If the U.S. Securities and Exchange Commission (SEC) approves more than a dozen Bitcoin ETFs within the next few days, as expected, virtually everyone will have access to Bitcoin, whether they are familiar with crypto assets or not. (BTC) will become even easier to access, leading to a flood of investment funds into the crypto market.

That would force ETF issuers to scramble to buy tens of billions of dollars worth of Bitcoin to meet the surge in demand from citizen investors young and old.

Currently, the largest Bitcoin investment vehicle, a (relatively difficult to purchase) financial product called Grayscale Bitcoin Trust (GBTC), has assets of $26 billion (approximately 3.77 trillion yen, 145 yen to the dollar). This is a scale that gives a sense of the appetite for investing in Bitcoin to some extent.

Is the industry ready? According to market participants, the Bitcoin market has seen significant purchases of Bitcoin from ETF issuers including BlackRock, Grayscale, Fidelity, and Galaxy/Invesco. It is said that the company has sufficient liquidity to easily accept the

Authorized Participant (AP) and Market Maker

In order to efficiently trade large amounts of capital, two key players need to intervene. These are trading companies called authorized participants (APs) and market makers.

APs create and redeem ETF shares and move investor money into and out of the fund. It may sound mundane, but it’s essential to keeping an ETF’s price closely linked to the value of the fund’s underlying assets.

With GBTC, purchased products cannot be redeemed. This could lead to an oversupply of GBTC and downward pressure on its price. In fact, GBTC has been trading well below its so-called net asset value (NAV) for several years. This is also one of the reasons why Grayscale wants to convert GBTC into an ETF.

AP’s work is in the “primary market,” but another important player, the market maker, is needed in the “secondary market,” such as the exchange where most transactions take place. There is.

Market makers build on the role of AP, buying when others want to sell ETFs, and selling when others want to buy. When prices fluctuate wildly, market makers can trade to bring the price back to its original level and make a profit. In some cases, market makers may play the role of AP.

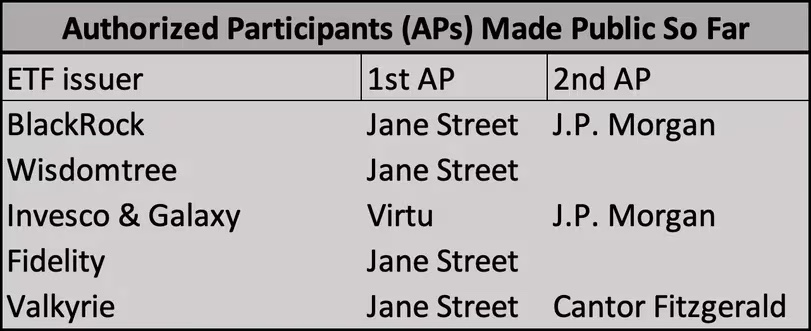

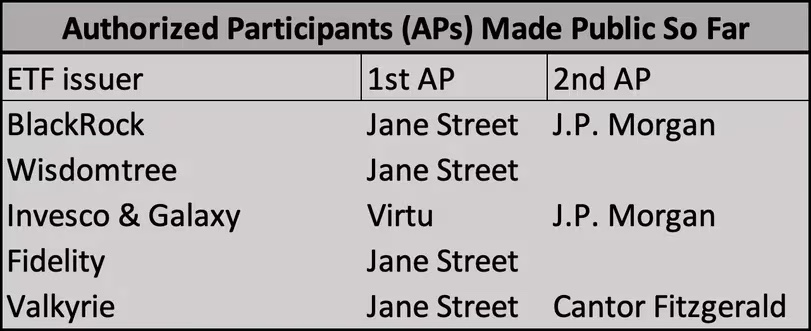

Several major Wall Street firms have agreed to serve as APs for Bitcoin ETFs. They are JPMorgan Chase, Jane Street, and Cantor Fitzgerald. Other companies may agree.

APs published so far by companies wishing to issue Bitcoin ETFs

APs published so far by companies wishing to issue Bitcoin ETFsLiquidity is sufficient

Trading firm DRW is one of the world’s largest liquidity providers. The company’s crypto asset arm, Cumberland DRW, is preparing for a Bitcoin ETF, onboarding issuers and raising Bitcoin, as new investment products come to market, and from AP. The company said it is making sure it is ready when orders come in.

Billions of dollars of Bitcoin orders may seem like too much for the market to handle, but traders are confident that the market is efficient enough to absorb trading volumes of this size. ing.

“Where there’s demand, there’s supply,” Rob Strebel, director of relationship management at Cumberland DRW, said in an interview.

“I don’t believe that issuers or regulators will allow this product to be launched unless they are confident that they will have liquidity. It is in everyone’s interest to have liquidity, and we are committed to providing I am confident that I can provide sex.”

What makes ETFs attractive to investors is that they are relatively easy to access. In the United States, customers can essentially use traditional brokerage accounts to buy any of the thousands of stocks and ETFs listed in the country. Buying a Bitcoin ETF will be as easy as buying Apple stock.

There is another selling point. ETFs tend to track the value of their holdings. For example, gold ETFs generally move in tandem with the price of the gold they hold. The mechanism is that AP dynamically issues or redeems ETFs in order to link the ETF price to the underlying assets.

Bustling Bitcoin market

Over the past 45 days, daily Bitcoin trading volume on major exchanges has averaged about $22 billion, but has soared to about $40 billion on some days, according to CoinMarketCap.com data analyzed by CoinDesk. Observers believe that is enough to meet demand from Bitcoin ETF issuers.

“The market can absorb new demand in the ETF market,” Laurent Kssis, director of financial services firm CEC Capital and former managing director of 21Shares, said in an interview. Stated.

While the new wave of capital could be good for the overall health of the market, it’s unclear whether it will have an impact on the Bitcoin price itself, and that will depend on demand for the ETF and how quickly it moves, he added. , continued as follows:

“Not all ETFs will be popular. We believe investment demand will be biased towards BlackRock ETFs.”

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Bitcoin ETFs Could Spark Huge BTC Trading. The Market Appears Up to the Task

The post Bitcoin ETFs will spark massive Bitcoin trading — the market is ready | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

102

1 year ago

102

English (US) ·

English (US) ·