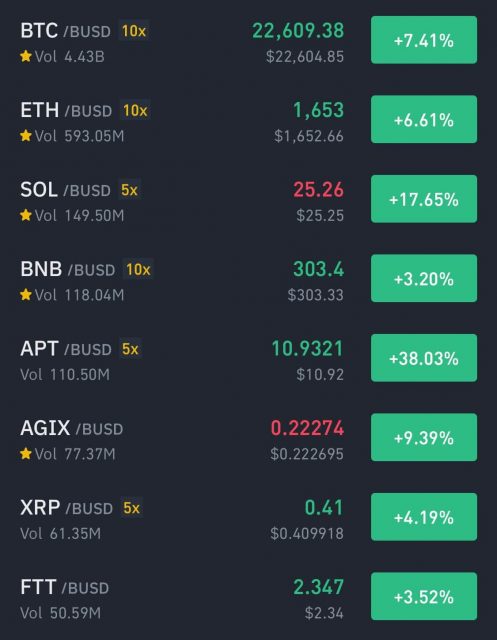

1/21 (Sat) morning market trends (compared to the previous day)

crypto assets

- NY Dow: $33,309 +0.8%

- Nasdaq: $11,110 +2.3%

- Nikkei Stock Average: ¥26,553 +0.5%

- USD/JPY: 129.5 +0.8%

- USD Index: 102 -0.08%

- 10-year US Treasury yield: 3.48 +2.4%

- Gold Futures: $1,928 +0.22%

traditional finance

Today’s New York Dow rebounded for the first time in four days, rising $264. The Nasdaq, S&P 500 and yesterday’s Nikkei also rose.

Markets were weaker than expected this week, with signs of a slowdown in the US Producer Price Index (PPI) in December suggesting an economic slowdown, and the possibility of a prolonged rate hike by the Fed due to strong employment. On the 20th, buybacks of IT and high-tech stocks seem to have pushed up the overall market.

Relation: U.S. PPI outperforms expectations but decelerates

Google’s parent company Alphabet announced on the 20th that it will cut about 12,000 jobs, or 6% of its global workforce. Shares soared following the announcement of cost reductions. Tech giants such as Amazon, Meta and Twitter have also recently announced job cuts, fueling speculation of a global economic slowdown.

Alphabet CEO Pichai said in an internal email that artificial intelligence (AI) represents a “great opportunity” as the company cuts jobs. In recent years, the AI/machine learning field has been intensifying competition in development and investment. Rival Microsoft recently announced that it could make an additional investment of up to $10 billion in OpenAI, which developed ChatGPT, a conversational AI model. It was reported that Google executives had a sense of crisis about ChatGPT, which was released in December last year, and that they had fundamentally changed their internal development system.

Relation: Dollar Yen continues to fall Bitcoin returns to $ 20,000, AI-related tokens such as “AGIX” soar

Google is also actively involved in the cryptocurrency field, and in November last year it introduced a proxy service for the operation of the verification node of Solana (SOL).

In terms of individual US stocks, Big Bear ai (AI related) +4.8%, Amazon +3.4%, Microsoft +3.4%, Apple +1.5%, Tesla +4.6%, Meta +2.2%, Coinbase +11%, Micro Strategy +8.3%.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Upcoming important economic indicators and events

- January 26: U.S. Real GDP (Quarter Annual Rate) (Preliminary Report)

- January 28: University of Michigan Consumer Confidence Index (confirmed)

- February 2: FOMC policy interest rate

- February 3: U.S. Unemployment Rate, Nonfarm Payrolls

USD/JPY: 129.5 +0.9%

USD/JPY is 1USD=129.57JPY, +0.91%. The dollar/yen exchange rate hit the 130 yen level last night as the dollar strengthened against the yen. Ten-year US Treasury yields also rose.

Source: Yahoo! Finance

The managing director of the International Monetary Fund (IMF) said at the World Economic Forum’s Davos meeting on the 20th that the outlook for the world economy was “not as bad as I was worried a few months ago.” Did it lead to buying yen selling?

Relation: Bank of Japan monetary policy meeting on the 18th, “yen depreciation, dollar strength” sharp rise due to easing

In addition, the consumer price index (CPI) for December 2010 announced by the Ministry of Internal Affairs and Communications on the 20th increased to 104.1 from 100.0 in December of the previous year, up 4.0% from the same month of the previous year, excluding fresh food, which fluctuates greatly. This is the first level in 41 years since December 1981, when the effects of the second oil crisis continued.

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

Virtual currency overall high

The virtual currency market is high across the board. Bitcoin (BTC) hits a year-to-date high at around $22,750. In addition, Solana increased by more than 17% from the previous day, surpassing Polygon (MATIC) in order of market capitalization and ranked 10th again.

Source: Binance

Did FTX CEO John J. Ray consider whether the exchange could be reopened on the 19th and the bankruptcy filing of the lending company Genesis that was confirmed on the afternoon of the 20th? It seems that the move to file for bankruptcy for debt consolidation of Genesis without selling the portfolio such as GBTC held by the parent company DCG led to short-term selling pressure relief. CoinDesk, a major cryptocurrency media outlet under DCG, is looking for a buyer.

Relation: Virtual currency lending company Genesis filed for bankruptcy, creditors such as Gemini and Van Eck

In addition, the price of Solana (SOL) seems to have been pushed up by the continuous increase in NFT trading volume and the number of transactions per day exceeding the total number of major L1 chains.

FACT CHECK: @solana DOES MORE DAILY TRANSACTIONS THAN ALL THE CHAINS COMBINED. pic.twitter.com/OXjVXj2X2X

FACT CHECK: @solana DOES MORE DAILY TRANSACTIONS THAN ALL THE CHAINS COMBINED. pic.twitter.com/OXjVXj2X2X

— Sol Bulletin  (@SolBulletin) January 20, 2023

(@SolBulletin) January 20, 2023

Relation: Which chain has the highest number of new developers of virtual currency and the most expanded? |Annual Report 2022

Other stocks such as Aptos, Magic, Hook and LDO are also soaring.

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase Global | $55 (+11%/+10%)

- Marathon Digital Holdings | $8 (+9.9%/+5%)

- MicroStrategy | $240 (+8.4%/+10%)

- Monex Group | ¥475 (-2.2%/-0.8%)

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

GM Radio 2023 first episode next week

As a special guest this time, we invited Anthony Rose, head of engineering at Matter Labs. The company is developing Ethereum (ETH) L2 solution “zkSync”. Matter Labs is developing a technology to improve the scalability of Ethereum by utilizing cryptographic technology called zero-knowledge proof, and it is currently attracting a lot of attention.

It will be distributed on the Twitter space of @CoinPost_Global from 12:30 to 13:00 on Thursday, January 26, Japan time.

This year’s first “GM Radio” will be held!

Guests are executives of Ethereum L2 “zkSync” development company https://t.co/Wqyrx8PcGy

— CoinPost-virtual currency information site-[app delivery](@coin_post) January 19, 2023

Click here to watch the archive of the previous episode, including Yat Siu, chairman of Animoka Brands.

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

— CoinPost Global (@CoinPost_Global) December 22, 2022

The post Bitcoin hits year-to-date highs NY Dow and cryptocurrency-related stocks rise | 21st Financial Tankan appeared first on Our Bitcoin News.

2 years ago

153

2 years ago

153

English (US) ·

English (US) ·