After some volatility late last week, Bitcoin bulls regained control and broke back-to-back highs throughout Wednesday.

Most of the day’s gains were limited to Bitcoin and a handful of meme coins.

The top 99 altcoins managed to hold onto the green, though gains were modest, with the best performers limited to under 15%.

This pattern is typical during significant Bitcoin rallies, as the market tends to focus more on BTC, leaving altcoins with slower momentum.

The overall cryptocurrency market capitalisation stood at $3.28 trillion and was up a little over 1.5%.

What drove Bitcoin’s price rally?

Bitcoin dominance remained over 56% throughout the day, buoyed by intense demand from Wall Street following the launch of the first spot crypto ETF in the U.S. to enable options trading.

The new offering allows institutional investors to manage Bitcoin exposure more effectively, whether through hedging or leveraging.

BTC options are expected to boost demand by opening up sophisticated trading opportunities for both cautious investors and speculators.

On its first trading day, options for the iShares Bitcoin Trust ETF amassed $2 billion in capital on Nasdaq, a feat market analysts referred to as “unheard of.”

Some added support for today’s rally came from whales, as on-chain data pointed to a rise in the number of large holders.

According to IntoTheBlock, these investors hold at least 19,800 BTC or 0.1% of the total supply.

The “Large Holders Netflow” metric showed significant inflows into their wallets, signalling strong accumulation activity.

Adding to the momentum, many market observers believe the rally could continue as President Donald Trump’s inauguration day approaches.

Trump’s administration is widely viewed as crypto-friendly, and recent reports of Trump Media & Technology Group exploring the acquisition of Bakkt, a crypto trading platform, have further bolstered sentiment.

Is BTC going to hit 100k?

With these catalysts at play, BTC surged to an all-time high of $94,890 just before publication, entering price discovery mode.

Indicators like the Relative Strength Index and MACD on the daily chart suggested strong trend momentum with no signs of weakening.

One key metric supporting this outlook is the lack of retail euphoria, as shown by Santiment’s FOMO indicator. Social media sentiment remains “lukewarm at best,” despite Bitcoin’s record surge.

On-chain analysts view this muted excitement as a positive and believe this environment allows whales and institutions to keep driving the rally.

CryptoQuant analyst IT Tech echoed that the subdued retail sentiment is a positive development for long-term investors.

The sentiment aligns with Bitcoin’s ongoing price discovery phase, as many analysts see the $100,000 mark as the next logical target for the flagship.

Analysts, Moustache and Ali, pointed to chart patterns and RSI levels that closely mirror Bitcoin’s parabolic rally in 2020.

Moustache highlighted similarities suggesting Bitcoin is at the start of a parabolic phase, which could drive the price well beyond $100,000.

Ali supported this view, predicting BTC could rise to $108,000, briefly drop to $99,000, and then rally to $135,000, following a trajectory reminiscent of its 2021 bull run.

Both analysts, Moustache and Ali, pointed to past patterns as the basis for their belief that Bitcoin is on track to surpass $100,000.

Moustache highlighted chart patterns similar to those seen before Bitcoin’s parabolic rally in 2021.

According to him, BTC appears to be at the start of a similar phase, suggesting exponential gains that could push the price well beyond six figures.

Ali, on the other hand, drew parallels to Bitcoin’s price action in December 2020.

He noted that the current chart setup, including the RSI, is nearly identical to that period.

Based on this, Ali predicted BTC would first climb to $108,000, dip to $99,000, and then surge to $135,000, following a trajectory like its 2020 bull run.

Meanwhile, altcoins showed minimal movement throughout the day. At press time, the top altcoin gainers were:

Cardano

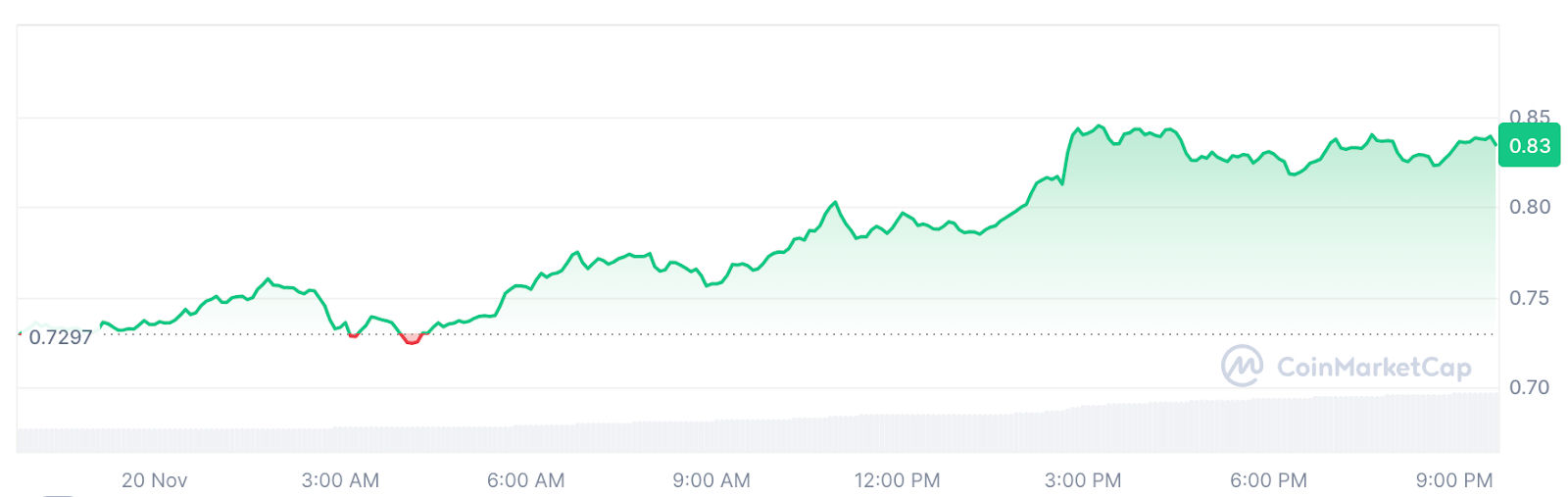

Cardano (ADA) rose over 14% on Wednesday exchanging hands at $0.8361 a price level not seen since early May 2022.

The altcoin’s market cap was seated at $29.5 billion making it the 10th largest crypto asset in the market per data from CoinGecko.

Source: CoinMarketCap

According to CoinGlass data, the open interest in ADA’s futures market rose from $584 million on Tuesday to $782 million on Wednesday, the highest level seen since November 2021.

Further rumours of a potential Ripple partnership, sparked by discussions between Cardano’s Charles Hoskinson and Ripple’s Brad Garlinghouse added to the sentiment.

In their discussions Hoskinson had hinted at using Cardano’s privacy sidechain, Midnight, to enhance XRP’s DeFi capabilities.

Stellar

Stellar (XLM) saw gains of 11.4% extending its weekly gains to 100% while its market cap rose to $7.8 billion a level last seen on December 4, 2021.

The altcoin was trading at $0.2616 with a daily trading volume of over $1.6 billion.

Source: CoinMarketCap

XLM experienced a sharp rise following major collaborations with MasterCard and Franklin Templeton.

The latter, a leading global investment firm, aims to bring $1.7 trillion in assets on-chain, promising to greatly reduce transaction costs.

Further, the United Nations recently recognized Stellar Lumens and Ripple, the creator of XRP, as integral elements of a new financial system adding fuel to their rallies.

Cronos

Cronos (CRO) was up 10.8% over the past day, trading at $0.1868 when writing.

The altcoin’s market cap was seated at over $5 billion.

Source: CoinMarketCap

The altcoin rally followed the community’s $50 million CRO burning proposal aiming to drive scarcity in the token.

The altcoin also gained momentum as analysts projected a bullish outlook for the crypto asset, setting a price target of $0.8868 in the coming months.

The bullish outlook was also supported by expectations of fresh developments promised in a recently revealed roadmap.

The post Bitcoin hits record high of $94,890, with Cardano (ADA) and Stellar (XLM) driving altcoin rally appeared first on Invezz

English (US) ·

English (US) ·