Macroeconomics and financial markets

In the US NY stock market on the 9th, the Dow Jones Industrial Average fell 56 dollars (0.17%) from the previous day, and the Nasdaq Index closed at 77.3 points (0.63%).

With the release of the CPI (US Consumer Price Index) just around the corner, the market is taking a wait-and-see attitude. Results such as the CPI provide clues to expectations of an interest rate hike at the US Federal Open Market Committee (FOMC) meeting in June.

In addition, there is a risk that the US government will default on its debt if Congress does not approve the US debt ceiling issue, which is a concern. In the unlikely event of a default, financial market turmoil is inevitable, similar to the downgrade of US Treasuries by rating agencies in 2011.

Congress raised the debt ceiling again in December 2021, but it has again reached the legal ceiling of $31.4 trillion. President Biden said on the 10th that if the debt ceiling issue is not resolved, he will have no choice but to miss the G7 summit (a summit of seven advanced nations) scheduled to be held in Hiroshima on the 19th.

In addition, President Biden has included cryptocurrency (virtual currency) transactions in the same wash sale regulations as securities, and has indicated in the “2024 Budget Proposal” tax system changes, including the abolition of tax deductions for such transactions.

A wash sale is a tax-saving act in which the profit or loss at the time of sale is not recognized for tax purposes when buying and selling financial products such as stocks, and the same financial product is purchased again. In Japan and the United States, it is prohibited by the Financial Instruments and Exchange Act.

The budget bill also includes a 30% tax on the electricity bills used in cryptocurrency mining operations, which will inevitably hurt miners if approved.

President Biden on the 9th, while rejecting the Republican federal budget cut proposal, suggested that “blocking the tax loophole will bring in tax revenue of $ 18 billion” with wealthy crypto asset (virtual currency) investors in mind. However, it was criticized for lacking grounds for the assumption.

We don’t have to guess what MAGA House Republicans value. pic.twitter.com/BM6JGMEFeq

—President Biden (@POTUS) May 9, 2023

Meanwhile, Robert Kennedy Jr., the nephew of former President John F. Kennedy, who announced his candidacy for the Democratic nomination in the run-up to the 2024 presidential election, took the stage at a cryptocurrency conference held in Miami, USA. .

In addition to evaluating Bitcoin as “a major innovation engine for the United States,” he expressed a negative view of the Biden administration’s proposal to impose a 30% tax on mining operations.

Cryptocurrencies, led by bitcoin, along with other crypto technologies are a major innovation engine. It is a mistake for the US government to hobble the industry and drive innovation elsewhere. Biden’s proposed 30% tax on cryptocurrency mining is a bad idea.

—Robert F. Kennedy Jr (@RobertKennedyJr) May 3, 2023

connection:Nasdaq rises slightly ahead of CPI, Buffett is bullish on Japanese stocks | 9th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, bitcoin remained flat at $27,720, up 0.02% from the previous day.

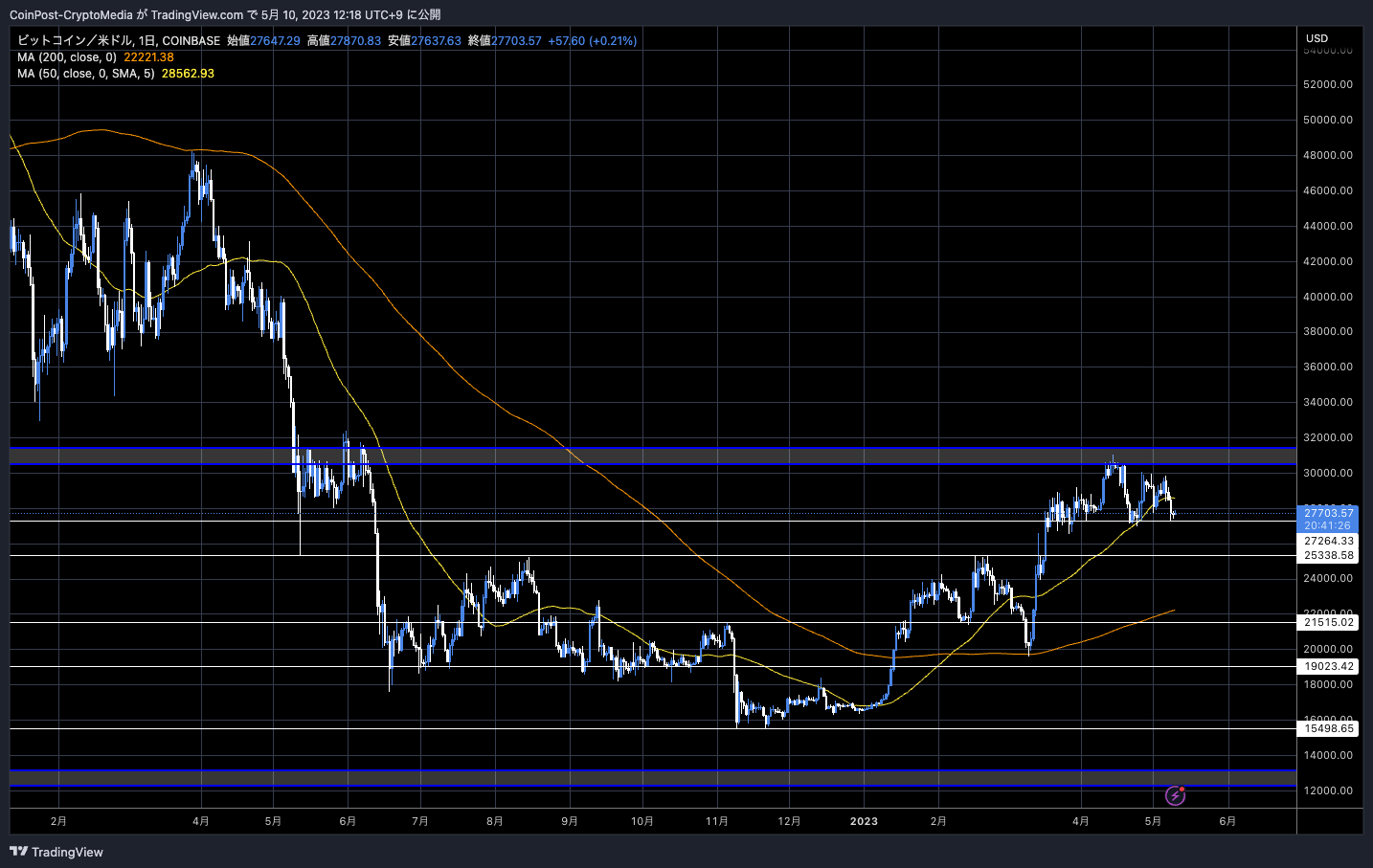

BTC/USD daily

The price has endured at the $27,000 support line (lower support line), but the temporary bullish trend until the other day has faded and it has been weakening recently. It is a level that can fluctuate greatly depending on the CPI (U.S. Consumer Price Index).

Game of Trades refers to the “Head and shoulders pattern,” which suggests a trend turning point. He pointed out the downside risk if the price breaks below the neckline.

Bitcoin is likely to be set up for more downside:

Excess optimism

Head and shoulders pattern

Bearish momentum  pic.twitter.com/OpRasEmbBJ

pic.twitter.com/OpRasEmbBJ

— Game of Trades (@GameofTrades_) May 8, 2023

Regarding the MACD (Moving Average Convergence Divergence), which is used in technical analysis, he cites bullish negative signals and declining momentum.

The hard-line stance of the US government and regulators on the crypto-asset (virtual currency) industry has led to concerns about the outflow of major market makers.

In fact, multiple market makers may have already withdrawn, and liquidity has declined at Binance.US (US version). Binance.US generated a 1.5-3.4% premium (price divergence) compared to Binance’s global platform.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin flat, CPI restraint trend appeared first on Our Bitcoin News.

2 years ago

138

2 years ago

138

English (US) ·

English (US) ·