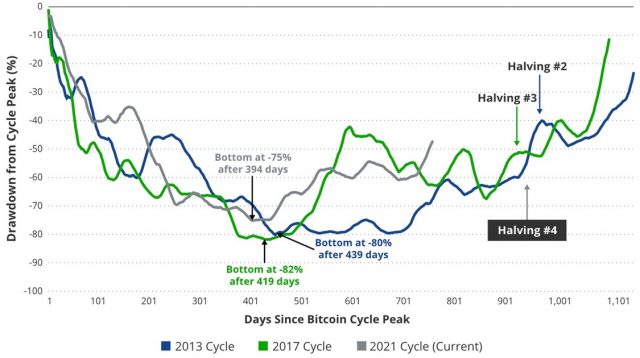

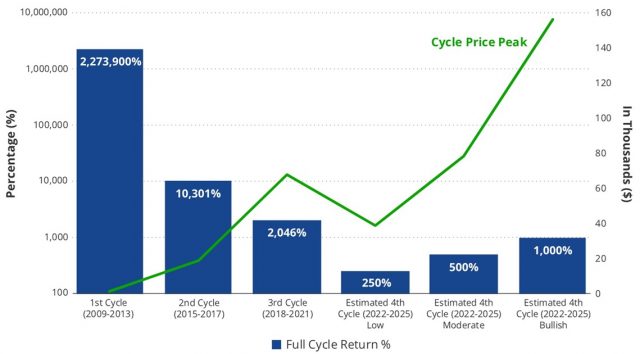

Views based on halving and market cycles

On the 7th, VanEck, a major US asset management company, released a 2024 forecast report for the crypto asset (virtual currency) market. It is believed that by the second half of 2024, the crypto asset (virtual currency) Bitcoin (BTC) will undergo significant fluctuations and will likely rise to a record high (1 BTC = $69,000). .

One of the factors influencing this rise is that Bitcoin’s halving, which occurs every four years, is scheduled to occur around April 2024. VanEck expects the fourth halving to be completed successfully and expects Bitcoin to rise above $48,000 in the days and weeks that follow.

This price corresponds to the neckline of the head-and-shoulders pattern formed in April 2022, and a break above this could be interpreted as a new bullish sign.

Source: VanEck

Additionally, with the halving, cost-advantaged miners, particularly CleanSpark (CLSK) and Riot Blockchain (RIOT), are expected to boost performance. I think it will double in value.

What is half-life?

Bitcoin halving occurs approximately every four years, or every 210,000 blocks, and the reduction in mining rewards could slow down the pace of BTC issuance and encourage an increase in asset value. The next Bitcoin halving, the fourth, is scheduled for around April 18, 2024, and the mining reward will be reduced from the current 6.25 BTC to 3.125 BTC.

Virtual currency glossary

Virtual currency glossary

connection:Prediction of Bitcoin reaching $125,000 in 2024, Matrixport analysis based on halving

Reaching all-time high after US presidential election

Furthermore, the US presidential election, which could have an impact on monetary policy, is scheduled for November of this year, and high volatility and political changes are expected.

VanEck points out that there is growing evidence to refute the efforts of the green lobby against the Bitcoin mining industry. Furthermore, it is possible that Republican Donald Trump could win the votes and return to the presidency.

Bitcoin prices hit an all-time high in November as the political shift builds momentum to prompt a change in the regulatory approach of SEC Chairman Gary Gensler, who has shown opposition to cryptocurrencies. is expected to be recorded. This is based on market cycles repeating certain patterns, and coincides with Bitcoin’s November 2020 breakout, which occurred exactly three years after its November 2017 top.

Source: VanEck

Finally, there is a bold prediction that if Bitcoin reaches 1 BTC = $100,000 next December, Satoshi Nakamoto will be chosen as Time Magazine’s Person of the Year.

connection:Prediction of capital inflow to Bitcoin ETF, calculated from gold ETF and economic environment – VanEck analysis

Half-life special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Bitcoin expected to reach all-time high by November next year, with halving and US presidential election likely to be factors in the rise | VanEck Report appeared first on Our Bitcoin News.

1 year ago

88

1 year ago

88

English (US) ·

English (US) ·