- Bitcoin’s implied volatility has plummeted since the U.S. Securities and Exchange Commission approved spot ETFs, providing a lesson for volatility traders as the focus shifts to expectations for Ethereum ETFs.

- Traders looking to see how Ethereum behaves ahead of and following the ETF’s launch, expected later this year, would do well to trace how options are priced.

A Bitcoin (BTC) exchange-traded fund (ETF) that invests in actual tokens began trading in the United States on January 11th. After years of waiting, the investment product was approved by the U.S. Securities and Exchange Commission (SEC) on Tuesday.

Several things have happened in the weeks leading up to its debut, some related to implied volatility (IV) and the options market as speculators look to Ethereum (ETH) as the next candidate for ETF approval. The incident is noteworthy.

IV represents investors’ expectations of price volatility and positively influences the prices of call and put options. Buyers of call options can profit from or hedge against rising prices, and buyers of put options can protect against falling prices.

When faced with an alternative event, such as a stock’s closing date or the SEC’s decision to file a spot ETF, traders tend to buy options to create “vegalong” positions that benefit from increases in IV. is. However, this strategy exposes the trader to the possibility that volatility will plummet after the event, resulting in a drop in option prices.

According to Samneet Chepal, a quantitative crypto researcher, this is exactly what happened in the Bitcoin market, and Ethereum learned the lesson that it is dangerous to take long positions on volatility on the day of the approval announcement. He said he gave it to a trader.

“Volatility is all red right now. Here’s what to remember about the Ethereum ETF storyline: Price action typically picks up well before a big day, but volatility often spikes as the event approaches. It may not be ideal for volatility to be net long by the time of the actual announcement,” Chepal said.mentioned in X.

“Those of us who have been down this path with Bitcoin ETFs have some insight that it may be realistic to consider a ‘vega short’ position for Ethereum ETFs,” Chepal added.

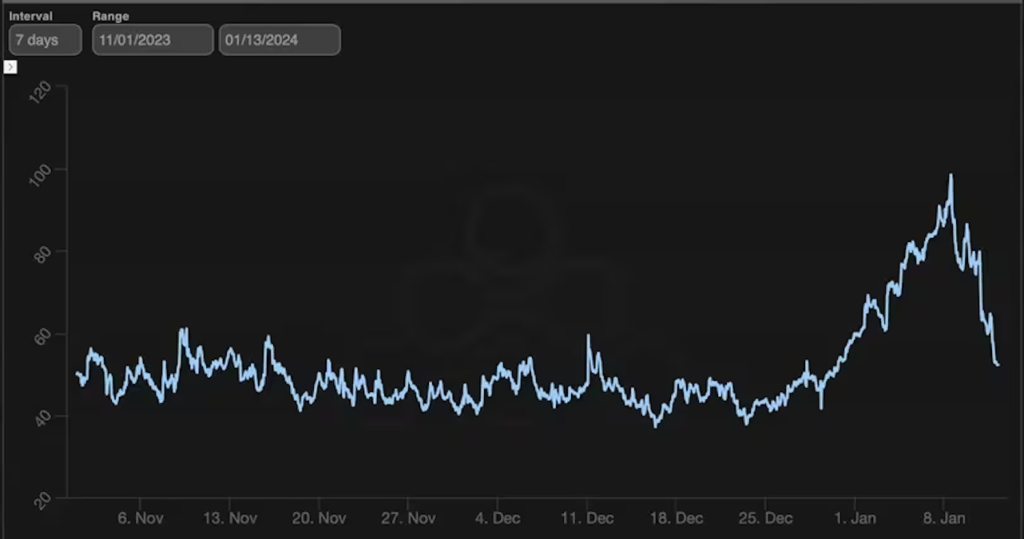

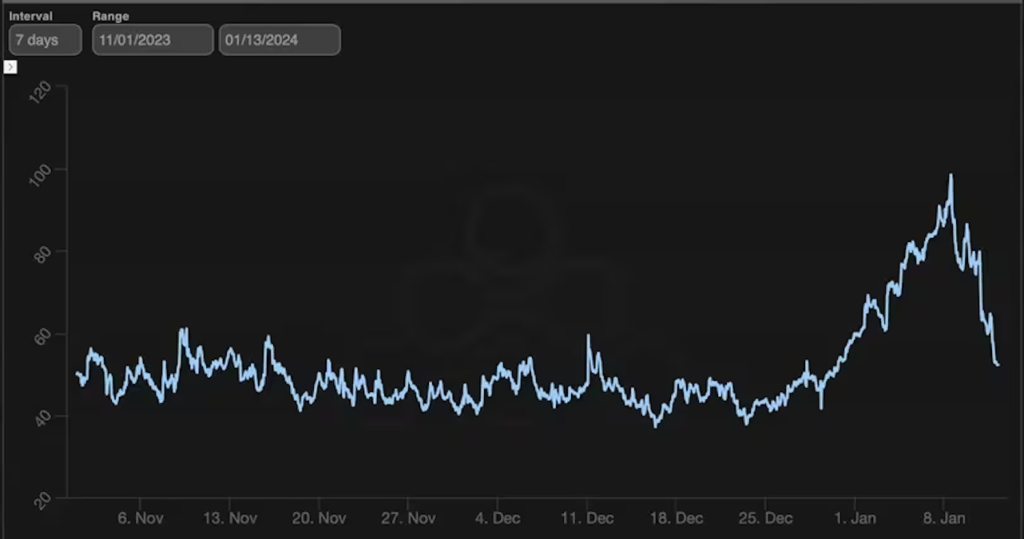

Since the US SEC approved spot ETFs, 7-day IV has plummeted. (Amberdata)

Since the US SEC approved spot ETFs, 7-day IV has plummeted. (Amberdata)Bitcoin prices started rising in early October on ETF optimism, but the annualized 7-day IV soared this month, reaching 96% ahead of SEC approval. However, since then it has fallen to 52%.

Pay attention to option prices

Bitcoin rose more than 60% in the three months leading up to the ETF launch. Still, the consensus forecast earlier this week was for stocks to rise, ruling out a “sell on the news” after the Jan. 10 approval announcement.

However, the option warned of a cooling-off period after approval. Earlier this week, Bitcoin puts began trading at a premium to calls, a sign that sophisticated market participants were seeking protection against falling prices.

Bitcoin rose from $46,000 to more than $49,000 after spot ETFs began trading on the 11th. However, this surge was short-lived and the price has since retreated to near $46,000.

As such, traders will want to keep an eye on how Ethereum options are priced while following the potential launch of an Ethereum spot ETF.

Several companies, including BlackRock, have filed for an Ethereum spot ETF in November 2023. VanEck’s ETF has the earliest approval deadline in May, followed by BlackRock’s ETF in August.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Amberdata

|Original text: Bitcoin ETF Debut Serves as a Lesson for Ether ETF Speculators

The post Bitcoin ETF movements offer lessons for Ethereum ETFs | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

123

1 year ago

123

English (US) ·

English (US) ·