Macroeconomics and financial markets

In the US NY stock market on the 8th, the Dow closed at $574 (1.72%) lower than the previous day and the Nasdaq at $145 (1.25%) lower.

“The recent economic data (inflationary pressures) have been stronger than expected,” Powell said in his testimony at the hearing. He suggested raising the terminal rate of the policy rate and re-expanding the pace of rate hikes.

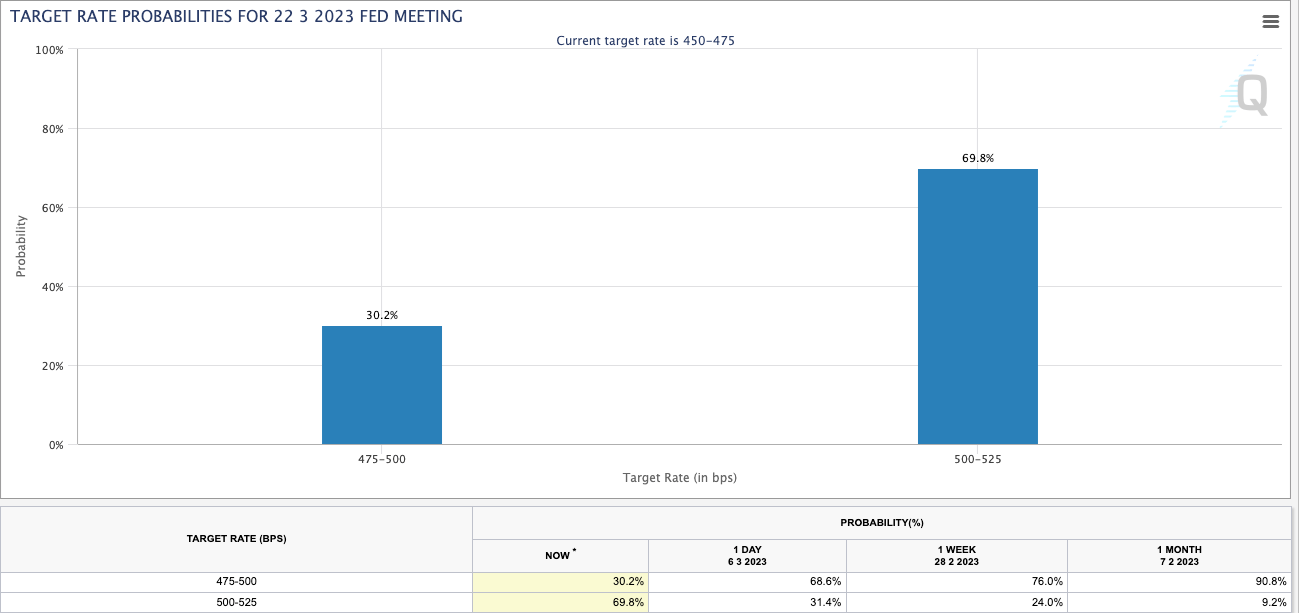

As a result, expectations for a 50bps rate hike at the next FOMC jumped to 69.8% in the US interest rate futures market. It was 31.4% as of the previous day and 9.2% in the previous month, so it can be seen that it has begun to be factored in rapidly.

CME FedWatch Tool

connection:Nasdaq and other U.S. stocks fall across the board Disgusted by chairman Powell’s congressional testimony, dollar yen to 137 yen level | 8th financial tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

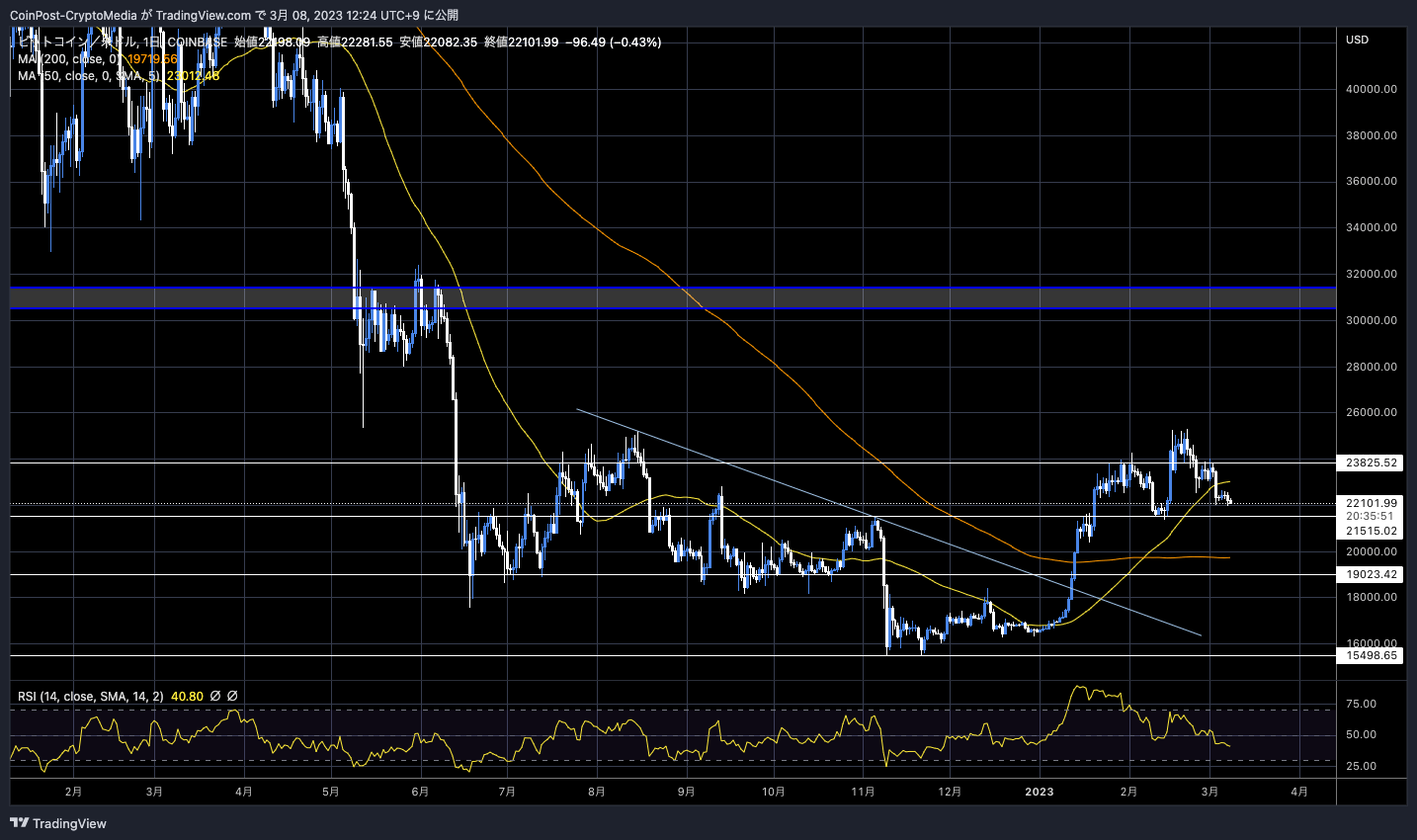

In the crypto asset (virtual currency) market, Bitcoin fell 1.58% from the previous day to $22,107.

BTC/USD daily

Risk aversion among market participants strengthened, and the US stock index fell, leading to a decline.

A further decline is expected once the dollar falls below the $21,500 support line (lower support line). Employment data on the 10th, CPI (U.S. Consumer Price Index) on the 14th, and the US Federal Open Market Commissioner on the 22nd. With the FOMC meeting approaching, it is expected that the market will sell out to prepare for increased volatility (price volatility).

According to data from CoinMetrics, the “positive correlation” between the US stock market (S&P 500) and Bitcoin (BTC) price is fading. The correlation coefficient fell to 0.30, the lowest level since April 2010. The record high was 0.66, which was recorded in September 2010.

Coinmetrics

A correlation coefficient is a statistical index that indicates the degree of similarity. A value of 1.0 indicates a perfect correlation and a negative value indicates an inverse correlation.

In past history, the correlation coefficient (60 days) between Bitcoin and the S&P 500 rarely reached 0.3, and there were times when it remained negative (negative correlation). In 2018, when the cryptocurrency bubble burst, it temporarily dropped to -0.22.

On the other hand, when the corona shock occurred in March 2020, risk assets in general such as stocks and bitcoins plunged, and the correlation coefficient surged to 0.4.

According to Arcane Research, a research firm, the correlation between Bitcoin and traditional financial markets has increased significantly since around July 2020, when risk assets began to soar due to the effects of large-scale monetary easing after the corona shock. It seems that the influx of institutional investors is having an effect.

Market uncertainty is

Uncertainty in the crypto market remains strong due to the impact of the major crypto asset (virtual currency) exchange FTX, which went bankrupt last November.

On the 2nd of this month, the US bank holding company Silvergate Capital announced that it would not be able to submit the annual report (Form 10-K) for the fiscal year in terms of financial statements, etc. by the deadline.

It has been revealed that major crypto asset-related companies such as major US exchange Coinbase, stablecoin issuer Paxos, and Crypto.com have terminated their remittance transactions and fund settlement partnerships one after another.

On the 3rd, it decided to abolish its own payment network “SEN (Silvergate Exchange Network)” that can raise US dollars with Bitcoin as collateral, saying that “excessive risk has arisen.” On top of that, the company is said to have borrowed $3.6 billion from the U.S. Federal Home Loan Bank.

As a result, the major derivative exchange Bybit announced that it would suspend US dollar settlement by bank transfer (including SWIFT).

Notice on Suspension of USD Payments via Bank Transfer

You may continue to make USD deposits via the Advcash Wallet, or buy cryptocurrencies with your credit card on our One-Click Buy page.

More details here: https://t.co/Roae3T4pYJ#Bybit #TheCryptoArk pic.twitter.com/XAUI2AeDJC

— Bybit (@Bybit_Official) March 4, 2023

Bloomberg reported that officials from the Federal Deposit Insurance Corporation (FDIC), an independent government agency in the United States, visited Silvergate Bank’s headquarters to examine books and other documents and are believed to have discussed a remedy. be done.

US regulators have been sent to the headquarters of Silvergate Capital, as the troubled crypto-friendly bank looks for a way to stay in business https://t.co/fq2sPWS7nV

—Bloomberg Crypto (@crypto) March 7, 2023

In January of this year, cryptocurrency lending company Genesis Global Capital announced that it had filed for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code. With an estimated $1 billion to $10 billion in debt, concerns spilled over to Genesis’ parent company, Digital Currency Group (DCG). DCG owns Grayscale, which issues a Bitcoin mutual fund (GBTC).

On February 8, the Financial Times reported that Grayscale had sold some of its holdings, including the Ethereum Investment Trust (ETHE), for about $22 million to repay creditors. reported in the news.

connection:DCG sells part of stake in Grayscale-provided cryptocurrency mutual fund = report

On the other hand, on the 7th of this month, oral arguments were held over the issue of Grayscale suing the US Securities and Exchange Commission (SEC) for not allowing the conversion of the Bitcoin Investment Trust (GBTC) to an exchange-traded fund (ETF). It was conducted. Courts have questioned the SEC’s ruling.

Grayscale claims that the approval of Bitcoin physical ETFs will bring it under the oversight of the Chicago Mercantile Exchange (CME), which will provide greater investor protection. The SEC has already approved Bitcoin futures ETFs, but has repeatedly denied approval of physical ETFs.

connection:U.S. Court Questions SEC Claims in Grayscale GBTC Lawsuit

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Drops After Powell’s Congressional Testimony appeared first on Our Bitcoin News.

2 years ago

160

2 years ago

160

English (US) ·

English (US) ·