Macroeconomics and financial markets

In the US NY stock market on the 25th, the Dow Jones Industrial Average fell 255 dollars (0.77%) from the previous day, and the Nasdaq Index closed 76 points (0.61%) lower.

With the US Treasury Department sounding the alarm on the issue of the debt ceiling, which is expected to dry up government funds on June 1, the market sentiment has cooled as no major progress has been seen in talks between the ruling and opposition parties.

Uncertainty about the downgrade of government bonds and the risk of default (non-fulfillment of debt) has increased, and risk-averse selling such as liquidation of positions is taking precedence.

Fitch Ratings, the international rating agency, has said it may downgrade the U.S. rating, Bloomberg reported. While assuming that negotiations on the debt ceiling issue will be concluded, the Bank announced that it has designated “AAA (triple A),” the highest credit rating for long-term foreign currency-denominated issuers in the United States, as “Rating Watch Negative.”

This indicates that the rating agency is closely monitoring the issuer’s creditworthiness, and can be said to be a precursor to a downgrade.

Also, even if a final agreement is reached that includes spending cuts priced in by the financial markets, if the Republican Party’s proposal is realized, there is an estimate that the United States’ gross domestic product (GDP) will fall by 0.8% by the end of next year, leading to a recession. There are voices of concern about the worsening of the (economic recession).

connection:Debt ceiling negotiations do not progress, US stocks continue to fall, Nvidia soars after hours | 25th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.7% from the previous day to $26,200.

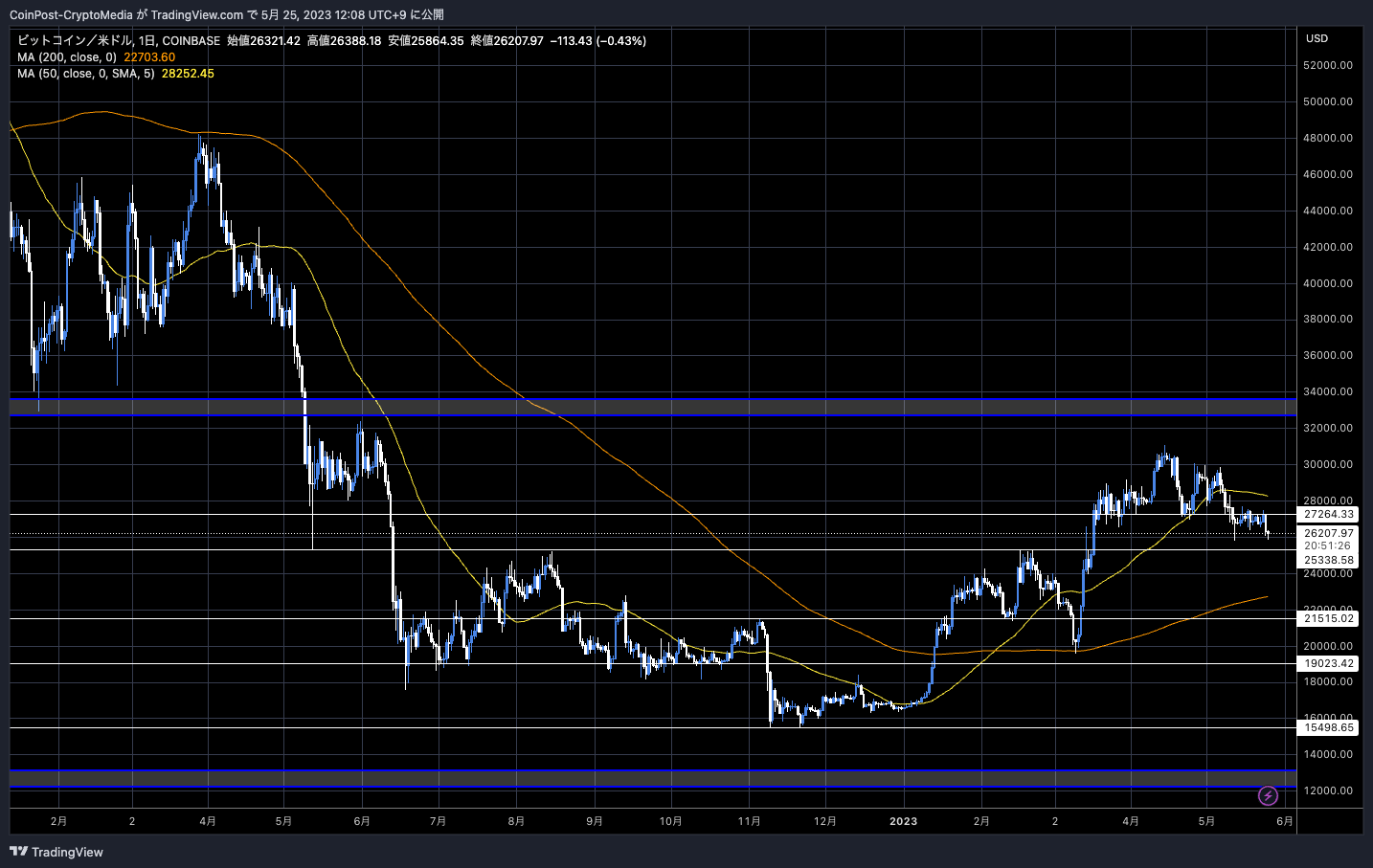

BTC/USD daily

Despite the struggle at the neckline for a while, yesterday’s negative line showed buyers running out of strength, and the technical situation worsened.

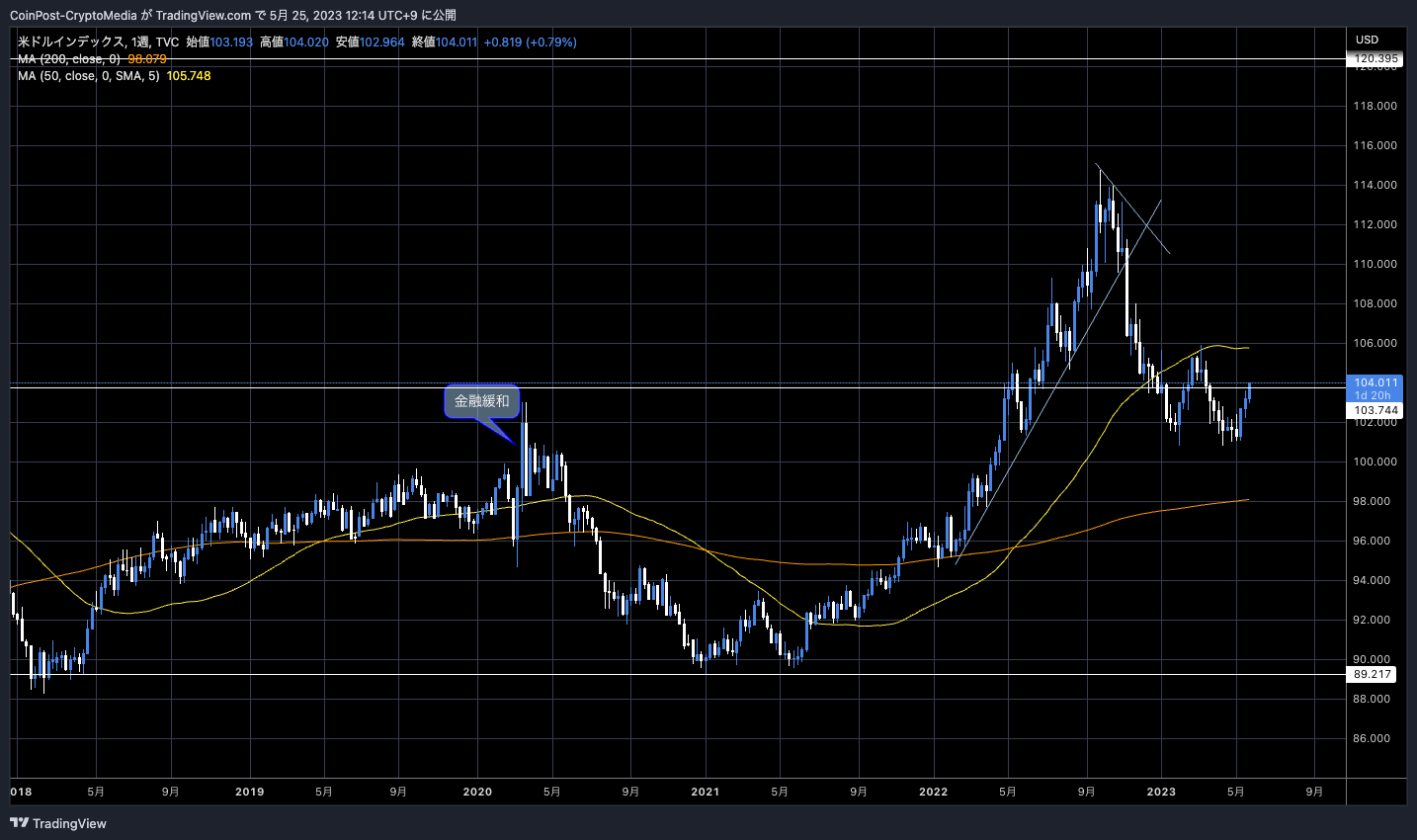

As the US Federal Reserve (FRB) chief’s hawkish remarks were factoring in the suspension of interest rate hikes, the dollar was bought. The rise in the dollar index weighed on risky assets such as crypto assets (virtual currencies).

DXY Weekly

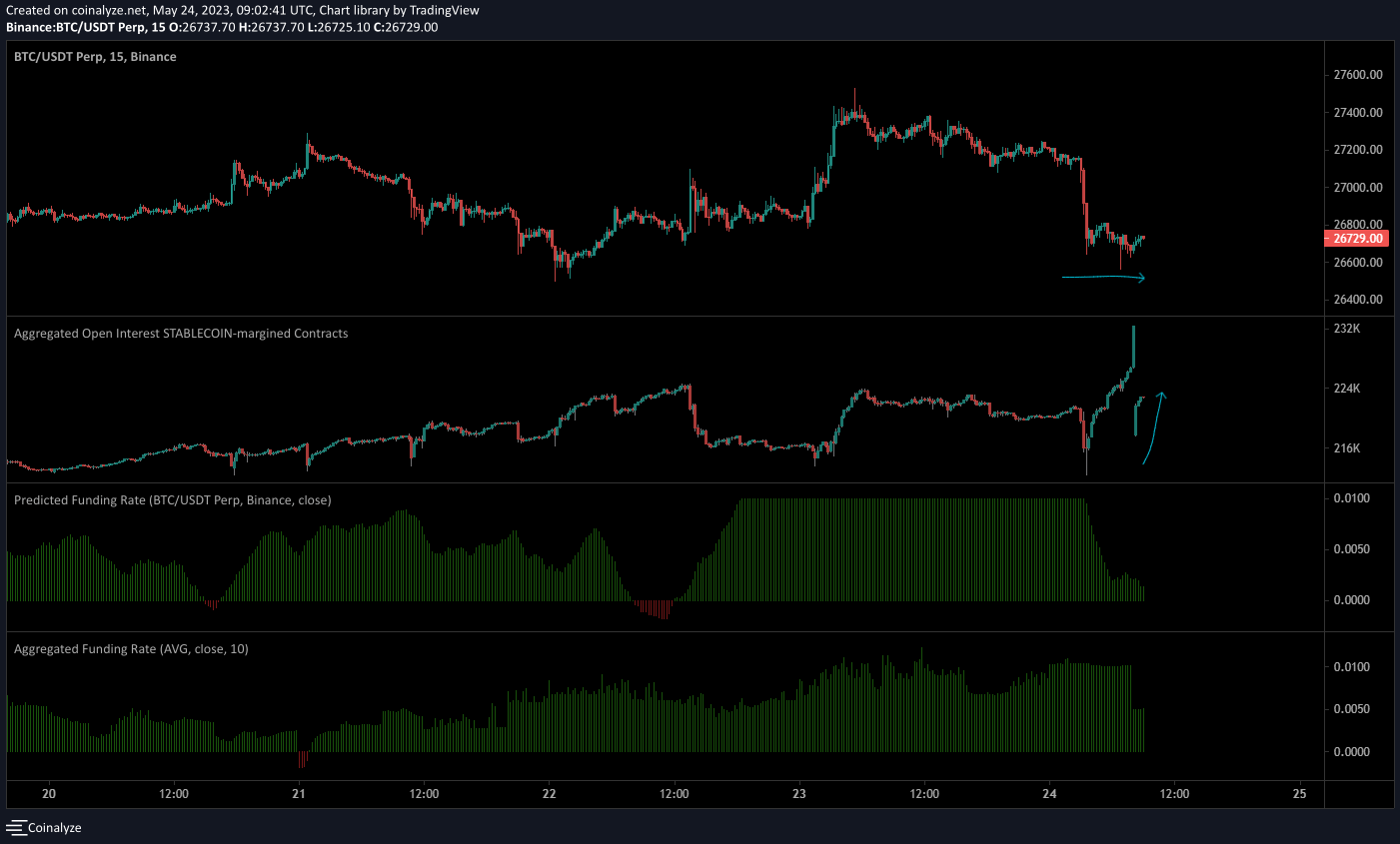

According to analyst Daan Foppen, the current crypto asset (virtual currency) market is in a futures-driven market as physical selling continues.

Open interest (OI) remains at a high level, which, combined with declining liquidity, is adding to the volatility of the market.

Daan Foppen

As the BTC price falls, the Funding Rate is mostly flat but in positive territory, which could trigger further liquidation of longs.

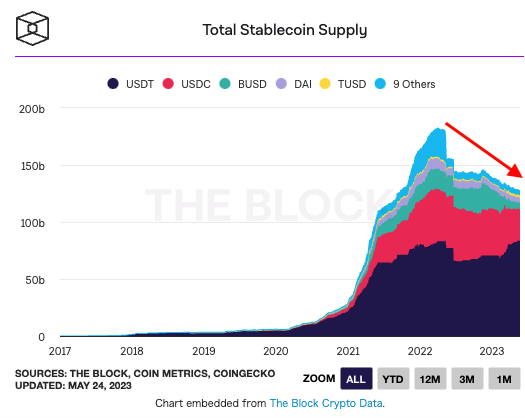

The stablecoin market is shrinking

The stablecoin market’s 14th straight month of declining demand also speaks volumes to investor interest.

It has fallen to its lowest level since September 2021, according to a report in CCData for institutional investors from CryptoCompare, a leading provider of digital asset data.

Recently, due to the withdrawal of market makers and the shrinking of the stablecoin market due to the tightening of regulations by the US SEC (Securities and Exchange Commission), the decline in liquidity in the crypto asset (virtual currency) market is becoming apparent.

Meanwhile, according to The Block, the total supply of Tether (USDT) reached $83.5 billion, approaching the all-time high of $84.1 billion set last year. This contrasts with USD Coin (USDC) supply dropping from nearly $47 billion to $27.8 billion, heavily influenced by US regulators.

The Block

Binance’s promotion of TUSD as an alternative to BUSD has not seen an increase in trading volume, but supply has increased around offshore trading by market makers and big investors.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin falls to the $25,000 level, while the financial market is becoming more cautious appeared first on Our Bitcoin News.

2 years ago

116

2 years ago

116

English (US) ·

English (US) ·