Macroeconomics and financial markets

In the US NY stock market on the 17th, the Dow Jones Industrial Average rose 100 dollars (0.3%) from the previous weekend, and the Nasdaq index finished trading 34 points (0.28%) higher.

connection:US stocks rebound Tesla and other high-tech financial results start this week | 18th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

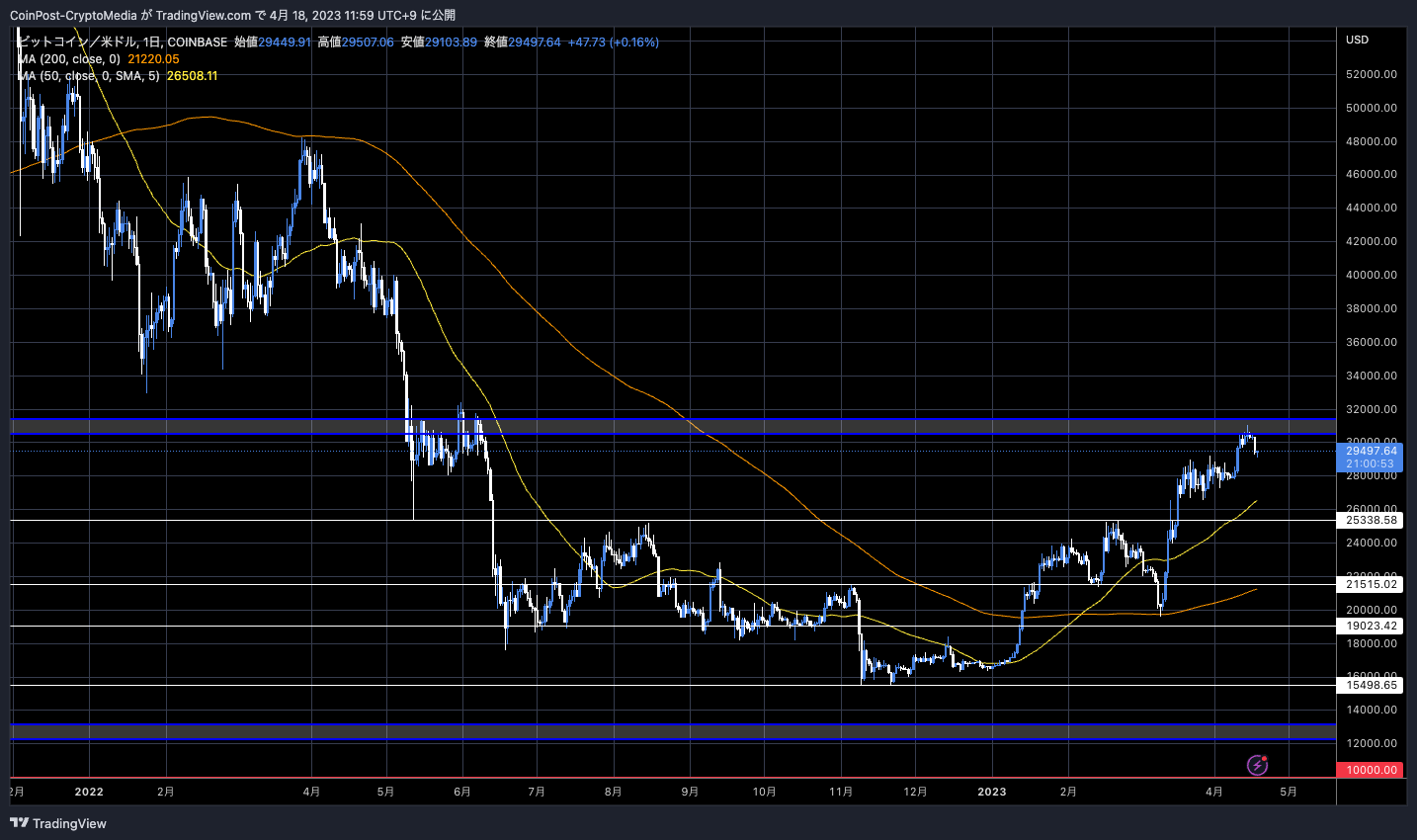

In the crypto asset (virtual currency) market, Bitcoin fell 1.74% from the previous day to $29,487.

BTC/USD daily

As the price continued to rise, it reached the $30,000 mark and the resistance line (upper resistance line), leading to profit-taking.

“The weekly chart has crossed the orange horizon, and a post-breakout return move attempting to retest the $28,800 support is rather healthy,” said crypto analyst Rekt Capital. indicate.

#BTC enjoys a solid Weekly Close above ~$28800 support (orange)

If this current dip is to get deeper, it would be entirely healthy for $BTC to retest ~28800

After all, that level was a multi-week resistance and now may have the chance to become support#Crypto #Bitcoin https://t.co/ZUMHMa7ukR pic.twitter.com/PCAzaIkAvV

— Rekt Capital (@rektcapital) April 17, 2023

He said that there should be a dip because profits will be sold after soaring.

According to the futures interest rate market, a 0.25% rate hike by the U.S. Federal Open Market Committee (FOMC) in May has already been factored in by nearly 90%, but “the market underestimated the possibility of further rate hikes after May. It is pointed out that Upward swings in economic indicators that show the underlying strength of the economy suggest room for further interest rate hikes.

Over the past few days, as the dollar index (DXY) rose, which formed a double bottom, gold and bitcoin, which had continued to rise, slowed down and remained weak. Bitcoin and the US dollar tend to be inversely correlated.

Behind the rise in the dollar index in the foreign exchange market, the “New York Federal Reserve Bank Manufacturing Index”, which indicates business sentiment, showed an increase since November last year, and the dollar was bought. It seems that there are reports that show that the sentiment index has improved for four months in a row.

“U.S. sanctions on Russia (asset freeze) and the rise of China in international trade have reduced global demand for U.S. dollar-denominated bonds,” Ray Dalio said. He said, “Countries with large dollar holdings are losing the incentive to accumulate more dollars.”

On-chain data analysis

According to a new report from Glassnode, several on-chain Bitcoin indicators show similarities to early 2016 and early 2019, the year before the “cryptocurrency bubble.”

Bitcoin reached its halving in May 2020, and in December 2020, it hit a record high of 1 BTC = $20,000 for the first time in three years.

Glassnode points out that this quarter’s return of over +70% is the highest since October 2021, when 1 BTC = $ 60,000, a record high. “The strong market performance from 2023 onwards is in contrast to 2022, when bad news continued and the market crashed, suggesting that a new regime shift (trend-like structural change) is underway.” evaluated.

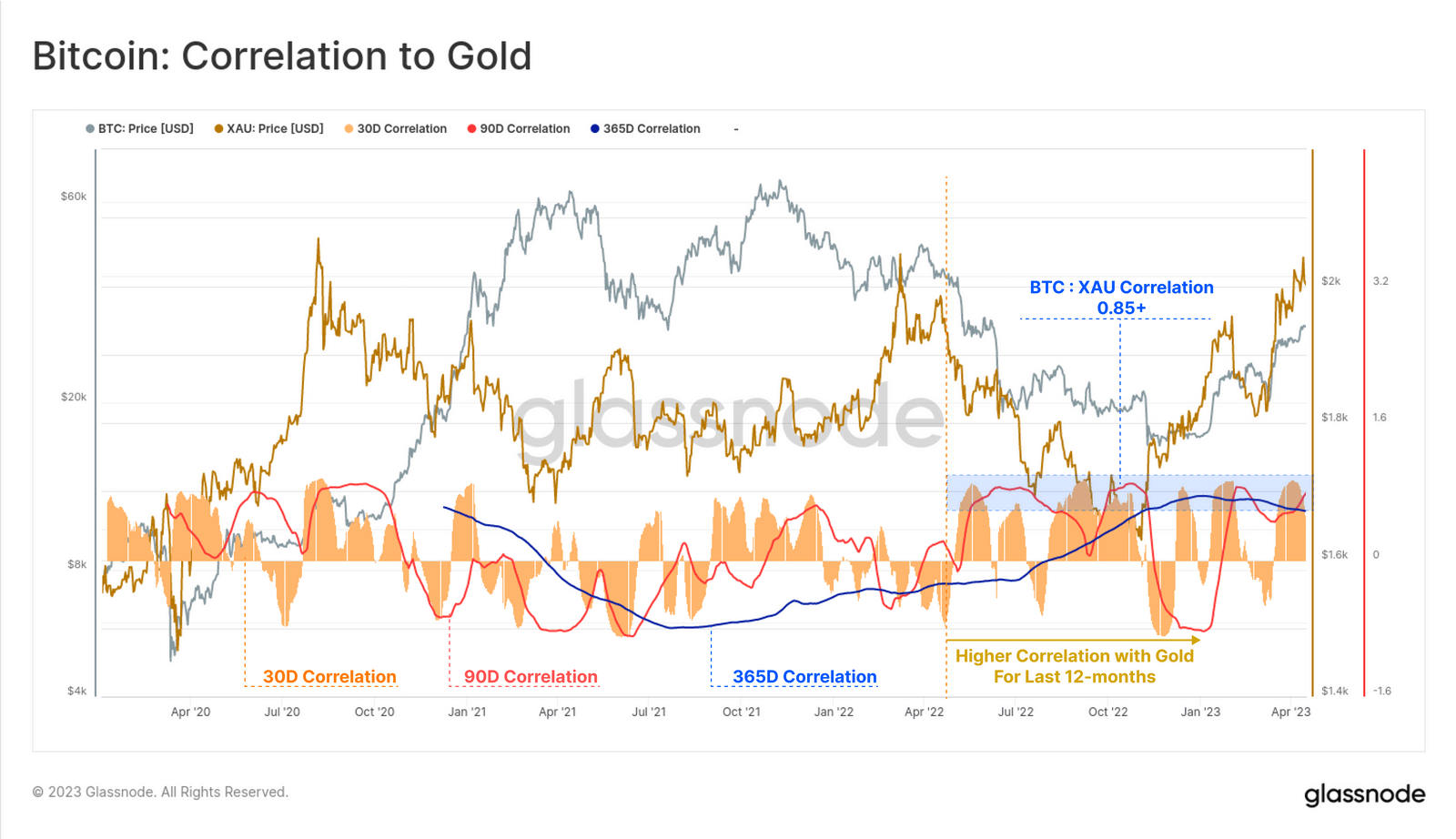

The correlation coefficient between gold and bitcoin, which is a representative of alternative assets, recorded high figures such as a positive correlation of 0.85 at one point in the 90-day correlation (red line).

Glassnode

In the 365-day correlation (blue line), it has been rising steadily since last summer. Even when credit instability shook Western countries due to the failure of Silicon Valley Bank (SVB) and other factors, and counterparty risk became a concern, it remained at a high level.

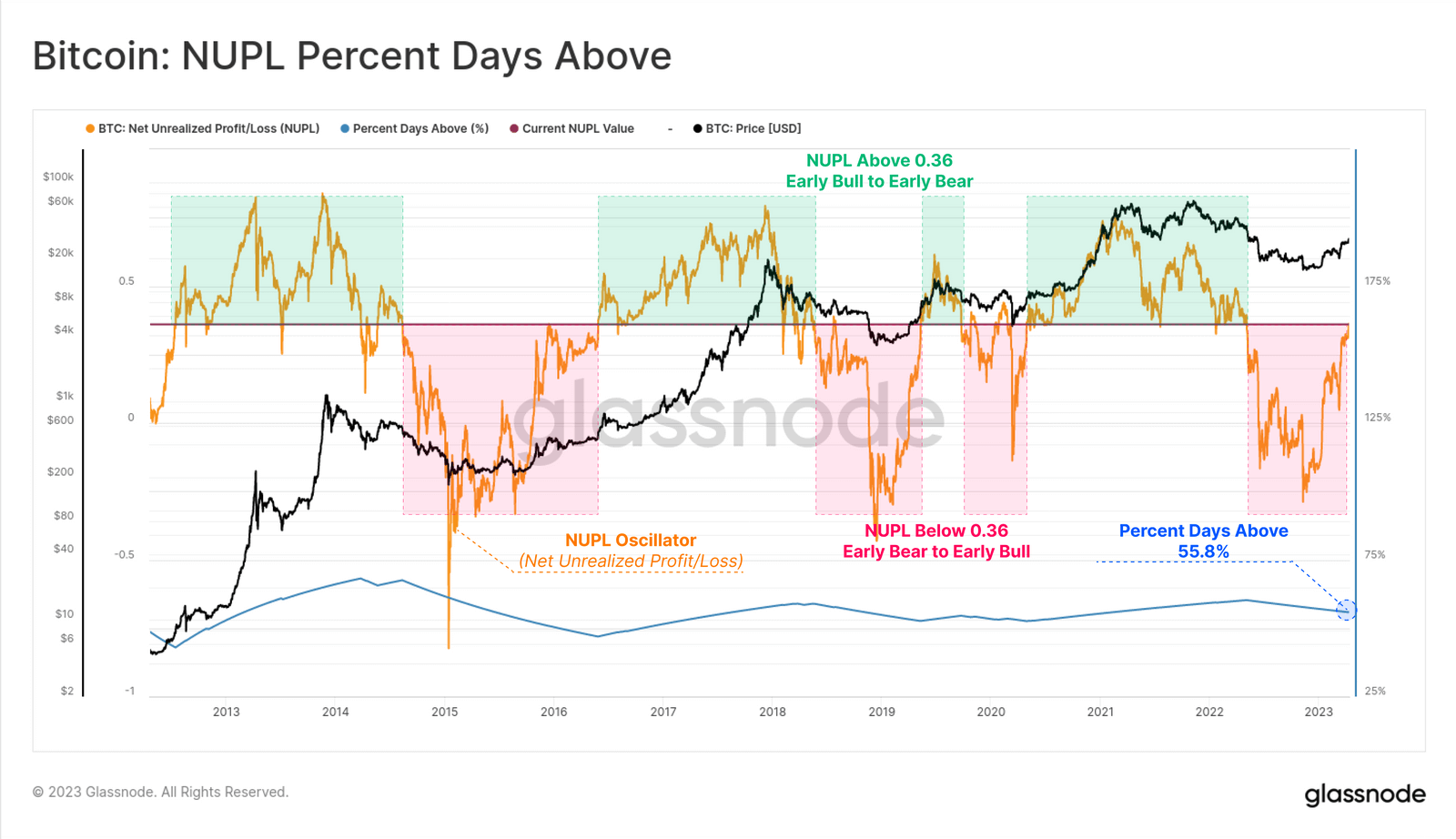

When I checked the “unrealized profit and loss (NUPL)”, which indicates the “unrealized profit ratio” in the market capitalization of Bitcoin, the current figure was 0.36.

Glassnode

NUPL’s historic troughs to neutral levels coincide with key turning points between bear and bull markets in historical cycles. (Above: End point of red square)

alto market

Data from Beaconcha.in show that 1.03 million ETH (worth $2.1 billion) were withdrawn in the five days following the Ethereum (ETH) mega upgrade “Shapella”.

Lachlan Feeney, CEO of blockchain development company Labrys, said, “The major upgrade Shapella has removed long-term capital constraints and greatly increased the reliability of the protocol. Validators tend to re-stake the ETH they have withdrawn.” It pointed out.

connection:What is the withdrawal status and future outlook for Ethereum (ETH) staking rewards?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Drops to $29,500, On-Chain Data Similar to Past ‘Turning Point’ appeared first on Our Bitcoin News.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·