Macroeconomics and financial markets

In the US NY stock market on the 14th, the Dow closed at $336 (1.1%) higher than the previous day and the Nasdaq at $239 (2.1%) higher.

The CPI (U.S. Consumer Price Index), which has attracted attention, exceeded market expectations by 0.1% in the core index excluding energy and food, but the inflation rate fell from 6.4% in January 2011 to 6%. As it fell within the expected range, it led to buybacks of stocks and Bitcoin (BTC).

connection:U.S. stocks and Nasdaq rebound CPI growth slowdown | 15th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 2.4% from the previous day to $ 24,960.

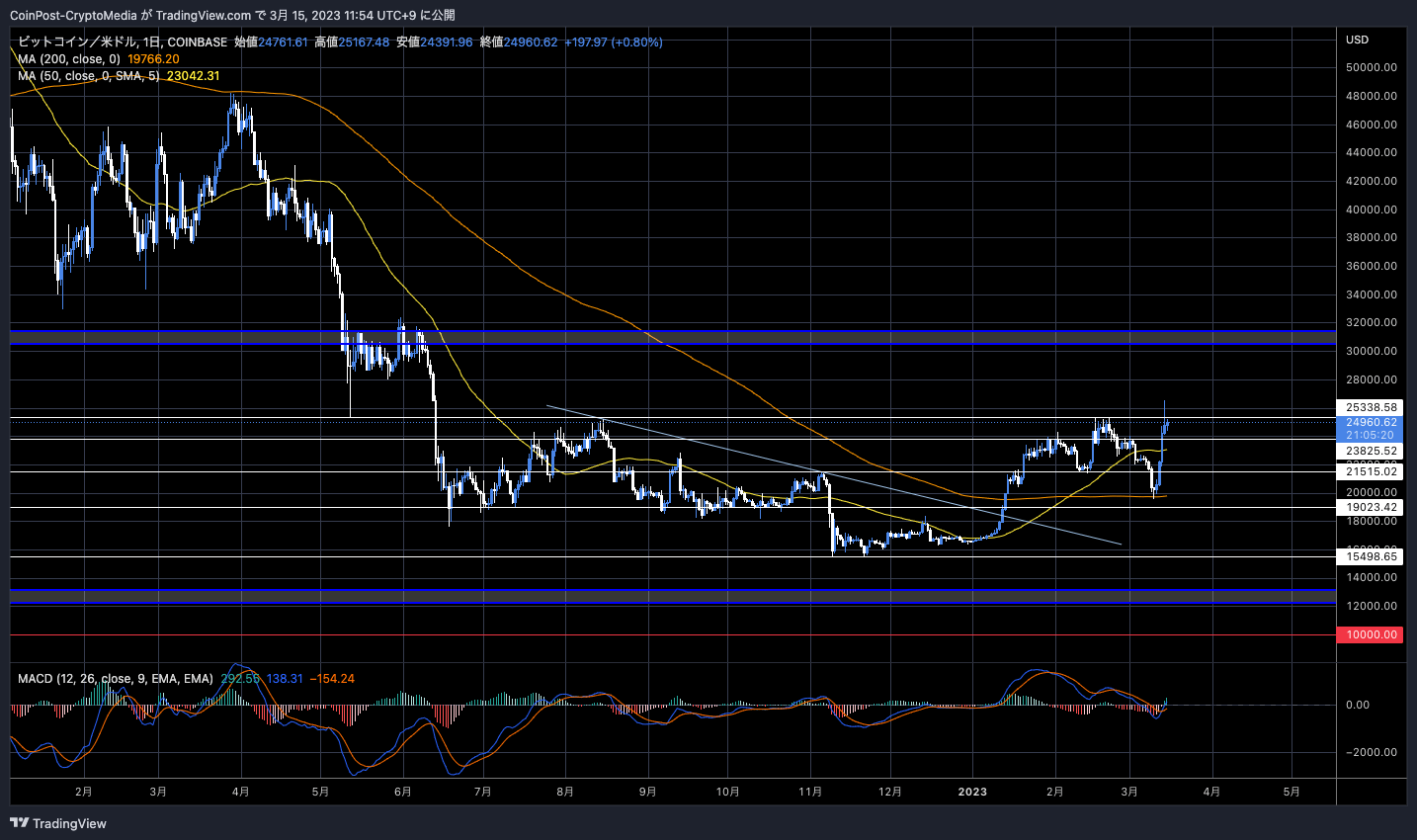

BTC/USD daily

Following the CPI result, the price surged to $26,553 at one point, but fell back to about $2,500 in US time.

Since the price has rebounded sharply from $19,564, it seems that the rise has come to a halt in the form of profit-taking selling.

connection:The background of the Bitcoin surge is a professional analysis of the virtual currency derivatives market | Contributed by virtual NISHI

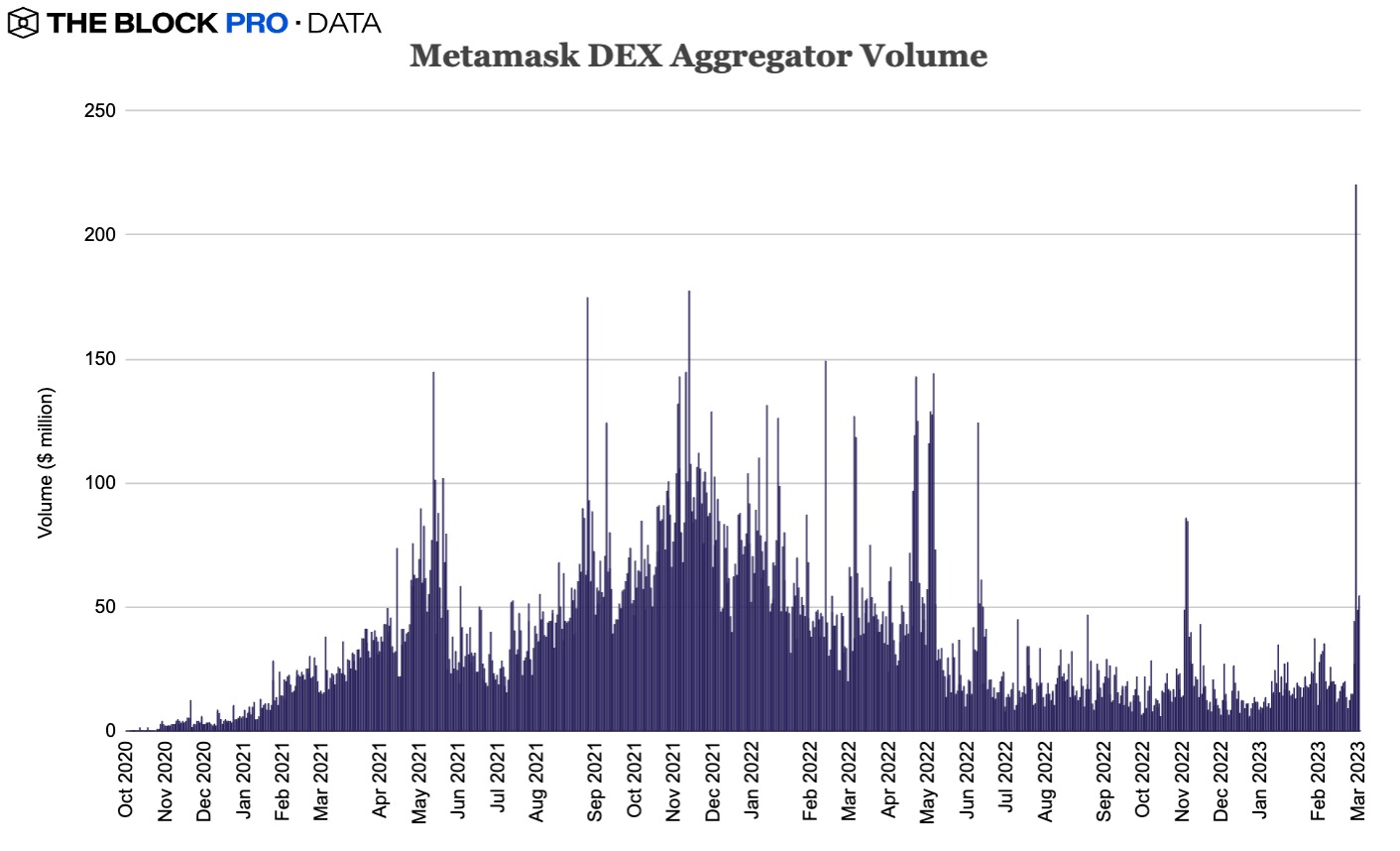

MetaMask Swap Trading Hits Record High

Following the successive bankruptcies of Silvergate Bank, Silicon Valley Bank, and Signature Bank, the token swap (exchange) transaction volume of the largest digital wallet Metamask reached a record high. Hit a record number.

Source: TheBlock

It was revealed that Circle, which mainly issues stablecoin USDC, has deposited a reserve of 3.3 billion dollars in Silicon Valley Bank, and the dipeg with the US dollar, whose value is linked at 1:1, has accelerated due to credit concerns. due to that. It is highly likely that the USDC held in the exchange or digital wallet was suddenly swapped to another stable coin such as USDT or Bitcoin for asset preservation.

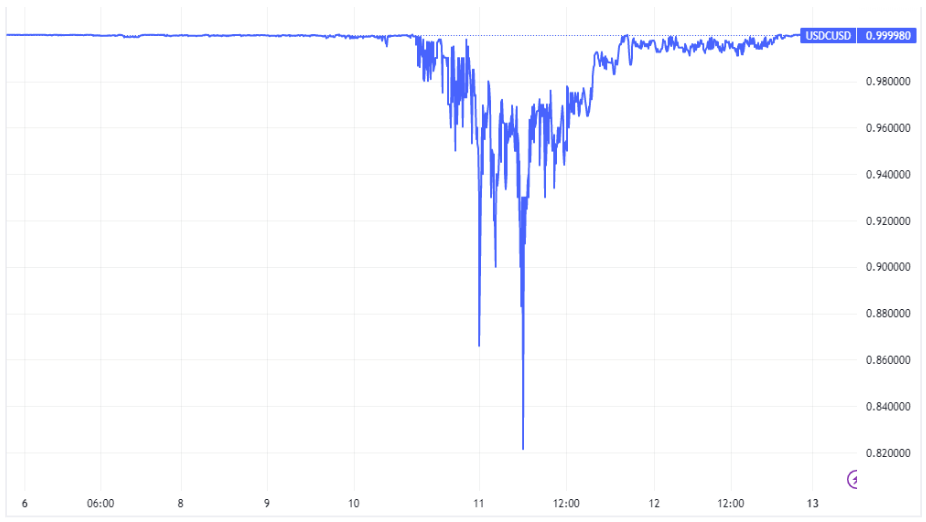

USDC normally holds above $1.00, but last weekend saw a sharp divergence to $0.82, prompting FUD (bad rumors) and panic selling of cryptocurrencies. After that, when the USDC’s peg recovery brought relief to the market, which had assumed “just in case,” it led to buybacks of virtual currencies such as Bitcoin.

USDC Dipeg Chart (Grayscale)

According to data from Dune Analytics, Uniswap exceeded $12 billion in DEX (decentralized exchange) trading volume per day at this time. This is equivalent to 5% of the daily trading volume of the US stock market “NASDAQ”.

connection:Cryptocurrency wallet “Metamask” updates account management function

Meanwhile, according to a Grayscale Research report, Bitcoin and Ethereum prices continue to trend upward amid turmoil as the stability myth of many dollar-backed stablecoins crumbles, followed by a sharp recovery in pegs. rice field.

Grayscale

It seems that BTC and ETH were prioritized as safe havens for stablecoins centered on USDC.

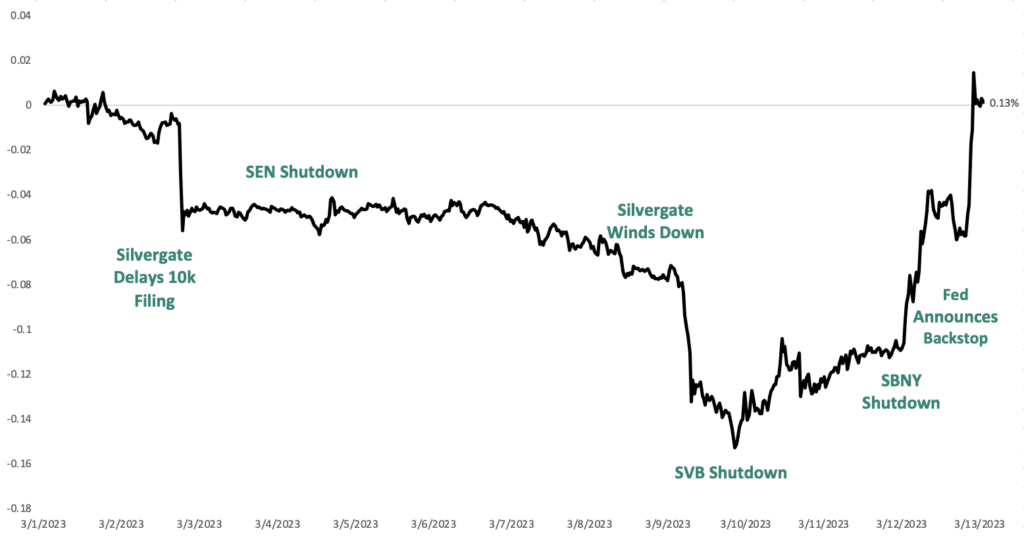

Bank failure impact and timeline

Regarding the situation at this time, Grayscale Research posted a graph that visualizes the time series of bank failures and the transition of the market capitalization of the virtual currency market.

Source: CoinMetrics

When the bankruptcy of Silvergate Bank, whose deposit amount decreased by 70% due to the bankruptcy of major exchange FTX in November last year, was reported, bitcoin fell sharply. The market capitalization of the entire market also fell sharply.

After that, because it was oversold, the SVB closed and reversed. When the Federal Reserve launched a depositor insurance fund guarantee, it caused a big rally.

At this time, large-scale loss cuts of short (selling) positions have occurred in the derivatives market.

coin glass

Silvergate Bank, which has been useful to cryptocurrency-related companies, provided the 24/7 instant payment network “Silvergate Exchange Network (SEN)” used for cryptocurrency transactions such as Gemini, Kraken, and ErisX. It is undeniable that there was also an increase in anxiety.

As for the outlook for the future, the turning point will be the monetary policy of the Federal Open Market Committee (FOMC) scheduled to be announced around 3:00 am on the 23rd (Japan time).

Given the bankruptcies caused by rapid interest rate hikes, the government will be faced with an extremely difficult decision as to whether to maintain its stance of restraining inflation or to prioritize the stabilization of the financial system.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin hits all-time high, Metamask hits all-time high due to bank failure appeared first on Our Bitcoin News.

2 years ago

138

2 years ago

138

English (US) ·

English (US) ·