The post Bitcoin Investment Strategy 2024: Navigating the Bull Run and Institutional Surge appeared first on Coinpedia Fintech News

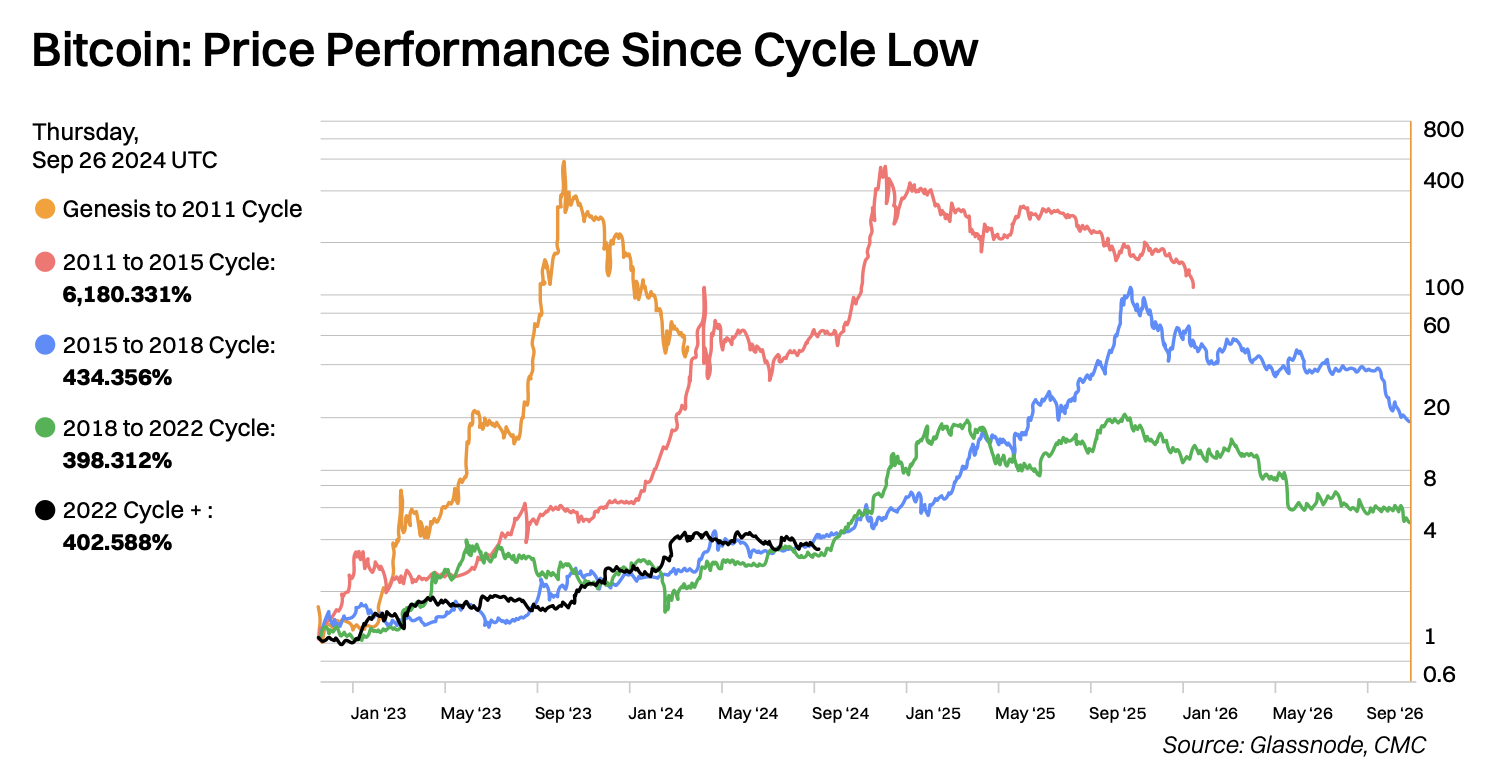

As we all know, halving is an event that happens in the Bitcoin market every four years. The market follows a specific pattern as it moves from one halving to the next. Usually, the price of BTC reaches its peak around 518 to 546 days after a halving event in a bull market. This typically provides a rough idea of how long we should wait to see the highest point of a cycle. Considering the existing pattern, one can assume that this cycle’s peak is not imminent. However, a research report, released by CMC Research, indicates that we may not have to wait that long to reach the highest peak of the cycle this time.

Bitcoin’s Accelerated Cycle: What You Should Know

The report predicts that this time the Bitcoin market will reach its highest peak of the cycle between mid-May and mid-June 2025. This Bitcoin price prediction suggests that BTC may hit a new peak at least 100 days earlier than expected, indicating the possibility of an accelerated cycle.

At this moment, it is not clear what exactly has caused this shift in the typical pattern. Some point to factors like institutional adoption, ETFs, and increased correlation with traditional assets.

Signs of a ‘Super Cycle’ in Bitcoin?

The report brings the spotlight to the increasing institutional interest in Bitcoin. It claims that this newfound interest may be contributing to a ‘Super Cycle’ in the market. The report highlights the recent surge in total BTC holdings by top players like MicroStrategy and Semler Scientific. MicroStrategy has at least 252,200 BTC, and Semler Scientific holds 1,012 BTC. At the start of this year, MicoStrategy’s holdings were 189,150 BTC, and Semler Scientific held none.

Bitcoin’s Growing Connection to Traditional Assets

An interesting trend the report notes is that Bitcoin is increasingly behaving like a traditional financial asset. If this finding of the report proves accurate, it may no longer be possible to predict the future price momentum of the Bitcoin market using old patterns.

In conclusion, the report provides clear evidence that the Bitcoin market is rapidly evolving and is slowly expanding beyond the boundaries of the cryptocurrency market, gaining greater acceptance from traditional investors.

1 month ago

17

1 month ago

17

English (US) ·

English (US) ·