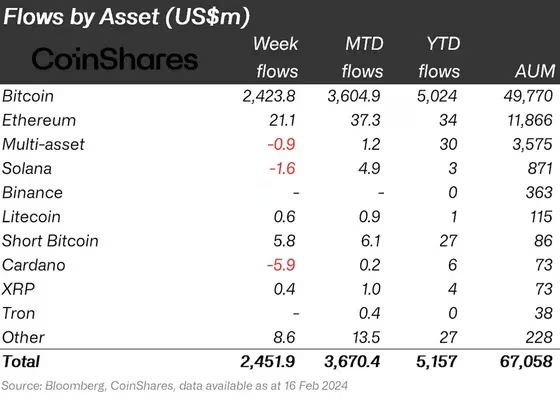

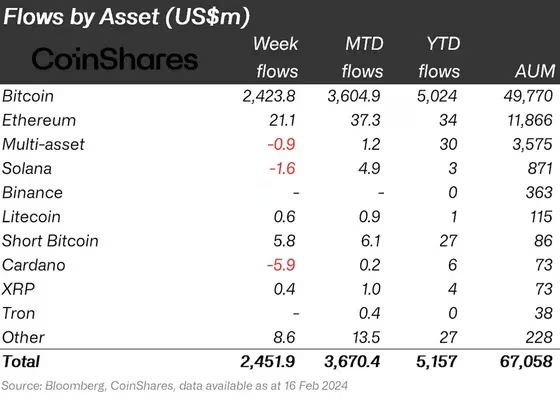

- Overall, CoinShares reported that a record $2.5 billion flowed into crypto exchange-traded products (ETPs) last week, with Bitcoin ETFs accounting for 99% of all inflows.

- Outflows in Grayscale's GBTC were offset by large inflows into BlackRock's IBIT and Fidelity's FBTC.

Crypto asset management company CoinShares announced on the 19th that demand for Bitcoin ETFs (exchange traded funds) rose again last week, resulting in a record $2.4 billion (approximately 360 billion yen, equivalent to 150 yen to the dollar). announced that there has been an influx. Inflows into digital asset investment products accounted for the majority at $2.45 billion.

Inflows to the newly approved US Bitcoin spot ETF exceeded the $623 million outflows caused by Grayscale's GBTC, which converted an existing fund into an ETF. BlackRock’s IBIT and Fidelity’s FBTC have seen inflows of $1.6 billion and $648 million, respectively, over the past week.

“This means that net inflows have accelerated significantly and are widely diversified across a variety of providers, leading to increased interest in spot-based ETFs,” said James Butterfill, head of research at CoinShares. “This shows that the situation is increasing.”

Demand for Bitcoin ETFs has soared as Bitcoin (BTC) reached $52,000 (approximately 7.8 million yen) for the first time since December 2021, with investors hoping Bitcoin will hit an all-time high this year. I'm keeping an eye on it to see if it will be updated.

The CoinShares report also noted that weekly inflows into the crypto asset class also hit an all-time high. Bitcoin accounted for 99% of all net inflows into crypto funds, followed by Ethereum (ETH) products with $21 million in inflows.

Meanwhile, blockchain equity ETFs experienced $167 million in outflows, suggesting investors took profit, CoinShares noted.

|Translation and editing: Rinan Hayashi

|Image: CoinShares

|Original text: Bitcoin ETFs See Record $2.4B Weekly Inflows; BlackRock's IBIT Leads: CoinShares

The post Bitcoin ETF records weekly inflows of $2.4 billion ─ BlackRock’s IBIT leads the way | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

92

1 year ago

92

English (US) ·

English (US) ·