Macroeconomics and financial markets

On the 4th, in the US New York stock market, the Dow Jones Industrial Average closed 10.1 points higher than the previous day, while the Nasdaq index closed 81.9 points (0.56%) lower.

Among US stocks related to crypto assets (virtual currency), Coinbase rebounded by 2.1% from the previous day, MicroStrategy rose 3.6%, and Marathon Digital rose 10.7%.

CoinPost app (heat map function)

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price rose 1.38% from the previous day to 1 BTC = $43,524.

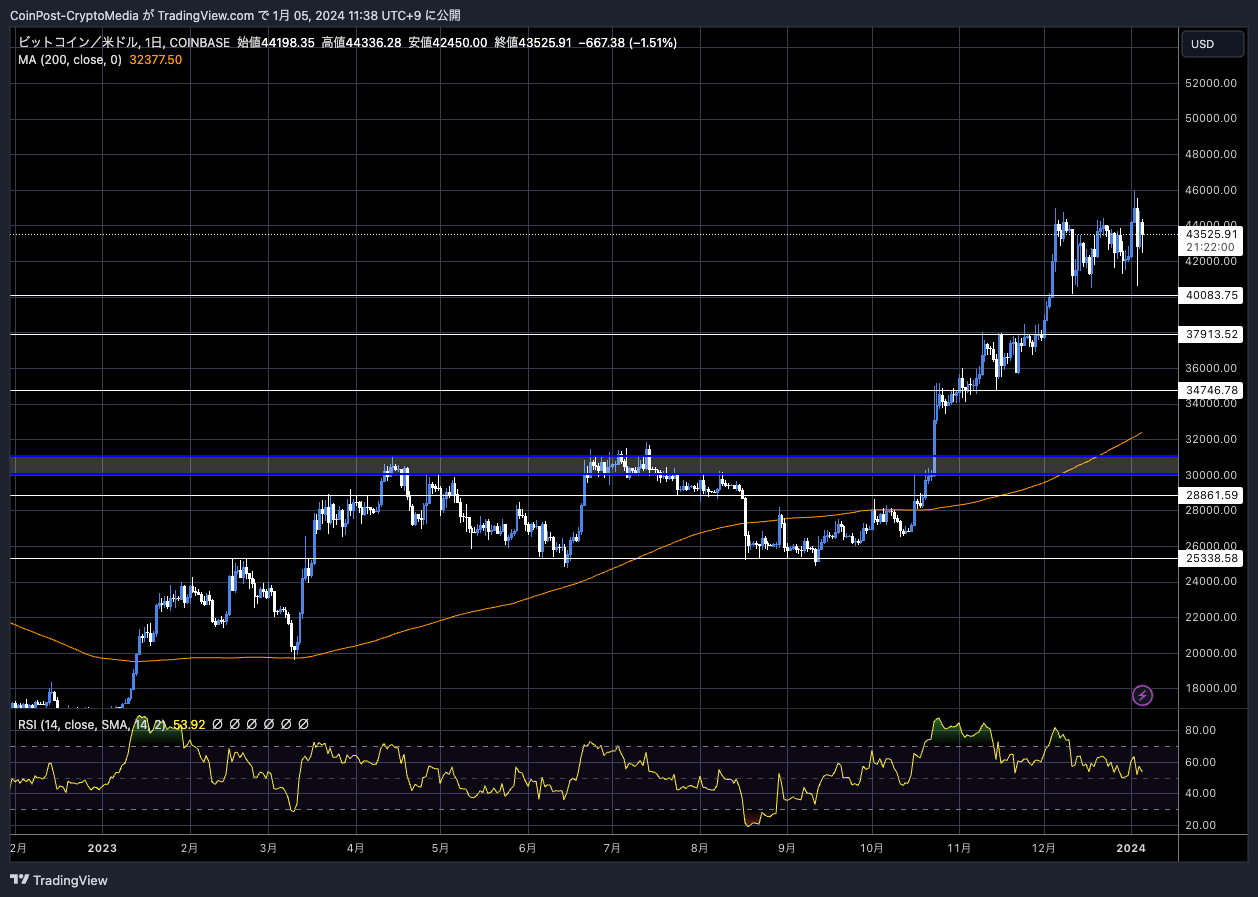

BTC/USD daily

Bitcoin ETF (Exchange Traded Fund) prices temporarily fell to $40,625 on the 3rd due to unapproved speculation, but rebounded due to market buying.

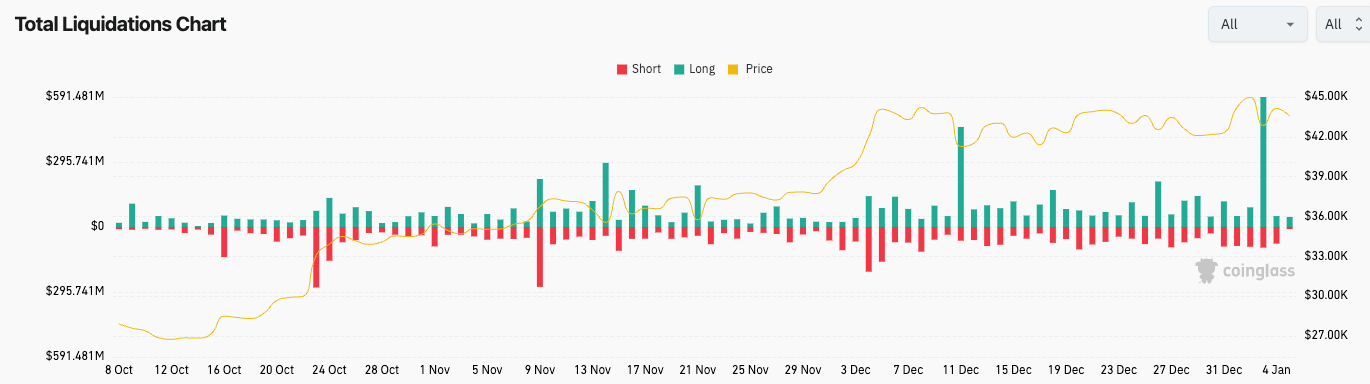

Long positions worth $590 million (85 billion yen) were liquidated, but it can be said that the risk of a sell-the-fact decline in the event of approval has been reduced because high-leverage positions have been wiped out. That’s it.

coinglass

Although the market is starting to factor in the approval of Bitcoin ETFs (exchange traded funds), uncertainty remains as final approval is left to the SEC’s discretion.

A report published by Matrixport on the 3rd stated that the SEC would disapprove Bitcoin spot ETFs, leading to a sharp decline in the market for crypto assets such as Bitcoin.

Matrixport points out the political background in that the five SEC committee executives involved in approving ETFs are all Democratic members. If you want to hedge your long position exposure, you should consider buying a put with a $40,000 strike through the end of January or shorting Bitcoin through the options market.

Nate Geraci, an ETF investment advisor, said that if the SEC rejects the Bitcoin ETF, it could lead to litigation, as in the Grayscale ETF conversion case.

connection:U.S. SEC disapproves Bitcoin spot ETF again? Matrixport releases new analysis

On the other hand, optimistic forecasts remain strong. Techcrunch’s Jacqueline Melinek, citing sources familiar with the matter, reported that a Bitcoin spot ETF (exchange traded fund) is expected to be approved by the US SEC (Securities and Exchange Commission).

heard from sources extremely close to the matter that the bitcoin spot ETF is going to be approved by the SEC for *multiple* firms’ applications

— Jacquelyn Melinek (@jacqmelinek) January 4, 2024

The final approval date for ARK Invest’s application is January 10th, but there are speculations that it will not be approved on its own, but will be approved all at once, including for ETFs currently being applied for by the largest asset management company BlackRock and others.

Grayscale Investments is working to file an amended Form 19b-4 within the next three business days, The Block reported, citing sources familiar with the matter. Expected to be published.

EDGAR is the SEC’s database used to store and search legal documents and reports that companies, mutual funds, and securities issuers must file with the SEC.

If the approval process goes well, trading could begin as early as this weekend or as late as the middle of next week.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Grayscale Investments has held talks with JPMorgan and Goldman Sachs to find accredited participants, Bloomberg reported on Wednesday.

Regarding the impact on the leading Bitcoin futures ETF market, ProShares said, “There is already mature liquidity that can be supplemented with demand that is not present in physical ETFs.”

Speaking of feisty ETF IQ clips, here’s ProShares yest on whether they worried about $BITO mkt share losing spot ETFs: “The bitcoin futures is a mature liquid and regulated. There’s things we don’t know about the spot market 1) there’s multiple prices, futures solve that,… https://t.co/eRPlQ8M8uE

— Eric Balchunas (@EricBalchunas) January 4, 2024

The ProShares Bitcoin Futures ETF was approved by the U.S. Securities and Exchange Commission (SEC) in October 2021 and began trading on the New York Stock Exchange (NYSE). Since the Bitcoin futures market is already established and has a certain level of liquidity and market structure, the use of futures contracts also has the advantage of allowing leveraged trading and risk hedging.

In addition, if a spot ETF is approved, it is expected to attract institutional investors.

Galaxy Digital predicts that if its Bitcoin spot ETF (exchange traded fund) is approved, it could expect to receive $14.4 billion in inflows in its first year of issuance.

connection:The history of the 2004 listed “Gold ETF” suggests the impact on the market price after Bitcoin ETF approval

According to a Bitwise survey, only 39% of U.S. financial advisors believe a Bitcoin ETF will be approved this year.

LESS THAN HALF OF ALL ADVISORS EXPECT A SPOT BITCOIN ETF IN 2024…

In a surprising development, only 39% of advisors believe a spot bitcoin ETF will be approved in 2024. By contrast, Bloomberg ETF analysts peg the likelihood of a January approval at 90%.

— Bitwise (@BitwiseInvest) January 4, 2024

There also appears to be a gap between crypto asset (virtual currency) market participants and general awareness. Financial advisors surveyed include investment advisors and institutional investors.

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin is likely to be bought on the spur of the moment, or is it recovering from the sharp decline at the beginning of the year that was accompanied by large-scale stop-loss cuts? appeared first on Our Bitcoin News.

1 year ago

142

1 year ago

142

English (US) ·

English (US) ·