The post Bitcoin Downward Swing May Ignite Plunge Below $20,000, Yet a Strong Yearly Close Above $70,000 Is Still On Cards appeared first on Coinpedia - Fintech & Cryptocurreny News Media| Crypto Guide

The star crypto Bitcoin is facing huge selling pressure for the past many days which is resulted in the price being restricted below $30,000. However a couple of breakouts were recorded, but eventually, the prices remain consolidated below these levels. In a worst-case incoming, the BTC prices are expected to drop harder in the upcoming days as Bitcoin continues to register consecutive red candles for the past 5 to 6 weeks.

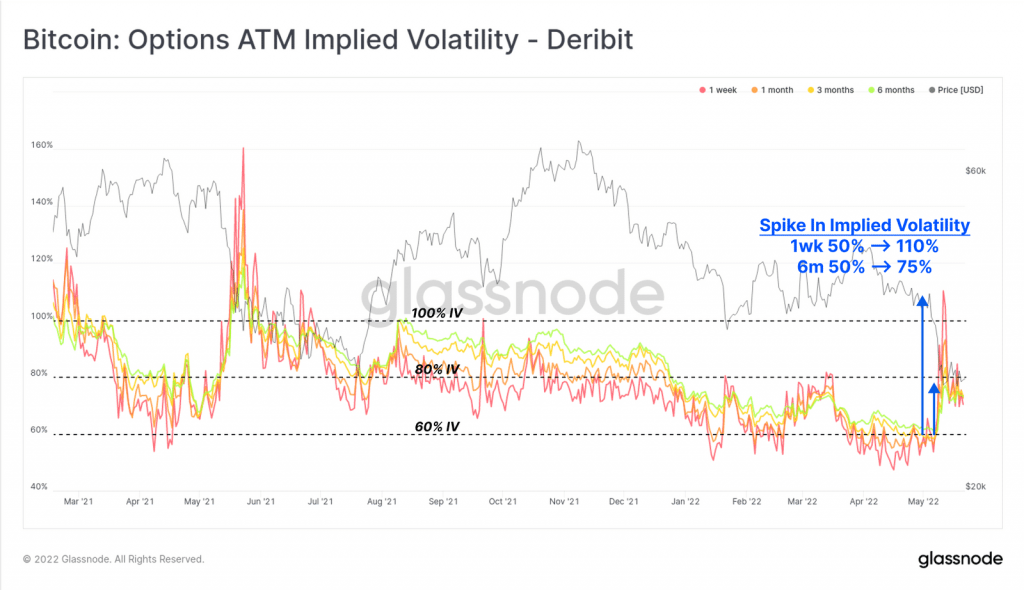

Further, looking ahead in the futures and derivatives market, a strong bearish move is much awaited for the asset in the next 3 to 6 months. As per the data provided by Glassnode, the Bitcoin options market appears to be pretty much uncertain about the upcoming swing and hence continues to price in the near uncertainty.

Source: Glassnode

Source: GlassnodeDuring the past week, when BTC’s price had fallen below $27,000, the BTC options implied volatility jumped significantly and uplifted the prices. Previously, this type of surge was recorded soon after the May 2021 crash. And in the other time, the volatility maintained its average range between 60% IV and 100% IV.

On the other hand, the Bitcoin put options point out a strong bearish sentiment hovering around to end of the Q2 2022 trade. The put/call ratio for Bitcoin in the past two weeks has surged from 50% to 70% that indicating a huge bearish movement is fast approaching. As the price head towards the end of Q2’s trade, the options are feared to drag the price below $25,000 or even $20,000 too.

However, by the end of the year 2022, the options set up point to a notable upswing in the BTC prices. Glassnode further explains that there is a clear preference for call options, with a concentration around the strike prices of $70,000 to $100,000. Further, the dominant put option strike prices are at $25K and $30K which are higher price levels than the mid-year.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·