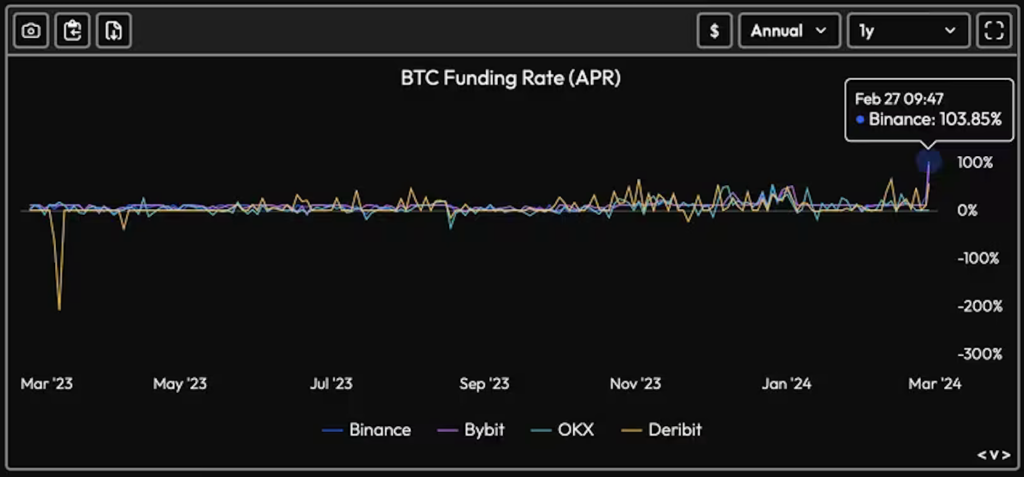

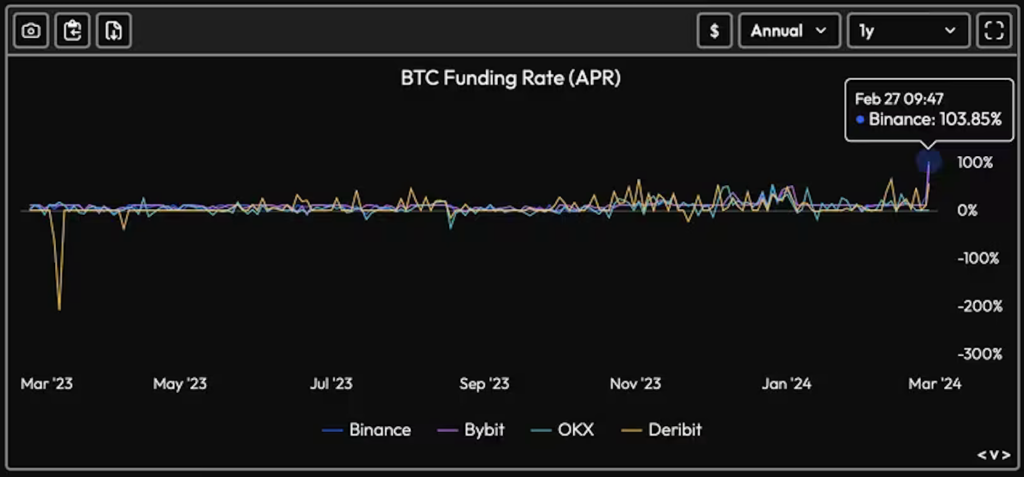

- The sharp rise in Bitcoin’s funding rate suggests that leverage is biased towards the bulls.

- One observer said that rising funding rates provide extremely attractive arbitrage opportunities for crypto hedge funds.

It seems that nothing can stop the Bitcoin (BTC) train from rushing forward. As a result, the cost of holding leveraged bullish bets on perpetual futures has skyrocketed, creating attractive arbitrage opportunities.

On February 27, Bitcoin rose to $57,000, its highest since late 2021, marking a year-to-date gain of 32%, according to CoinDesk data. The CoinDesk20 index (CD20), a broad market index, rose nearly 6%.

According to data sources Velo Data and CoinGlass, the annualized funding rate for Bitcoin perpetual futures listed on Binance has exceeded 100% for the first time in a year. Bybit and Deribit's funding rates rose to 95% and 56%, respectively.

Perpetual or open-ended futures use funding rates to bring the price in line with the spot price. A positive funding rate indicates that perpetual futures are trading at a premium to the spot price, and traders holding long or long positions are required to pay fees to traders holding short positions. The exchange collects this fee every 8 hours.

In other words, a positive and rising funding rate indicates that the market is in a bullish mood or that leverage is biased towards the bullish side.

Markus Thielen, founder of 10X Research, said the increase in funding rates is a sign that traders are making bullish bets in anticipation of continued inflows into U.S. spot exchange-traded funds (ETFs). It is likely that this is due to the fact that

Mr. Thielen, who predicted Bitcoin's rise to $57,000, said, “Open interest continues to increase and currently stands at $14.4 billion (approximately 2.16 trillion yen, at an exchange rate of 1 dollar = 150 yen).'' Ta. “Traders are increasingly confident that the halving and ETF inflows will be bullish.”

Bitcoin annualized perpetual funding rate. (Velo Data)

Bitcoin annualized perpetual funding rate. (Velo Data)The jump in funding rates means non-directional traders and arbitrageurs can earn attractive returns, Thielen added.

Arbitrage is profiting from the price difference between two markets. The increase in funding rates means that perpetual futures are trading at a significant premium to the spot price. Therefore, arbitrageurs can short perpetual futures and buy crypto assets (virtual currencies) in the spot market, avoiding the risk of price fluctuations and pocketing the premium.

“The rise in perpetual futures funding rates is providing extremely large arbitrage spreads for crypto hedge funds. Bitcoin and Ethereum (ETH) are trading at 20%, 30%, or even higher levels. It's a sweet spot for arbitrums. In this market, everyone can win, whether you're going outright long or doing a perp spread. It's a great moment to be in crypto.” Thielen said. told CoinDesk.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Velo Data

|Original text: Bitcoin Funding Rates Jump to 100%, Sparking Opportunity for Savvy Traders

The post Bitcoin funding rate soars to 100% ─ Opportunity for arbitrage trading has arrived | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

80

1 year ago

80

English (US) ·

English (US) ·