Macroeconomics and financial markets

In the US NY stock market on the 20th, the Dow Jones Industrial Average rose 163 dollars (0.47%) from the previous day, while the Nasdaq index, a high-tech shareholder group, closed 294 points (2.0%) lower.

In addition to the risk of soaring grain prices due to the worsening situation in Ukraine and the prospect of an interest rate hike at the next US Federal Open Market Committee (FOMC) meeting, the decline in stock prices of Tesla, which was disgusted by the decline in profit margins, and Netflix, whose sales forecast was lower than the market forecast, pushed down the index.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

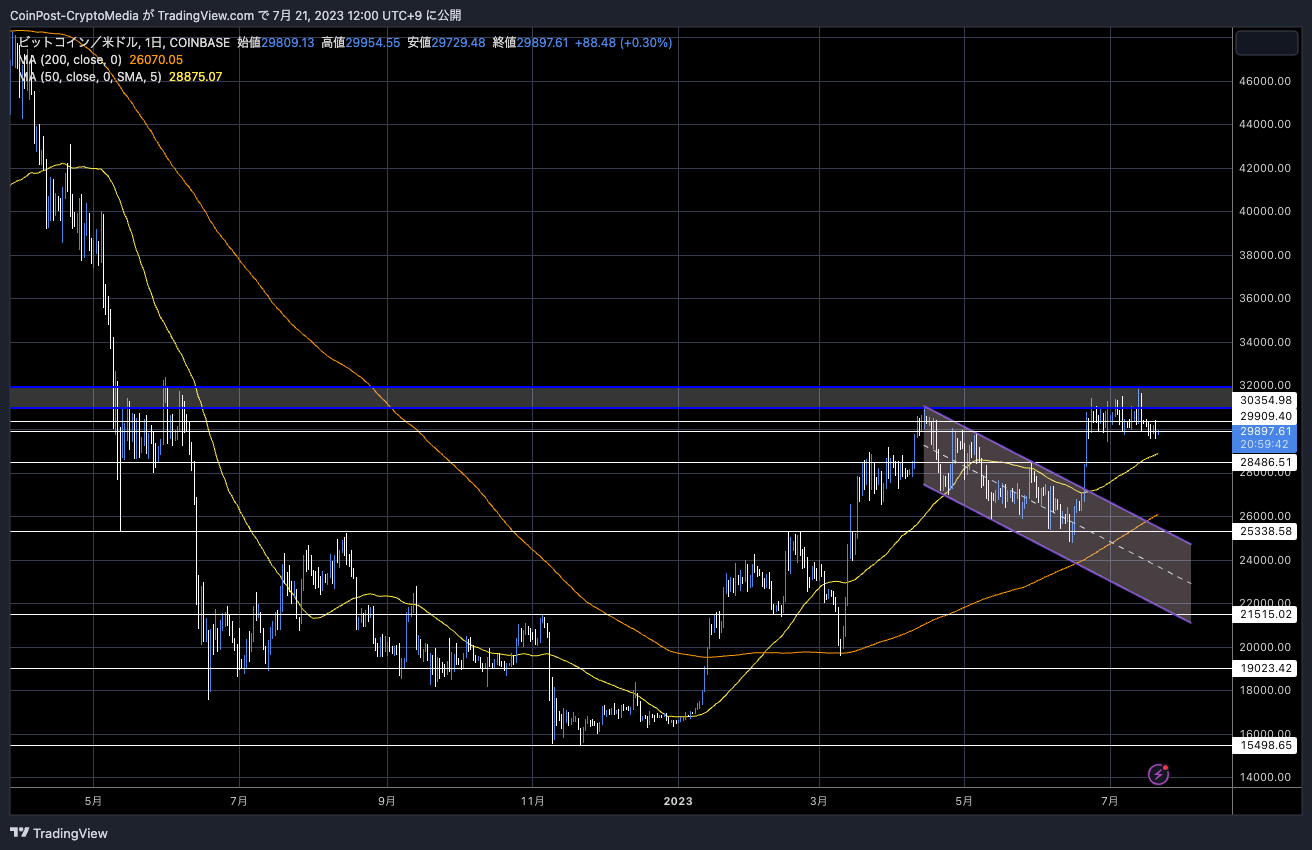

In the crypto-asset (virtual currency) market, bitcoin fell 0.24% from the previous day to $29,898.

BTC/USD daily

CryptoQuant analyst Kripto Mevsimi noted that the Bitcoin: Exchange Whale Ratio on cryptocurrency exchanges has risen above the “alert level” of 85%, a sign of selling pressure.

CryptoQuant

The Exchange Whale Ratio provides a reading of wholesale selling pressure by measuring the ratio of the total value of the top 10 largest trades sent to exchanges to the total inflow.

Recently, the selling pressure of miners has also been pointed out.

connection:Bitcoin weekly inflows to virtual currency exchanges are the third largest in history, suggesting continuation of minor selling

Another CryptoQuant analyst said on the 20th that the U.S. Department of Justice had already sold the 8,200 BTC seized in November 2022 from the Silk Road hackers on July 12th.

On the 12th of this month, 9,825 BTC (equivalent to $ 300 million) was confirmed to be transferred from a US government-related wallet, which has become a cautionary factor in the market. The U.S. government has indicated a policy to sell the seized 41,500 BTC in installments, and sold 9,861 BTC in March 2011.

altcoin market

According to CryptoQuant’s data analysis, price performance based on market capitalization saw a big jump in the “middle cap” alt cluster, including XRP, which surged following the positive surprise of the district court ruling.

Below is a plot of Bitcoin (BTC) and Ethereum (ETH) against their market capitalization.

Many of these issues, such as Cardano (ADA), Solana (SOL), and Polygon (MATIC), have been designated as unregistered securities by the U.S. SEC (Securities and Exchange Commission), and there were concerns about the risk of delisting in the U.S. market. It seems that the buy-back momentum has increased.

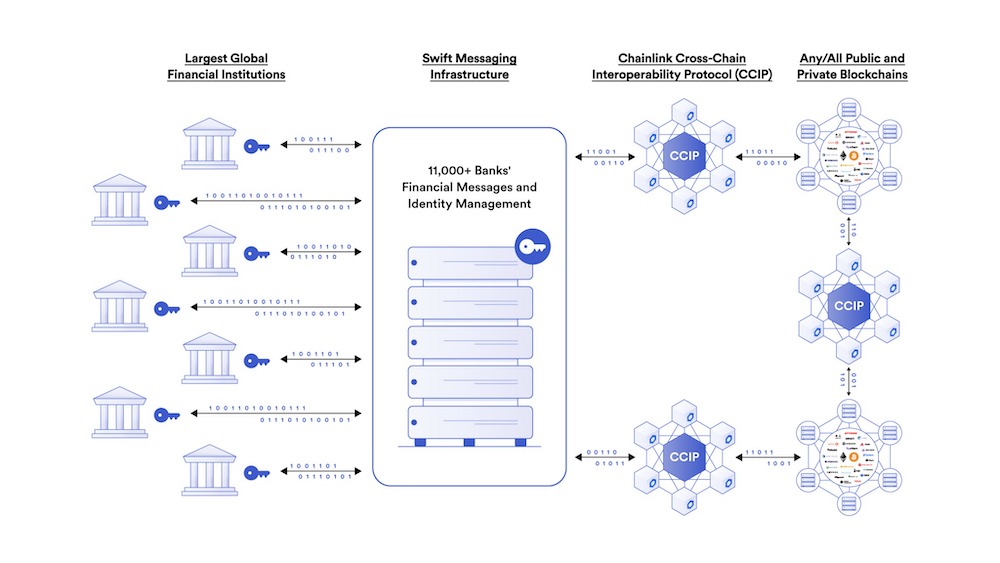

Among other individual stocks, chain link (LINK) soared to the $8.3 level, up 20% from the previous day.

Officially announced the mainnet launch of the cross-chain interoperability protocol “CCIP”.

1/ The Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially launched on Avalanche, Ethereum, Optimism, and Polygon mainnets.#LinkTheWorld pic.twitter.com/SdLVyaapg3

— Chainlink (@chainlink) July 17, 2023

CCIP is compatible with Avalanche, Ethereum, Optimism, and Polygon blockchains and utilizes Chainlink’s decentralized oracle network. It is expected to be interoperable with SWIFT’s international financial network and any blockchain environment.

Last year, Chainlink signed a partnership with interbank messaging system SWIFT. In cooperation with several major financial institutions such as BNP Paribas and BNY Mellon, we are working on a proof of concept to connect to a blockchain network, and are seeking a position as a financial market infrastructure provider to optimize the international payment process and establish a token transfer system.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin exchange whale ratio is at alarming level, Chainlink rises 20% from the previous day appeared first on Our Bitcoin News.

2 years ago

189

2 years ago

189

English (US) ·

English (US) ·