Bitcoin (BTC) spot exchange-traded funds (ETFs) could bring $30 billion in new demand to the world’s largest cryptocurrency, according to a research report by the New York Digital Investment Group (NYDIG), a Bitcoin-focused investment firm.

Spot ETF fever has swept the crypto market in recent weeks, with filings from the likes of BlackRock and Fidelity.

“The brand recognition of BlackRock and iShares, the ease of buying and selling through brokerages, position reporting, risk measurement, and tax filing convenience may provide additional benefits for spot ETFs compared to existing alternatives,” the NYDIG wrote in its report.

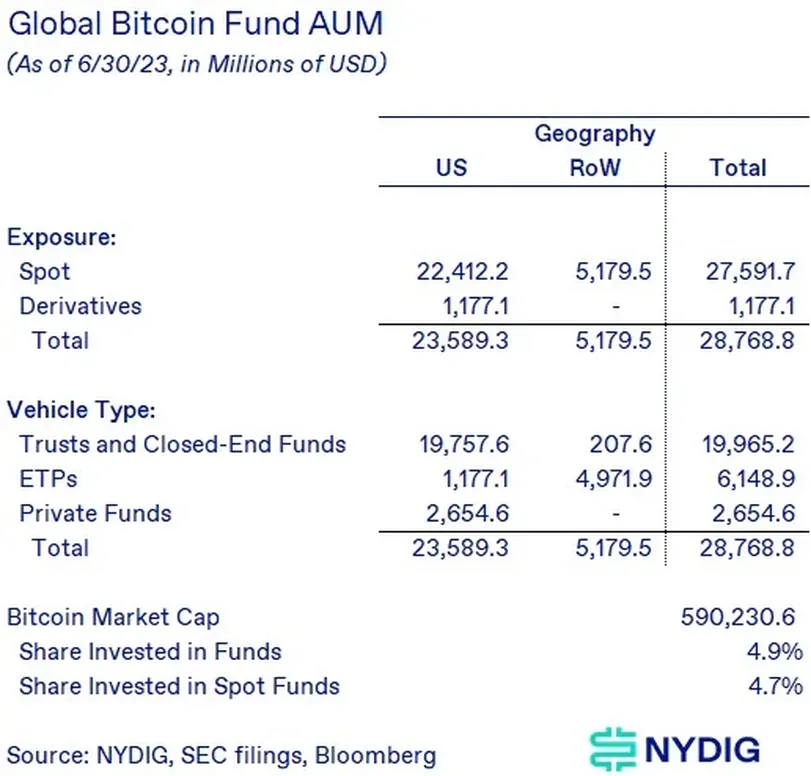

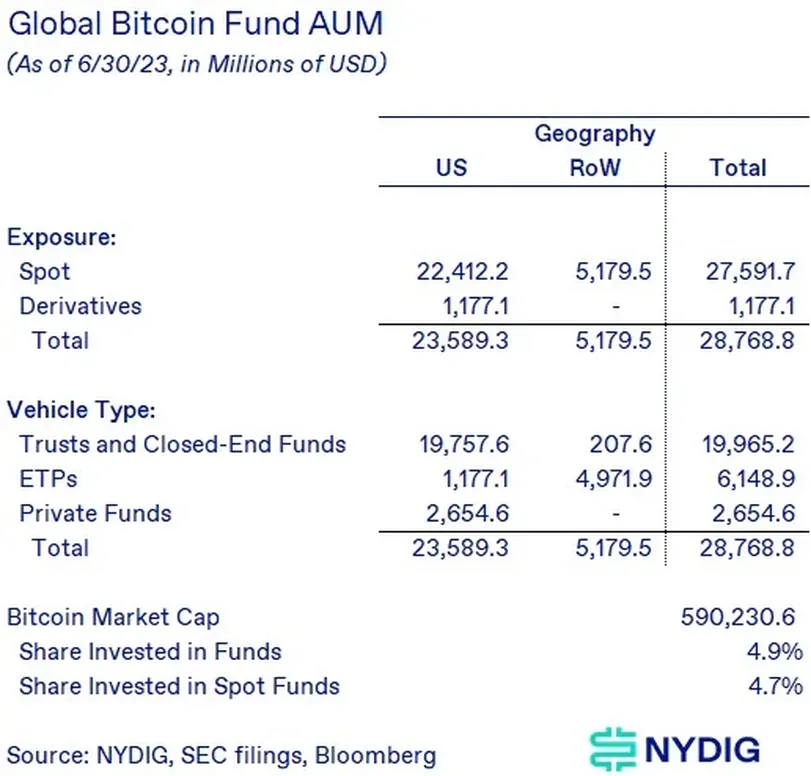

NYDIG has already modeled $28.8 billion in Bitcoin assets under management and $27.6 billion in spot products.

(NYDIG)

(NYDIG)Bitcoin is often referred to as digital gold, so comparisons will be made to gold ETFs that were listed in the early 2000s. Gold ETFs currently hold only 1.6% of the world’s total gold supply (national central banks hold 17.1%), while bitcoin funds hold 4.9% of the total bitcoin supply, NYDIG points out.

There is a wide gap between the demand for the two assets, digital and analog, in funds. More than $210 billion has been invested in gold funds, while only $28.8 billion has been invested in bitcoin funds.

“Bitcoin is about 3.6 times more volatile than gold, and in terms of volatility investors will need to buy 3.6 times more bitcoin in dollars than gold. Still, a bitcoin ETF will increase demand by nearly $30 billion,” NYDIG wrote.

Cryptocurrency newsletter Ecoinometrics takes a more cautious view of Bitcoin ETFs.

Ecoinometrics says the Gold ETF fills an important void in the market by providing an easily traded product that tracks the spot price of gold.

However, the comparison between Gold ETFs and Bitcoin ETFs can be misleading. That’s because gold’s big rally at the time was largely due to a favorable macro environment and a weaker dollar. Remember the War on Terror, the rise of China, the beginning of a ballooning US budget deficit, all packed into a decade?

“Gold ETFs have undoubtedly provided good inflows to the gold market, but the macro environment has been in control during that time,” said Ecoinometrics. “Bitcoin spot ETFs will help spark interest in Bitcoin and will definitely bring in new capital to Bitcoin. But 1 BTC cannot be worth $100,000.”

The real potential for Bitcoin ETFs, they write, lies in the convergence of factors such as ETF launches, the weakening of the US dollar, the Fed’s move toward quantitative easing, and the transfer of intergenerational wealth to younger individuals who are more likely to invest in crypto assets.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

|Image: Shutterstock

|Original: Bitcoin Spot ETFs Could Bring $30B in New Demand, Crypto Trader NYDIG Says

The post Bitcoin ETF Could Bring $30 Billion in New Demand: NYDIG | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

87

2 years ago

87

English (US) ·

English (US) ·