The post Bitcoin ETF Options: What Does This Mean for Investors? appeared first on Coinpedia Fintech News

The Bitcoin options market has made a new history. The first Bitcoin ETF option is set to jolt the market, as the US SEC recently approved options trading on BlackRock’s iShares Bitcoin Trust. The Bitcoin options trading community has welcomed the new development. Many believe that the new move will open the door for more opportunities. At the same time, there are some who want to be cautious about the potential risks. We can use this opportunity to assess the development logically. Ready?

Understanding Bitcoin ETF Options Trading

Before we move further, we should take a moment to understand why the approval of the new BTC ETF Options trading by the US SEC is so significant. In simple terms. more liquidity is the primary benefit the Bitcoin market can expect to achieve with this development. Generally, large investors, especially institutional investors, prefer assets with high liquidity. Considering that, there is nothing wrong with assuming that the new development will help the market attract more long-term investors or institutional investors.

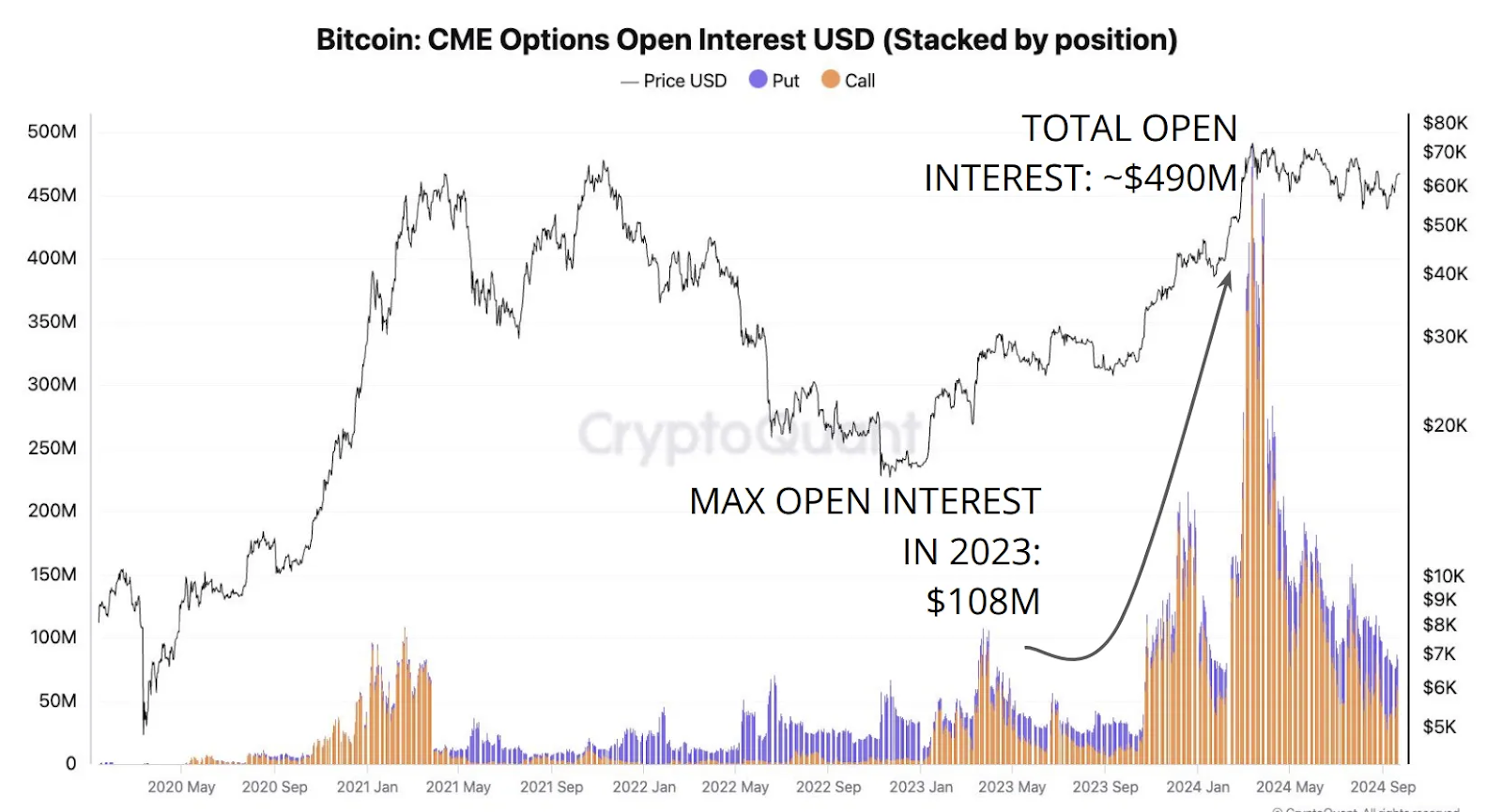

Bitcoin Open Interest after ETF. Source: CryptoQuant

Bitcoin Open Interest after ETF. Source: CryptoQuantInterestingly, as per a CryptoQuant report, options trading tends to attract long-term investors compared to futures trading. The report notes that at least half of all options have expiry dates of five months or more in the current BTC options market, but a large number of futures trades have expiry dates of three months or less.

Could Bitcoin ETF Options Bring Increased Shorting?

Though the majority of the crypto community is extremely happy with the new milestone achieved in the BTC options market, there are some who want the community to take a cautious approach at this stage. The primary question bothering these skeptics is whether the new BTC ETF Options trading could increase the chances of shorting. Their concerns are not unfounded. In the past, whenever there was an increase in the paper supply of Bitcoin the Bitcoin market shifted into a bearish zone.

In conclusion, there is no doubt that what the new Bitcoin ETF Options trading offers is more opportunities. At the same time, it is important to be aware that there are certain risks associated with this development. The crypto community should be mindful of all the potential threats, including the primary risk of shorting.

11 months ago

44

11 months ago

44

English (US) ·

English (US) ·