Macroeconomics and financial markets

On the US New York stock market on the 24th last weekend, the Dow Jones Industrial Average closed 83.5 points (0.24%) higher than the previous day, and the Nasdaq Index closed 40.7 points (0.29%) higher.

Christopher Waller, the US Federal Reserve Board member known to be a hawk, was well-received as he hinted at a shift in monetary policy, including by mentioning the possibility of lowering interest rates if the inflation rate continues to decline.

Among crypto-asset (virtual currency)-related stocks, Coinbase stock continued to rise and hit a new year-to-date high.

Binance, the largest cryptocurrency exchange that had been losing market share to its competitors, suffered a major setback with the resignation of Changpeng Zhao (CZ), and the main custodian (management/custody) of Bitcoin spot ETF (exchange traded fund) This appears to have been recognized for its high level of security and its superiority in the industry, which has helped it establish itself as a financial institution that conducts business.

$COIN was an obvious buy due to being the main custodian for the #Bitcoin ETFs so far.

Became an even clearer trade, when the US government put an end to @cz_binance. https://t.co/7YpOV5tLGr pic.twitter.com/p2KQvjId6b

— James V. Straten (@jimmyvs24) November 27, 2023

BlackRock, the largest U.S. asset management company that is currently applying for a Bitcoin spot ETF, entered into a partnership with Coinbase Global in August last year. The company has announced that it will provide institutional investors with Bitcoin transactions, storage, and a wide range of market data through its asset management system “BlackRock Aladdin.”

connection:Dollar/yen temporarily 147.3 yen, Coinbase stock rises significantly, US FOMC board member turning dovish | 29th Financial Tankan

connection:Stock investment recommended for virtual currency investors, “10 representative virtual currency stocks in Japan and the United States”

Virtual currency market conditions

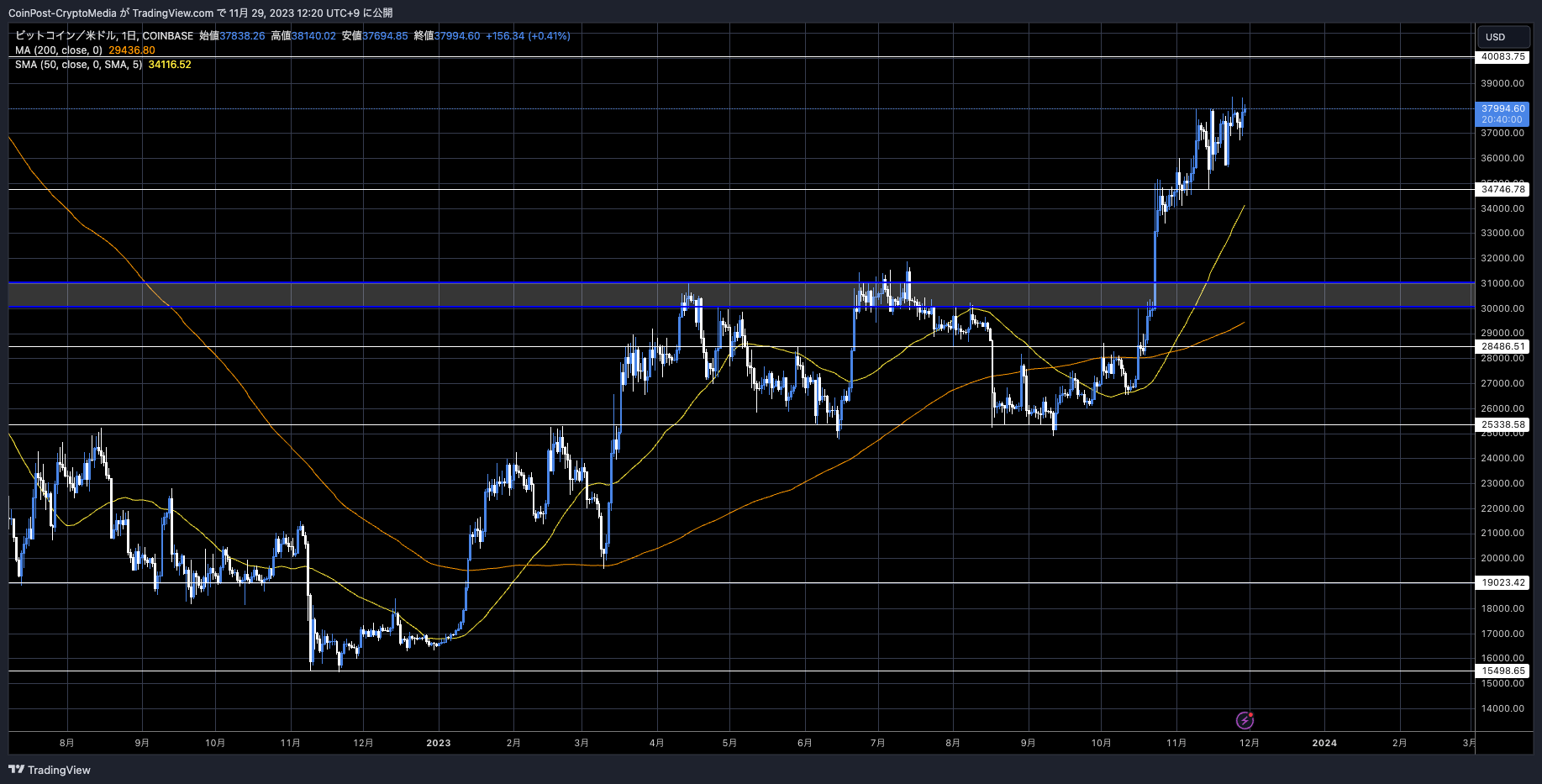

In the crypto asset (virtual currency) market, the Bitcoin price rebounded to 1 BTC = $37,993, an increase of 2.3% from the previous day.

BTC/USD daily

Among major alts, Solana (SOL), ranked 6th in market capitalization, which had been declining due to overheating, rebounded by 6.7% compared to the previous day, and Dogecoin (DOGE), ranked 10th, rose 3.2% compared to the previous day. Avalanche (AVAX) rose 3.1%.

According to data from CoinGlass on the 27th, open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) soared to a record high of 118,540 BTC ($4.22 billion).

CME #Bitcoin open interest reached 118.54K #BTC($4.42B), a new all-time high. (coin)

https://t.co/b1RbJ1A35P pic.twitter.com/mZN43aK3Yt

https://t.co/b1RbJ1A35P pic.twitter.com/mZN43aK3Yt

— CoinGlass (@coinglass_com) November 27, 2023

As of the 11th, it had reached 108,900 BTC ($4 billion), which caused a stir as it surpassed the largest crypto asset (virtual currency) exchange Binance for the first time. This suggests that institutional investors view Bitcoin as a valuable asset class, and the amount of money flowing through CME is increasing.

connection:CME’s Bitcoin futures OI surpasses Binance for the first time

Institutional capital flows totaled $346 million, the ninth consecutive week of net inflows, according to asset manager CoinShares’ weekly report.

Due to the rise in Bitcoin (BTC) and the inflow of funds, total assets under management (AuM) has expanded to $45.3 billion (6.6 trillion yen), the highest level in the past 18 months.

By region, Canada and Germany accounted for 87% of the total inflows, while in the United States, where the US SEC (Securities and Exchange Commission) is tightening its grip, inflows were only $30 million. There is also a strong view that the US is awaiting approval for spot ETFs.

Furthermore, Ethereum, which had been in a slump, recorded inflows of $34 million last week, bringing the inflows over the past month to $103 million, almost offsetting this year’s net outflows, a decisive turnaround in sentiment. showed that.

The background to this is that BlackRock has applied for an Ethereum spot ETF (exchange traded fund).

Additionally, according to CoinShares, $900,000 was semi-outflowed from the inverse Bitcoin ETP for three consecutive weeks. The stock is down 61% from its peak in April 2023, suggesting that short sellers are capitulating.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Bitcoin ETF special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

Click here for a list of past market reports

The post Bitcoin investment products experience net inflows for 9th consecutive week, the largest since the “bull market” in November 2021 appeared first on Our Bitcoin News.

1 year ago

121

1 year ago

121

English (US) ·

English (US) ·