The post Bitcoin ETFs Under Stress, Options Data Project Tough Recovery appeared first on Coinpedia Fintech News

With the entire crypto market facing another crossroads, the post-Bitcoin Halving days in 2024 are witnessing an increase in volatility. As the bearish sentiments are slowly taking over the market, the sudden spikes in some altcoins reflect an underlying bullish stand.

As the general market anticipates Bitcoin price prediction of $100,000 in 2024, the 7D post-halving return shows minimal upside. This is because of the recent 3.52% setback on Wednesday, 24th April.

With the crypto market standing at a crossroads, the buyers are struggling to take a bullish turn. Will the markets bounce back, or is a crash under $60,000 for Bitcoin inevitable? Let’s find out more in our market analysis report below.

Bitcoin Price Performance

Being the trendsetter in the crypto market, the biggest crypto, Bitcoin, sets the tone for the majority. With a market cap of $1.268 Trillion and a 9.44% drop in the last 30 days, the biggest crypto is on a downhill.

Further, Since the start of the year, there has been notable panic selling on the Binance and OKX exchanges, where 5,137 bitcoins have been sold at a loss. This reflects investors’ quick reactions to sell off their holdings and a rise in FUD.

As the rising supply hits Bitcoin, the broader market enters a pullback phase, cooling down the much-anticipated jump on Bitcoin Halving Day. A similar impact is seen in the new market of Bitcoin ETFs.

Analysis of Bitcoin ETFs

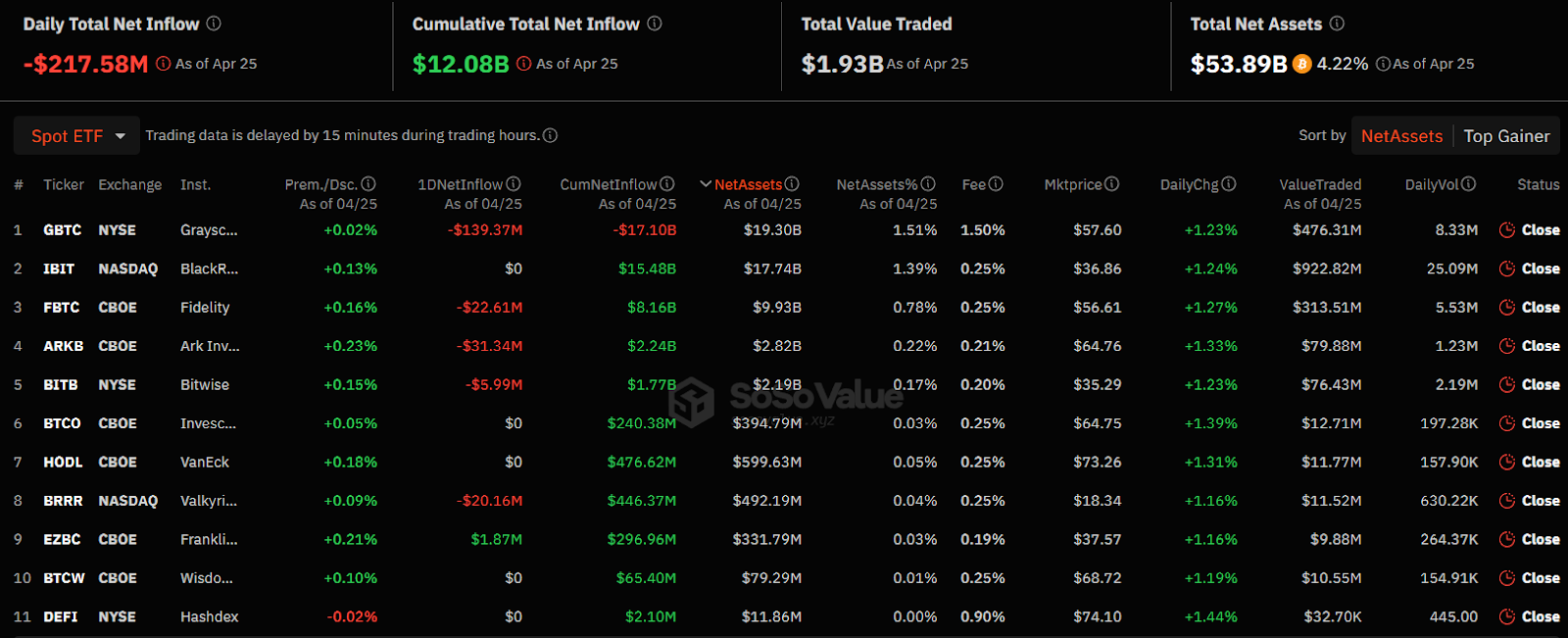

With a total net outflow of $217 Million on April 25th, the Bitcoin ETFs have lost $337 Million in the last two days. Amidst the growing outflows, Blackrock’s IBIT ETF shows a second consecutive $0 inflow day. However, with the largest cumulative inflow since its inception of $15.48 billion, IBIT remains the biggest positive player.

The Bitcoin ETFs market maintains a positive perspective despite the recent rise in outflow, with a cumulative total net inflow of $12.08 Billion.

In conclusion, the recent hiccup seems nothing more than a healthy correction. However, repetitive behavior in the next week will be a bearish signal of a greater correction phase.

Bitcoin Options Market Data

On April 26, about 96,000 Bitcoin (BTC) options and 990,000 Ethereum (ETH) options are set to expire. BTC options show a Put Call Ratio of 0.68 and a Maxpain point at $61,000, carrying a notional value of $6.2 billion.

For ETH, the ratio is 0.51, with a Maxpain point of $3,100 and a notional value of $3.1 billion. Market volumes have decreased, with both Bitcoin and Ethereum experiencing low activity levels.

The decline in implied volatility (IV) and recent ETF outflows suggest a subdued market sentiment, further dampened by a major investor’s ongoing concerns. This makes a BTC price recovery challenging.

Conclusion

Following the sharp recovery in early 2024 with the launch of spot ETFs, the volatility has also increased in the market. With the main catalysts of 2024 being ETFs, Bitcoin Halving and the highly anticipated rate cuts, the bulls are facing multiple roadblocks.

The weakness in the global markets impacting Bitcoin Halving through the newly launched Spot ETFs, the $100,000 dream gets farther. A bearish spiral possibility is on the cards with a potential supply dump from Miners. However, a historic trend of massive recovery in the year and next of Bitcoin Halving, the buyers remain hopeful.

1 year ago

92

1 year ago

92

Adler Jr (@AxelAdlerJr)

Adler Jr (@AxelAdlerJr)

English (US) ·

English (US) ·