Macroeconomics and financial markets

In the US NY stock market on the 1st, the Dow Jones Industrial Average rose $369.5 (0.97%) from the previous day, setting a new record high. The Nasdaq index closed 197.6 points (1.3%) higher.

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price rose 2.2% from the previous day to 1 BTC = $43,037.

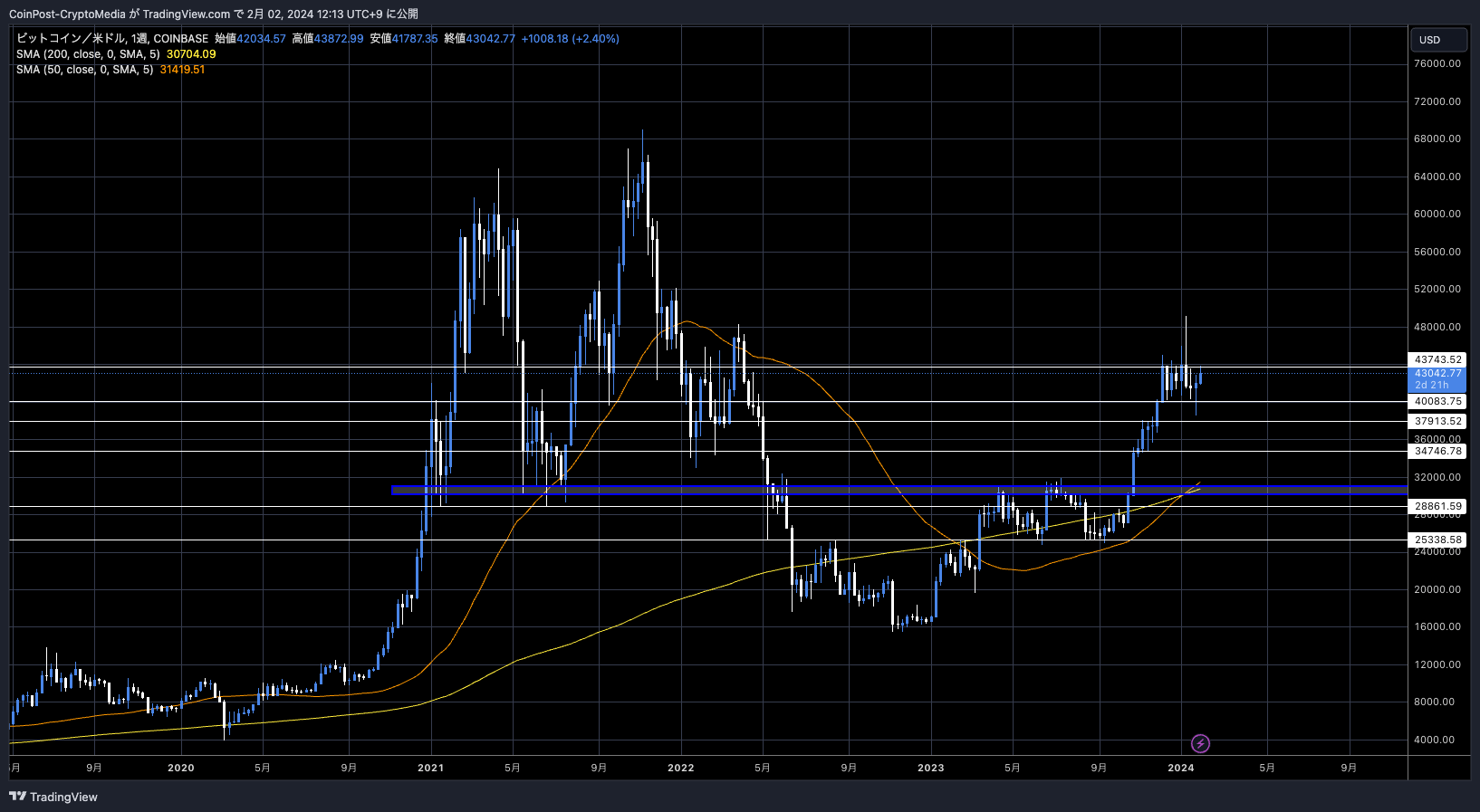

BTC/USD weekly

At the end of last month, the price bounced off the upper resistance level of $44,000, and there is a possibility that the price will remain in the range for the time being. Among the major alts, Ethereum (ETH) rebounded by 1.8%, and Solana (SOL) rebounded by 5.9%.

There was also a sell-off in the crypto asset (virtual currency) market after the US Federal Open Market Committee (FOMC) meeting, but it has since come to an end.

Economist Alex Krüger said, “Although Chairman Powell’s statement denying an early interest rate cut in March is a hawkish stance that puts market expectations on hold, the Federal Reserve (Federal Reserve System) is shifting to a dovish stance. “There is a strong possibility that the central bank will cut interest rates in May or June.”

FOMC thoughts

– Big picture dovish

– “Small” picture hawkish

Jay introduced “no cuts in March” to tamper animal spirits, but the Fed is turning dovish and will start cutting either in May or June.

Yes, there likely are too many cuts priced in for 2024. But this gets “fixed”… pic.twitter.com/J7v6wt5TsF

— Alex Krüger (@krugermacro) February 1, 2024

Meanwhile, the market is already pricing in a rate cut, and Bitcoin prices are likely to continue adjusting for the foreseeable future.

Multiple bullish signals

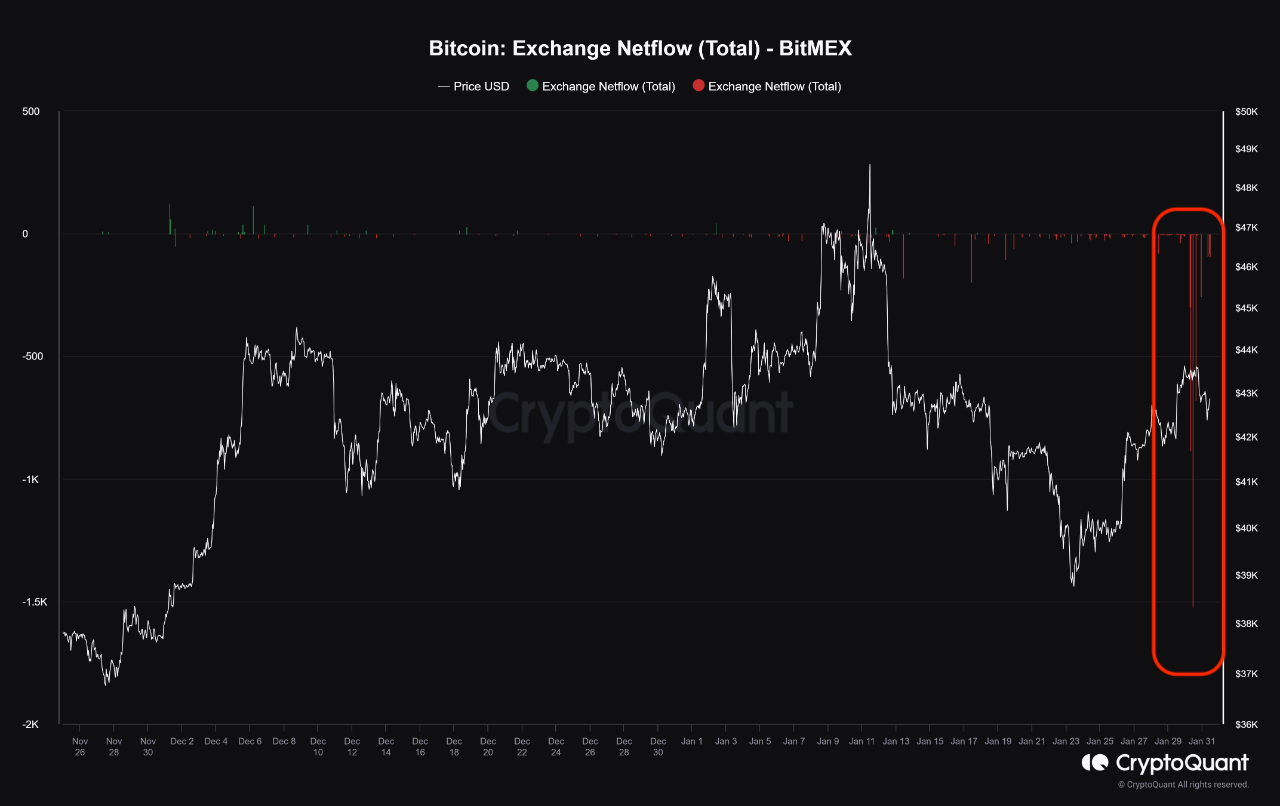

Analysts at data analysis company CryptoQuant pointed out that 4,000 BTC (approximately $168 million) was withdrawn on major exchange BitMEX.

BitMEX Exchange Netflow

This suggests that this is a strategic move by large investors to withdraw their funds with the assumption that they will hold them for the long term and store them safely in a custody service.

Historically, large-scale withdrawals by large BitMEX investors have served as a signal that the market is reaching a bottom. The most recent one is the yellow circle for October 2023.

Ali also said that the Accumulation Trend Score, an on-chain metric that tracks Bitcoin wallet balances, reached its highest level in three years.

#Bitcoin is witnessing one of its most significant accumulation streaks in almost 3 years!

Notably, the Accumulation Trend Score has hovered near 1 for the past 4 months, signaling that larger entities are accumulating $BTC. This trend indicates strong confidence in the market! pic.twitter.com/QcJOEhzBUb

— Ali (@ali_charts) February 1, 2024

The number of whales (large investors) holding 1,000 BTC or more has increased by 67 (4.5%) in the past two weeks.

While some shivered with fear during the recent price correction, #Bitcoin whales were accumulating more $BTC!

Around 67 new entities now hold 1,000 #BTC or more, marking a 4.50% increase in two weeks. pic.twitter.com/tje3fhznRR

— Ali (@ali_charts) January 30, 2024

“WebX2024” New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023” pic.twitter.com/vHZmFbNjwM

— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin is in a stalemate, and there are multiple bullish signals such as large investor trends appeared first on Our Bitcoin News.

1 year ago

128

1 year ago

128

English (US) ·

English (US) ·