- Bitcoin miners appear to adjust their balances whenever the price crosses $30,000.

- Bitcoin price has broken below the lower end of the Bollinger Bands.

Bitcoin (BTC) Prices Rebound from Last Week’s Rise. It has returned to the lower end of its recent range of $29,700 (approximately 4,158,000 yen, at an exchange rate of 140 yen to the dollar) as trading volumes slumped.

A feature of the recent market price movement is that the price has been rapidly reversing after repeatedly trying to break through the $31,000 level. One reason is that Bitcoin miners are selling when the price rises. This could indicate that miners are in need of funds, or that they are bearish on Bitcoin in the short term, or both. There are also two technical indicators worth noting.

Are Bitcoin Miners Going Bearish?

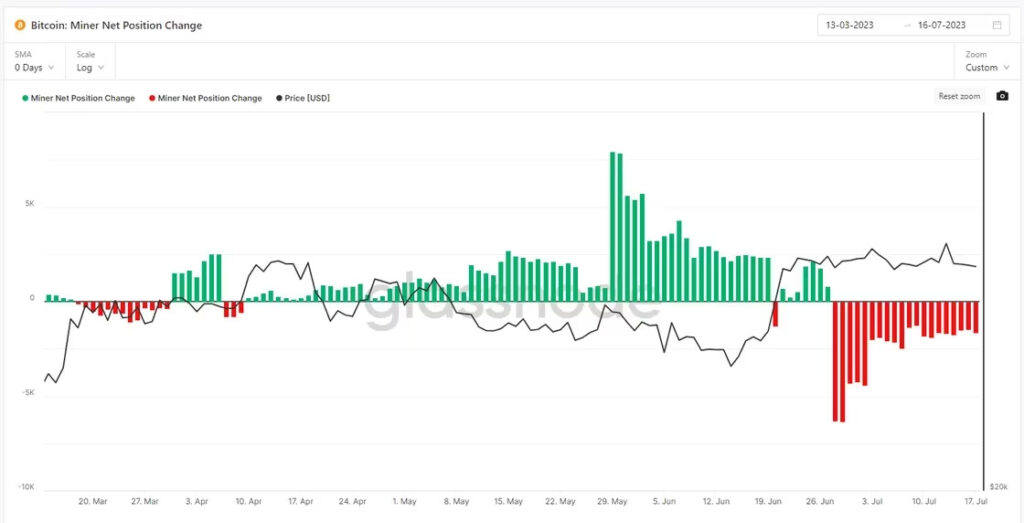

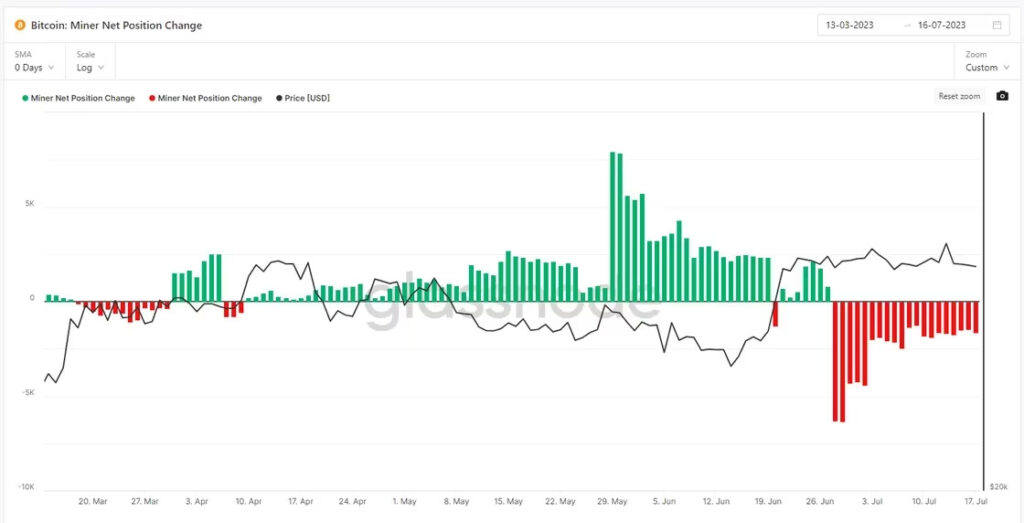

Bitcoin price has been above $30,000 for most of this month, and miners’ net positions are declining. The 30-day change in bitcoin holdings for miner addresses has been negative for the 20th straight day, according to blockchain data analytics firm Glassnode.

This contrasts with the net position being positive on all but one day from April 10th to June 27th.

Does this shift indicate a shift in sentiment, or simply that cash-strapped miners need to sell assets to fund their operations? There are probably both factors.

Considering Bitcoin’s 80% gain year-to-date, it’s entirely possible that Bitcoin miners will take some profits. However, the overall trading volume is not high enough to indicate a large sale.

Furthermore, the total Bitcoin balance held by miners is now 1.83 million BTC, compared to 1.82 million BTC on January 1st. This suggests that the recent activity may simply be an overall rebalancing of positions rather than a consideration of price levels.

Bollinger Bands break through lower bound

In the latest bullish case, the price surged just after the Bollinger Bands top breakout on June 14th.

The current price of $29,750 is just below the lower end of the Bollinger Bands of $29,800, so today’s price action could be bearish.

There is a significant support line at the $30,000 level

Barring new material, Bitcoin prices are likely to remain hovering around the $30,000 level. Bitcoin’s volume profile by price range shows significant trading activity at the $30,500 level since May. High levels of trading activity by price range tend to stabilize prices.

|Translation: CoinDeskJAPAN

|Editing: Rinan Hayashi

| Image: Glassnode

|Original: Are Bitcoin Miner Sales Preventing Breakout to Higher Prices?

The post Bitcoin, is it sluggish due to miner sales? | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

77

2 years ago

77

English (US) ·

English (US) ·