Bitcoin ranged for a second consecutive time this month as fresh bearish pressures kept prices suppressed.

The broader market, however, recovered to levels last seen at the start of the month.

As of late Asian trading hours on Friday, it hovered around $2.95 trillion.

Market sentiment improved, recovering towards neutral levels, up 13 points from the previous week.

Altcoin traders entered the weekend with modest gains, with a handful of prominent projects standing out in terms of weekly gains.

Why is Bitcoin down this week?

Bitcoin traders entered this week with cautious optimism as inflation concerns cooled off.

However, by the end of the week, fresh bearish pressure prevented the flagship crypto from gaining footing above the $85 support level.

The decline followed US President Donald Trump’s announcement of a 25% tariff on all imported automobiles, set to take effect on April 2.

The move weighed on risk assets across the board, with Bitcoin falling in tandem with US equities as the correlation between the two markets continued to rise.

Adding to market pressure, US inflation data released on March 28 showed stronger-than-expected results.

While headline PCE numbers aligned with forecasts at 0.3% month-on-month and 2.5% year-on-year, core PCE figures came in 0.1% higher than expected, warning of persistent inflationary pressures.

By the end of the week, BTC seemed to have lost momentum as it moved to visit multi-week lows.

Will Bitcoin go up?

Analysts remained sceptical about the broader crypto market, noting that Bitcoin’s recent stability above $80,000 hasn’t yet confirmed a recovery.

Veteran trader and analyst Michaël van de Poppe noted the “trend remains to be upwards” for BTC, but admitted it’s beginning to “look slightly less good.”

In a recent X post, he warned that a break below $84,000 may “see a test at $78–80K and perhaps lower” before the price recovers.

At press time, Bitcoin was quickly approaching those levels.

Fellow trader AlphaBTC echoed that caution, emphasising that Bitcoin needs to hold above the monthly open at $84,300, a key level that Bitcoin “must hold” to avoid ending the month in the red.

According to the analyst, Bitcoin might be drifting toward that level and into “max pain” territory, referring to the Friday March options expiry, which could add further pressure before the month wraps up.

More bearish predictions came from well-followed market commentator Ted Pillows, who predicted a drop towards $74,000 if BTC fails to make a weekly close above $89,000.

On the weekly chart, Bitcoin had formed a falling wedge pattern, the analyst noted in a March 28 X post. See below.

Source: Ted Pillows on X

Yet the bull run isn’t over just yet, according to analysts at CryptoQuant.

In a recent Quicktake blog, they pointed to four on-chain metrics that are currently in flux, showing signs of short-term turbulence, but not signalling a cycle top.

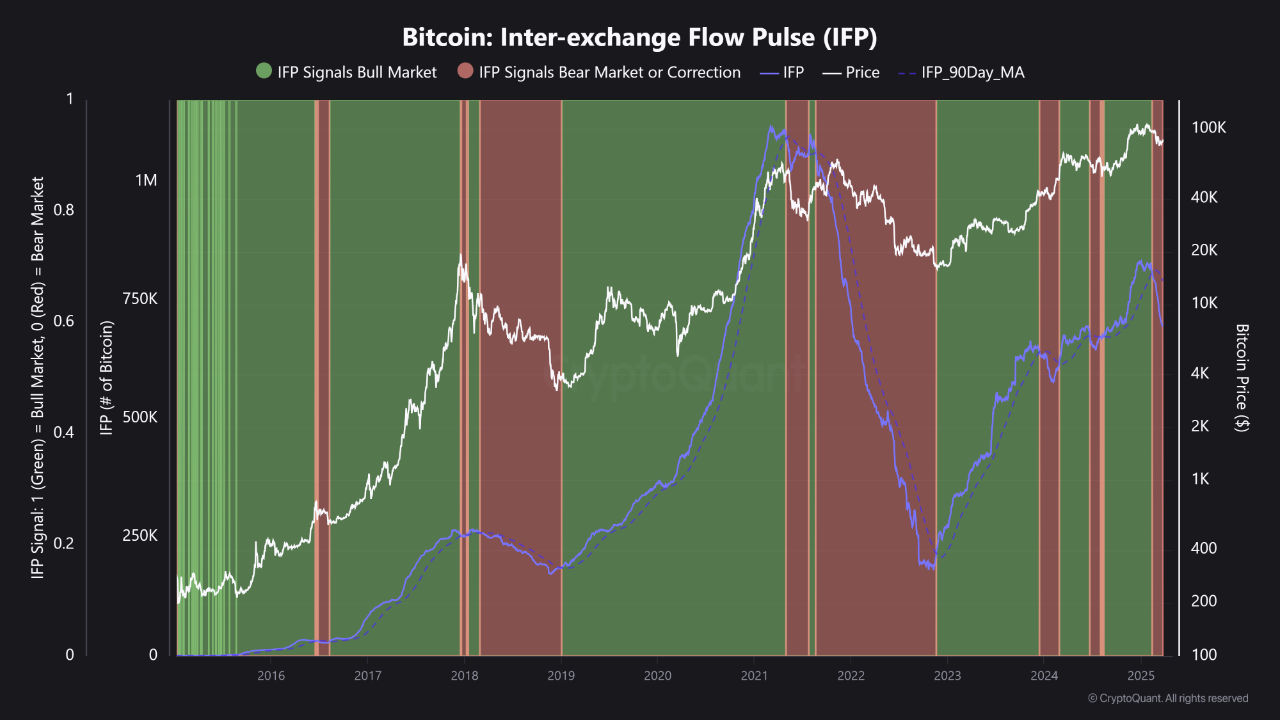

These include the MVRV ratio, NUPL, and the Inter-Exchange Flow Pulse (IFP), which turned bearish back in February.

Contributor Burak Kesmeci noted that while “Bitcoin is experiencing significant turbulence,” none of the data points suggest things have overheated.

For sentiment to shift, he added, the IFP needs to climb back above its 90-day simple moving average.

Source: CryptoQuant

As of the last check on Friday at 4 p.m. GMT, Bitcoin was trading at $84,264, showing no gains on the weekly timeframe.

Altcoin market recovers

The total altcoin market hit a weekly high of $1.25 trillion before receding to $1.21 trillion on late Friday.

Bitcoin remained the dominating force in the market with the altcoin season index at 17, down four points from the week before.

Although the vast majority of the top 99 altcoins had failed to recover from last week’s losses, the top gainers of the week all posted double-digit gains:

Cronos

Cronos (CRO) shot up 37% over the past week, exchanging hands at $0.106 when writing, while its market cap stood at $2.83 billion.

Trading activity also picked up big time, going from $67 million to $140 million during the same period.

Source: CoinMarketCap

Most of this week’s gains came from reports that Trump Media, the parent company of Truth Social, is partnering with Crypto.com to launch a series of exchange-traded funds under the Truth.Fi brand, including one featuring a basket of cryptocurrencies like CRO and Bitcoin.

The altcoin also got a big boost after the US securities regulator reportedly dropped its investigation into the Crypto.com exchange.

Additionally, Cronos recently rolled out its v26 mainnet upgrade, introducing new features along with better cross-chain support with ZK rollups.

Berachain

Berachain (BERA) gained 28.7% over the previous week as its market cap soared to $230 million.

Its daily trading volume stood at $230.2 million as of press time.

Source: CoinMarketCap

Berachain is gaining strong momentum as its DeFi ecosystem continues to grow.

According to DeFiLlama, the network’s total value locked surged to a record high of $3.495 billion yesterday, a significant rise from the year-to-date low of $770 million.

The BERA token is also climbing, partly because the stablecoin market cap on the network has grown to over $1.3 billion.

On top of that, BERA’s price got another boost thanks to the launch of “proof of liquidity”, a new feature that helps make the network more decentralized while letting users earn rewards.

Four

Over the past week, Four (FORM) rallied 27% to trade at $2.3 per coin at the time of writing.

Its market cap stood at $63.14 million, while its daily trading volume was 37% higher over the past day at $63.17 million.

Source: CoinMarketCap

While no immediate drivers fueling this rally could be identified at the time of writing, the project recently completed its rebranding from BinaryX (BNX), with its token symbol updated to FORM.

Four has also been actively expanding its ecosystem, integrating various DeFi, GameFi, and meme-related projects.

Further, the altcoin’s listing on prominent exchanges like Binance, KuCoin and Gate.io earlier in the week has also helped boost its visibility and attract more traders.

The post Bitcoin eyes $74K drop as CRO and FORM outperform with weekly gains appeared first on Invezz

English (US) ·

English (US) ·