ProShares, the company behind the first Bitcoin futures-tracking ETF in the United States, has put an end to concerns that the costs associated with trading derivatives will lead to tracking errors, saying the product closely mimics Bitcoin’s spot price performance.

The ProShares Bitcoin Strategy ETF will start trading on the New York Stock Exchange in October 2021 under the ticker BITO, allowing investors to gain exposure to Bitcoin (BTC) without owning a cryptocurrency. The world’s largest crypto asset fund, the ETF invests in regulated, cash-settled Bitcoin futures listed on the Chicago Mercantile Exchange (CME).

From the outset, BITO and other futures-based ETFs were expected to underperform Bitcoin significantly due to rollovers, the costs associated with selling expiring futures contracts and buying the next set. Long-term futures contracts typically trade at a premium over expiring futures contracts, a condition known as contango. Contango tends to get bigger during bull markets, and the more it does, the higher the cost, creating the so-called “contango bleed.”

Simeon Hyman, global investment strategist at ProShares, gave an email interview to CoinDesk. “Since listing (until 7/18), Bitcoin has returned -51.5%, BITO -54.5%, and more than half of that modest difference is BITO’s 0.95% annual fee.”

Bitcoin’s recent rally and accompanying contango expansion at the end of June has rekindled concerns over roll costs and fueled calls for spot-based ETFs that invest directly in Bitcoin and do not need to roll over positions. Since June 15, traditional financial giants such as BlackRock and Invesco have applied for spot-based Bitcoin ETFs to the U.S. Securities and Exchange Commission (SEC).

BITO has remained closely tracked to the spot price because interest income from cash held by the fund compensates for roll costs, which are closely linked to interest rate levels in the U.S. economy, according to Hyman.

“For financial futures with no storage costs, like CME Bitcoin futures, the futures contract premium should be similar to the term equivalent interest rate. The 5% increase in the base rate by the Federal Reserve Board (Fed) from March 2022 onwards is a key factor driving up these premiums and thus the roll cost of Bitcoin futures strategies,” Hyman said.

“Here is the key piece of the puzzle: BITO earns interest on cash balances, offsetting roll costs. As a result, it will largely follow the price action of spot Bitcoin,” Hyman added.

As Hyman notes, one component of futures prices is interest rates, and the Fed has increased its target range to 5% to 5.25% to keep inflation under control. Other variables include underlying asset price, storage costs and yield. Since CME Bitcoin futures are cash-settled, there are no storage costs.

BITO earns interest on the cash it holds. Interest income is paid out as monthly dividends to cover the roll decay of the fund. BITO has paid dividends six times this year.

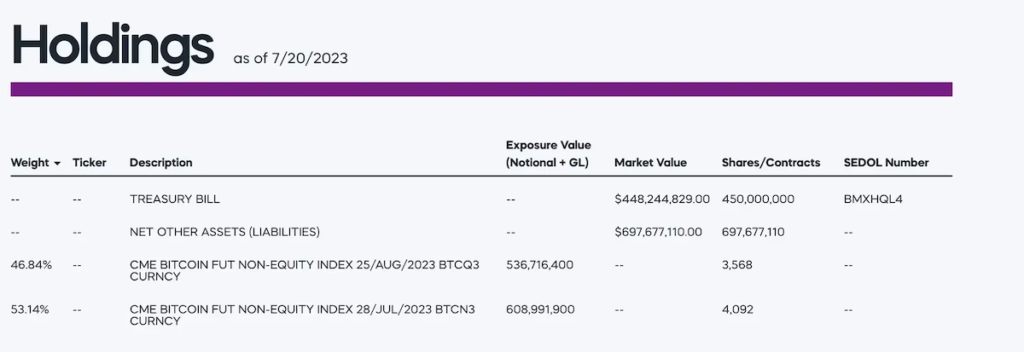

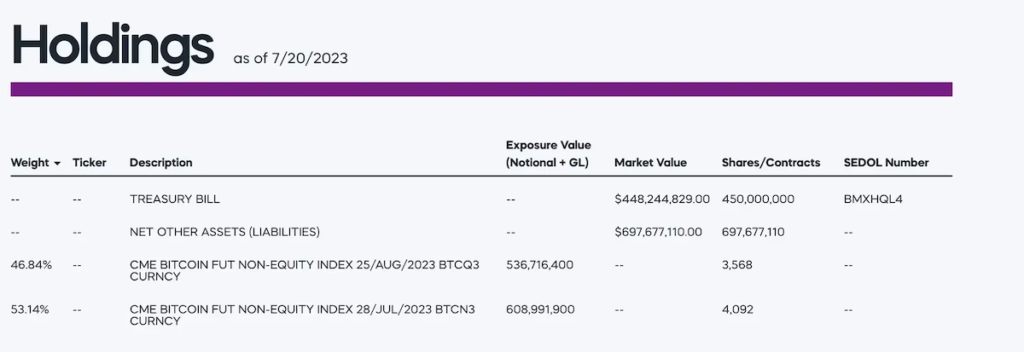

As of July 20, ProShares held treasury bills, other assets, and CME futures contracts that mature on July 28 and August 25. (ProShares)

As of July 20, ProShares held treasury bills, other assets, and CME futures contracts that mature on July 28 and August 25. (ProShares)Asked whether the potential for spot ETFs would keep investors away from futures-based products, Hyman said it’s hard to speculate about products that don’t exist.

“BITO’s performance and flows are a testament to the effectiveness and investor interest of Bitcoin futures strategies within ETFs,” Hyman said.

As of July 18, the ProShares ETF has $1.1 billion in assets under management. The inflow of funds since the beginning of the year is 336.2 million dollars (about 47.66 billion yen). Since its inception, the fund has raised $2.2 billion (approximately ¥320 billion) from investors.

The market expects a flood of institutional money when spot-based ETFs become available.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

| Image: Cheyenne Ligon/CoinDesk

|Original: ProShares Says Bitcoin ETF Has Matched BTC Price Closely, ‘Roll Cost’ Concerns Are Unwarranted

The post Bitcoin Futures ETF Almost Matches Spot Price, Roll Cost Concerns Are Unnecessary: ProShares | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

144

2 years ago

144

English (US) ·

English (US) ·