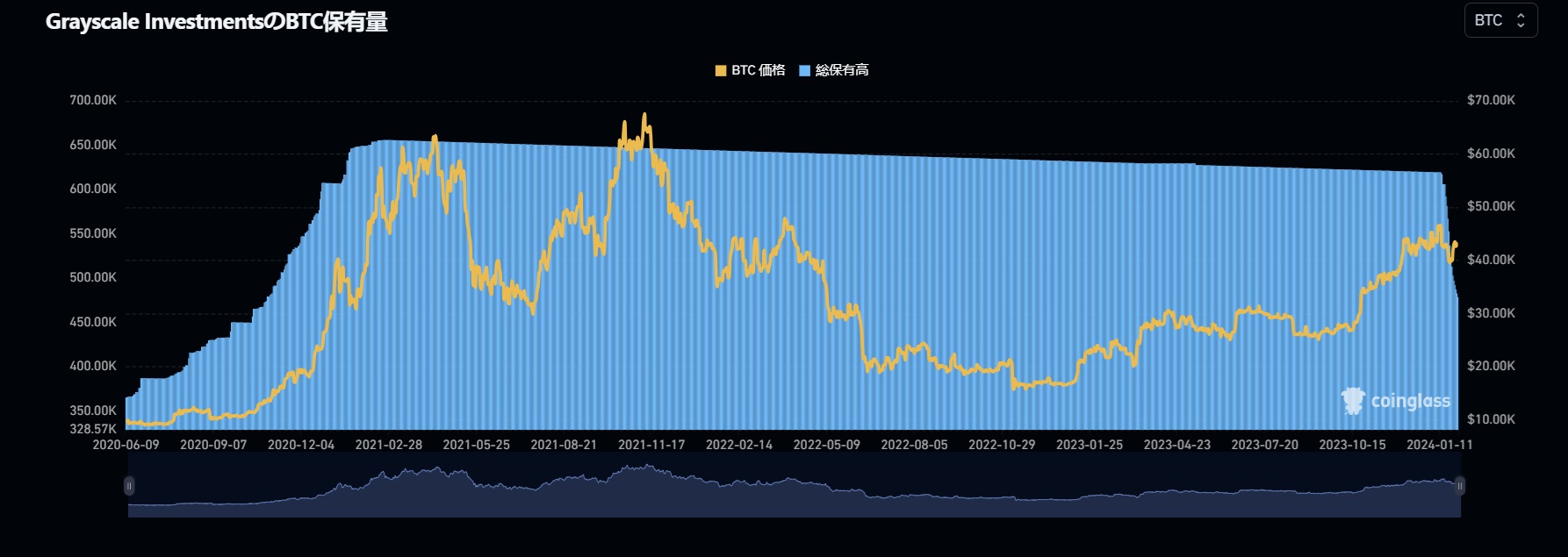

Fund outflow amount is approximately $4.3 billion

Since the Grayscale Bitcoin Trust (GBTC) converted into a Bitcoin spot ETF (exchange traded fund) on January 17, Japan time, the move has had a noticeable impact on the Bitcoin market. However, recent capital outflows are showing signs of slowing, and the market appears to be returning to calm.

According to a report dated the 29th from Bitfinex Alpha, the analytical arm of a major crypto asset (virtual currency) exchange, since the conversion of GBTC to an ETF, the amount of capital outflow from the trust has been approximately $4.3 billion (approximately 640 billion yen). Reached.

Source: Bybt

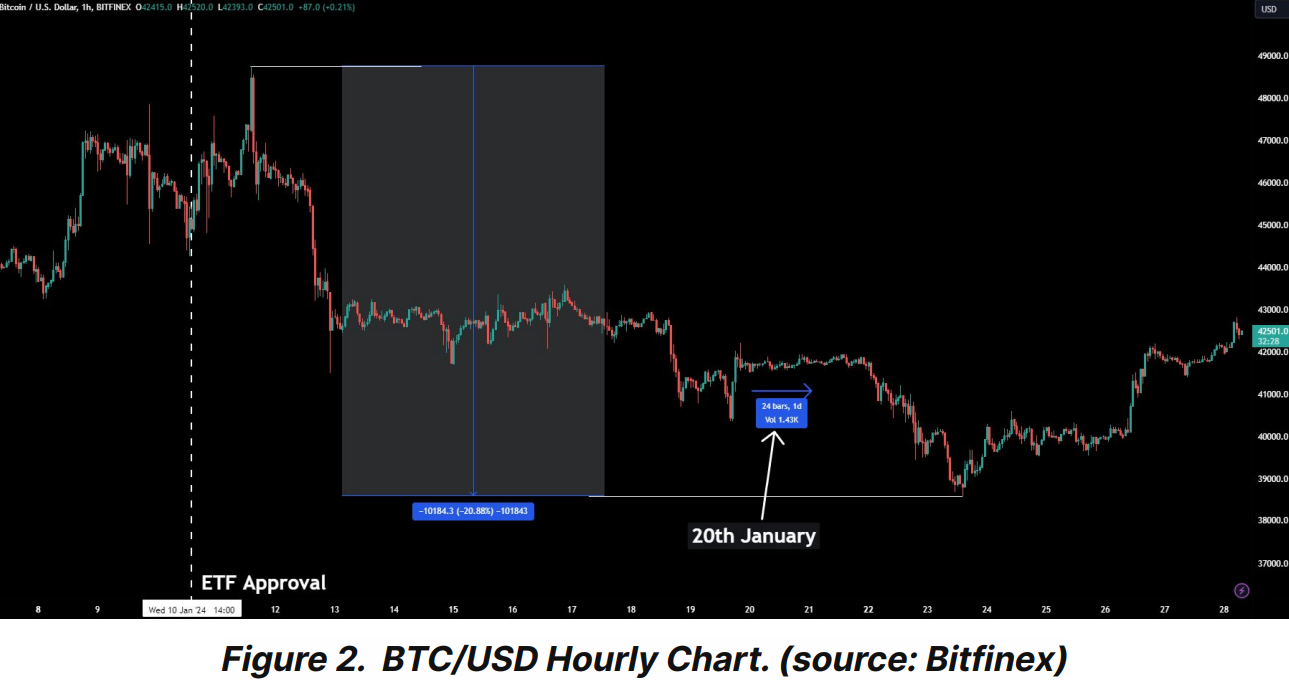

It is believed that there is a close relationship between these outflows of funds from GBTC and Bitcoin price trends, and following a slight price increase after the ETF approval, Bitcoin (BTC) prices fell by about 20%. did.

Source: Bitfinex Alpha

At the time of its approval, Grayscale’s Bitcoin Trust transformed into the world’s largest Bitcoin fund, initially boasting over $28.6 billion in assets under management. However, following the liquidation of the assets of the bankrupt virtual currency exchange, the exchange sold most of its GBTC holdings, causing a huge ripple in the market. FTX sold approximately 22 million shares worth approximately $1 billion, reducing its holdings in GBTC to virtually zero.

GBTC has been trading at a negative premium for the past few years. Therefore, many entities appear to have decided to withdraw from GBTC at a time when GBTC was converted to an ETF and the discount effectively became zero. On February 13, 2023, GBTC traded at a -47.35% discount to net asset value. This discount gradually narrowed and reached zero on January 26th.

connection:Bitcoin investment trust GBTC’s “negative divergence”, the background to the rebound

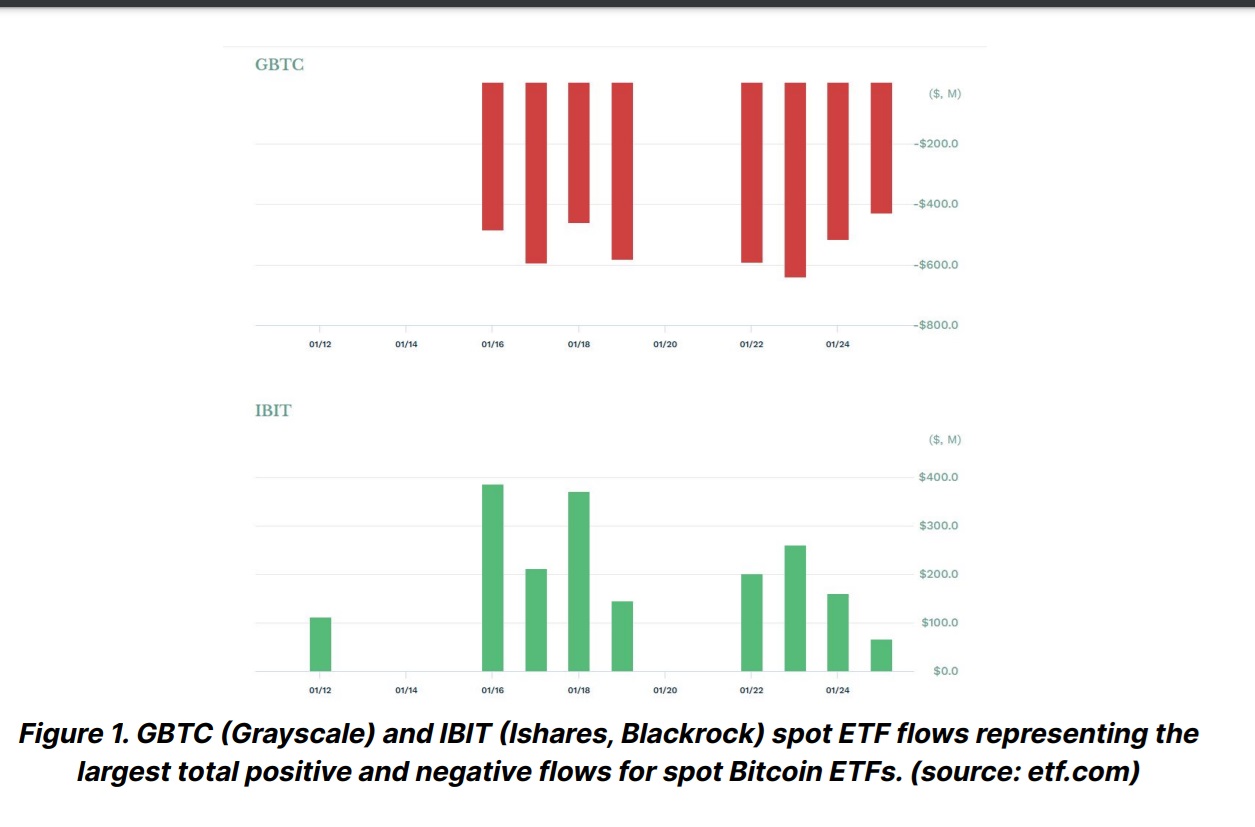

Overall net inflows of just over $800 million

Meanwhile, 10 Bitcoin spot ETFs have appeared on the market, and excluding the Bitcoin Trust ETF (GBTC), net inflows into Bitcoin ETFs (exchange traded funds) reached $5.2 billion, with a total of $19,000. There was an excess inflow of BTC (approximately $824 million). In particular, BlackRock’s iShares Bitcoin Trust (IBIT) recorded the largest net inflow of $1.92 billion.

Source: Bitfinex Alpha

Fee competition is intensifying in the Bitcoin ETF market, with GBTC maintaining a fee of 1.5%, while competitors are challenging the market with fees as low as 0.2% to 0.9%. This high fee structure encouraged investors to migrate to lower-cost Bitcoin ETFs.

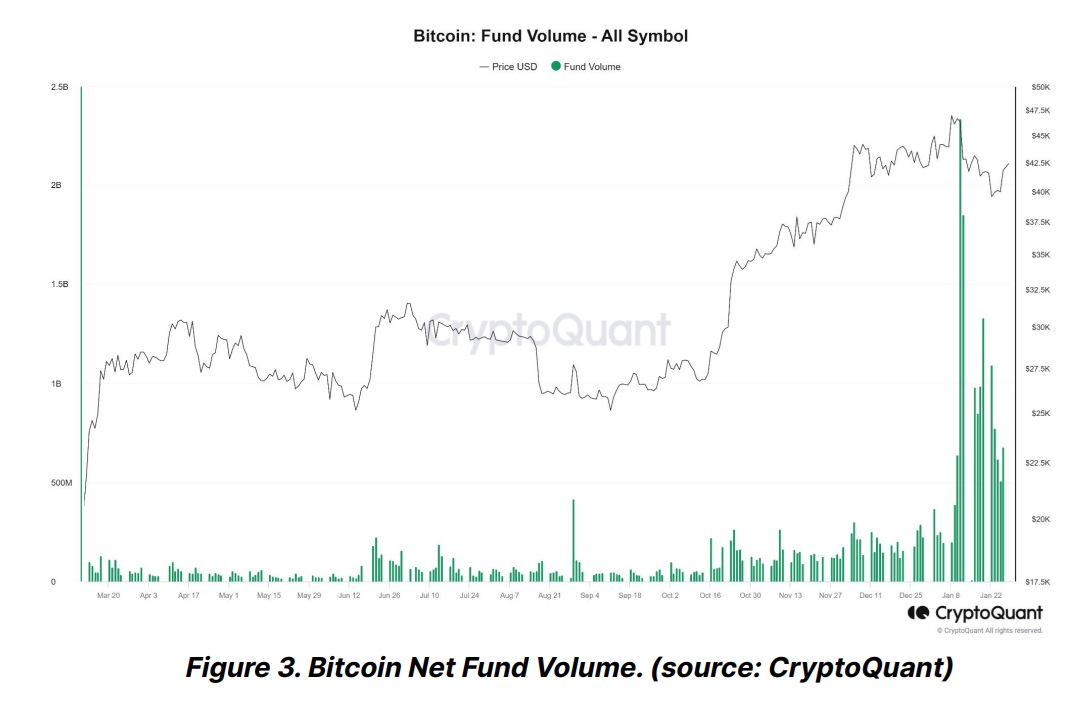

However, the market tide is gradually calming down as the movement of funds between Bitcoin ETFs is on the decline.

Source: Bitfinex Alpha

According to data from crypto information company IntoTheBlock dated the 29th, Bitcoin ETFs, including GBTC, currently hold 3.23% of Bitcoin in circulation. This is a higher share than gold ETFs, where about 1% of the supply is owned by the ETF.

“Despite the Bitcoin correction, the high ownership of Bitcoin ETFs shows that they are gaining support among traditional financial investors,” said Lucas Automurro, Head of Research at the firm. He is watching.

connection:10 US Bitcoin Spot ETFs Total Net Inflows of 19,000 BTC in January

The post Bitcoin ETF, the impact of capital outflows from GBTC on the market – Bitfinex Alpha appeared first on Our Bitcoin News.

1 year ago

70

1 year ago

70

English (US) ·

English (US) ·