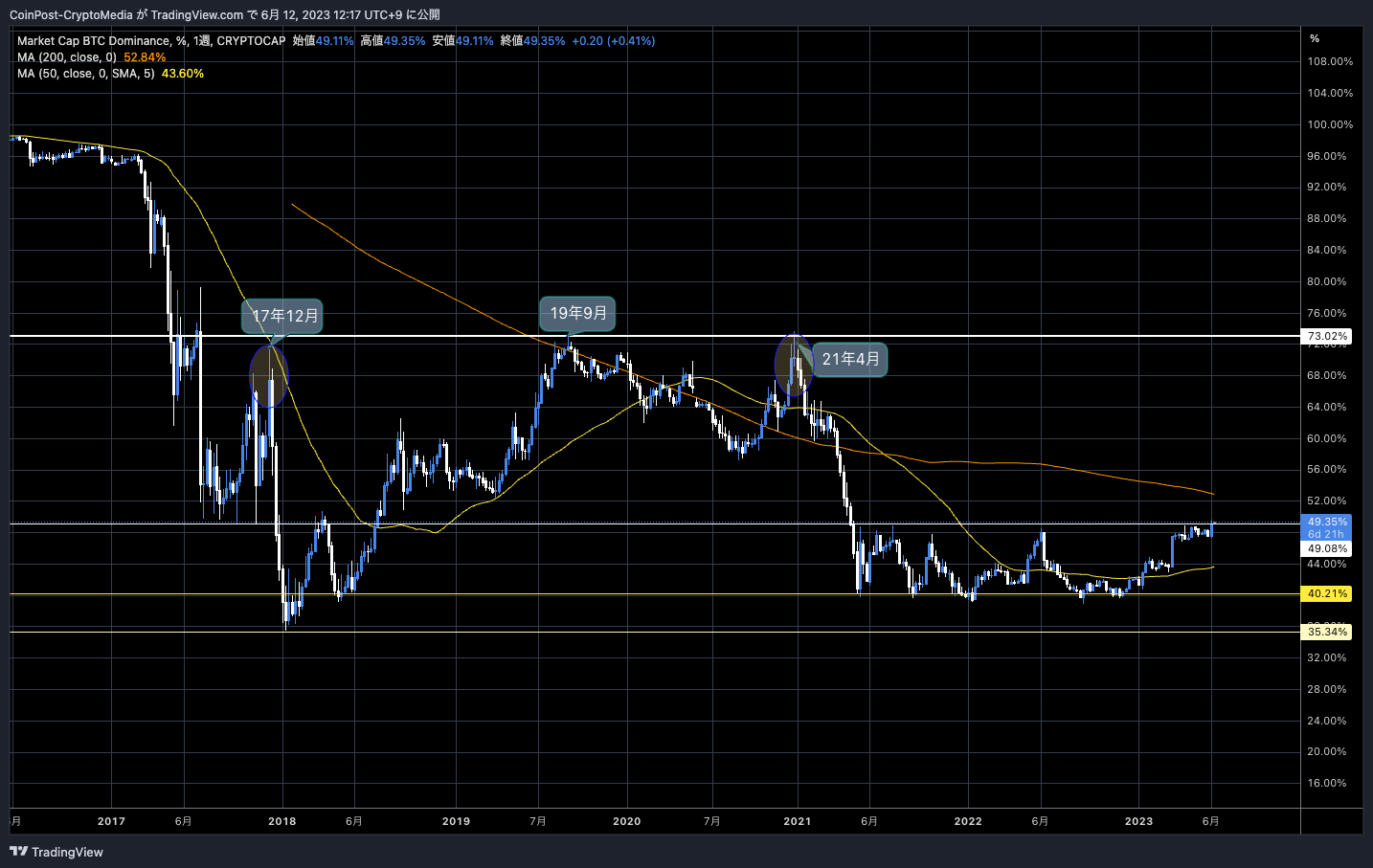

Dominance, which indicates the market share of Bitcoin (BTC), rose to the 50% level for the first time since April 2021.

BTC Dominance

U.S. SEC (Securities and Exchange Commission) Chairman Gensler claims that all crypto assets (virtual currencies) other than Bitcoin (BTC) are “unregistered securities”, and while many altcoins are plummeting, It seems that the demand for refuge to sell (loss cut) the altcoin owned and replace it with a legal currency such as the US dollar, a stable coin such as USDT, or a bitcoin is rapidly increasing.

Delisting of some stocks from Robinhood

Following the delisting of Ada (ADA), Polygon (MATIC), and Solana (SOL) announced on the 10th by Robinhood, a major US financial platform, related stocks plunged more than 30% at one point.

Earlier this week, the SEC sued crypto companies Binance and Coinbase. The SEC has alleged that a number of cryptocurrencies trading on those platforms are unregistered securities, including three that are currently supported on Robinhood Crypto.

— Robinhood (@RobinhoodApp) June 9, 2023

connection:Robinhood to delist Solana Polygon Ada

When the U.S. SEC (Securities and Exchange Commission) filed a lawsuit against Binance for violating the Securities Act, it designated many issues as “unregistered securities”. It is possible to trade and remittance of the corresponding issue, but if the delisted issue is held even after the deadline, it will be forced to sell at the market price.

Therefore, it seems that the selling pressure of the crypto assets (virtual currency) owned by Robinhood was conscious.

Robinhood delisting $ADA, $MATIC and $SOL could put significant sell pressure on these tokens.

RH holds ~$1.3b in alts.

According to rough calculations by @_FabianHD~$583m of this may be held in ADA, MATIC & SOL.

Users who still hold will be forced to sell on June 27.

— Miles Deutscher (@milesdeutscher) June 10, 2023

The number of monthly active users of Robinhood, which is a revolutionary service with no fees and is also popular as a stock brokerage app, is about 11.4 million, and the total investment amount is said to reach 62 billion dollars (8.6 trillion yen).

On the other hand, in response to this situation, Mr. CZ of Binance mentioned the rumors of the sale of cryptocurrency assets held by Binance and the matter of Robinhood. In order not to be misled by bad rumors and fears, he called attention to proper risk management when investing.

Why is the market is going up or down? No one really knows. A lot of people claim to know, and can often pin it on a single (often wrong) reason. In reality, there are many sellers and buyers in a market, Everyone may have their own reasons.

False narrative:… pic.twitter.com/LQDkEOK2as

— CZ  Binance (@cz_binance) June 10, 2023

Binance (@cz_binance) June 10, 2023

Regulatory uncertainty in the United States is driving large-scale flows of funds out of the United States. BTC reserves on US-based cryptocurrency exchanges have fallen to 2017 levels, according to a CryptoQuant research report.

US bitcoin spot trading volume share has dropped to 21% globally.

Kraken suspended its staking service, while Binance.US and Robinhood were forced to delist their designated securities.

Binance CEO Changpong Zhao (CZ) revealed yesterday that net outflows in the last 24 hours reached $392 million. Includes the impact of falling cryptocurrency prices.

According to our data, last 24 hours, @Binance net outflow is about $392m.

Our wallet addresses are public. Some 3rd party analytics measure Change in AUM (asset under management) in USD equivalent as outflow. This would include crypto price drops (which decrease AUM) as “outflow”.…

— CZ  Binance (@cz_binance) June 10, 2023

Binance (@cz_binance) June 10, 2023

On the other hand, he noted that there was a net outflow of $7 billion in 24 hours last November. With the bankruptcy of FTX, FUD to major exchanges such as Binance was rampant in the background, but you can also see a glimpse of pride in overcoming this.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

connection:Is the basis for the suspension of the FOMC rate hike weak, and BTC is expected to continue to develop uneasy | bitbank analyst contribution

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin dominance reaches 50% level, loss cut of 50 billion yen due to alt market crash appeared first on Our Bitcoin News.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·