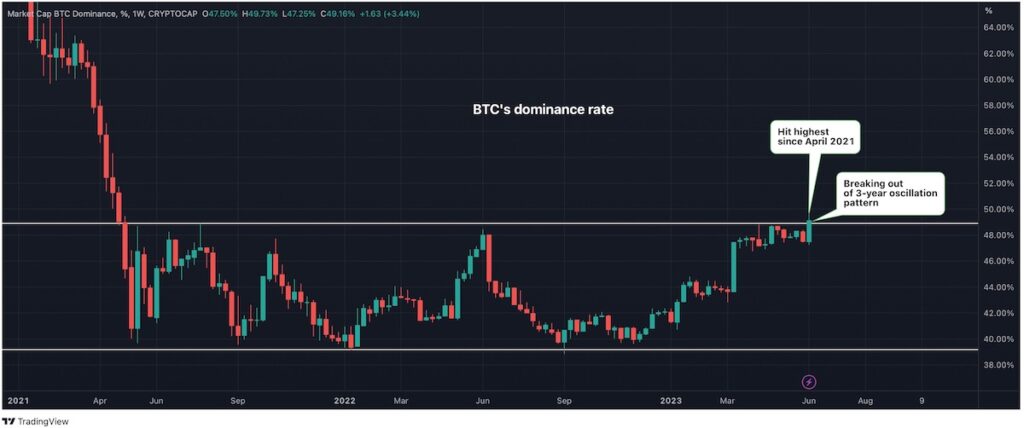

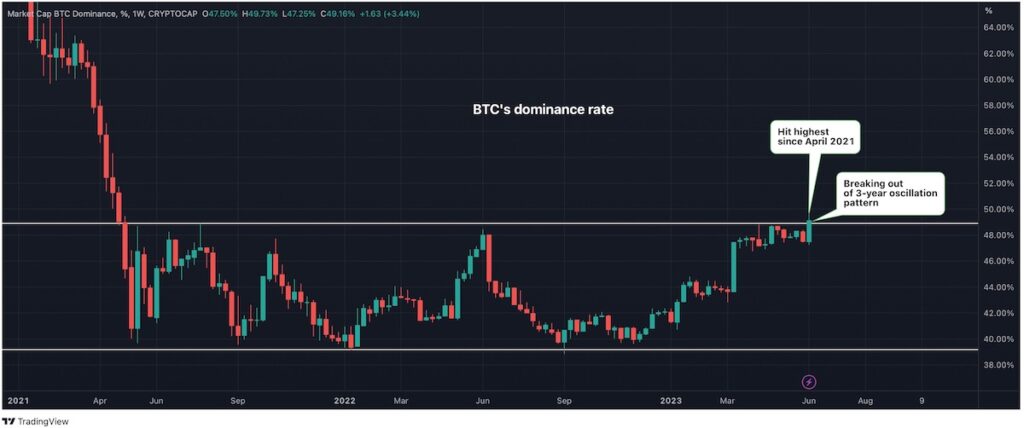

Bitcoin (BTC) dominance (the share of the total cryptocurrency market capitalization) rose in the early hours of June 10, approaching 50% for the first time since April 2021 (according to data site TradingView).

In the cryptocurrency market, investment firms are rumored to have sold around $2 billion worth of altcoins, including Solana (SOL), Polygon (MATIC), Dogecoin (DOGE) and Cardano (ADA). These prices fell by more than double digits.

Bitcoin, on the other hand, fell just 3%. Bitcoin’s relative outperformance is likely due to its growing demand as a safe haven asset. Investors appear to be moving their money from altcoins to Bitcoin, the world’s largest and most liquid cryptocurrency.

“Bitcoin relative dominance rising as altcoins sell out. Flight to majors (first step before crash happens),” tweeted @52kskew, an anonymous cryptocurrency trader and analyst. are doing.

Bitcoin Dominance (Trading View/CoinDesk)

Bitcoin Dominance (Trading View/CoinDesk)Bitcoin dominance has been steadily rising since November 2022, and spiked during the US banking crisis in March 2023. According to Lewis Harland of Decentral Park Capital, dominance now appears to be breaking away from its three-year up-and-down pattern, and there are signs that Bitcoin’s outperformance will continue in the coming months.

Tether (USDT), the dollar-backed stablecoin with the No. 1 market capitalization, also seems to have benefited from the risk-averse move on the 10th. According to TradingView data, dominance across the cryptocurrency market rose 5% to 7.82%, its highest level since January 8.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: Bitcoin Dominance (Trading View/CoinDesk)

|Original: Bitcoin Dominance Surges, Accounting For Nearly Half of The $1T Crypto Market, Amid Altcoin Selloff

The post Bitcoin dominance rises ─ Altcoin decline approaches 50% for the first time since April 2021 | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

112

2 years ago

112

English (US) ·

English (US) ·