Virtual currency market prices this week from 12/9 (Sat) to 12/15 (Fri)

Mr. Hasegawa, an analyst at Bitbank, a major domestic exchange, illustrates this week’s Bitcoin chart and deciphers the future outlook.

table of contents

- Bitcoin on-chain data

- bitbank contribution

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other services

bitbank analyst analysis (contributed by Tomoya Hasegawa)

Weekly report from 12/9 (Sat) to 12/15 (Fri):

This week’s Bitcoin (BTC) vs. yen price fell sharply at the beginning of the week, but has remained steady since then, and as of noon on the 15th, it was hovering around 6.1 million yen.

This week, with the results of the U.S. Federal Open Market Committee meeting scheduled for early on the 14th, profit-taking began in BTC from the beginning of the week, and the market price plummeted from around 6.4 million yen to 6.1 million yen, accompanied by long loss cuts. Selling prevailed during the same day in the U.S., and although the market price briefly fell below 6 million yen, there was some pushback buying at around the $40,000 level (approximately 5.8 million yen).

However, on the following day, the 12th, the top price was suppressed at the 42,000 dollar level (approximately 6.1 million yen), and as the November U.S. consumer price index (CPI) grew slightly faster than the previous month, the market price rose again to 6 million yen. broke the yen.

On the other hand, BTC continued to be supported by buying at the $40,000 level, and on the 13th U.S. time it rebounded in response to the downturn in the U.S. Wholesale Price Index (PPI) in November. Furthermore, the FOMC suddenly turned dovish in the early hours of the 14th, and the market price briefly recovered to 6.2 million yen.

On the 14th, a vulnerability was discovered in DApps that use Ledger’s connector library, and BTC plummeted again due to the upturn in US retail sales in November, but Ledger was not affected by the vulnerability. Thanks to the prompt response and the FOMC’s continued favorable reception, the market quickly recovered its losses.

Figure 1: BTC vs. Yen chart (1 hour timeframe) Source: Created from bitbank.cc

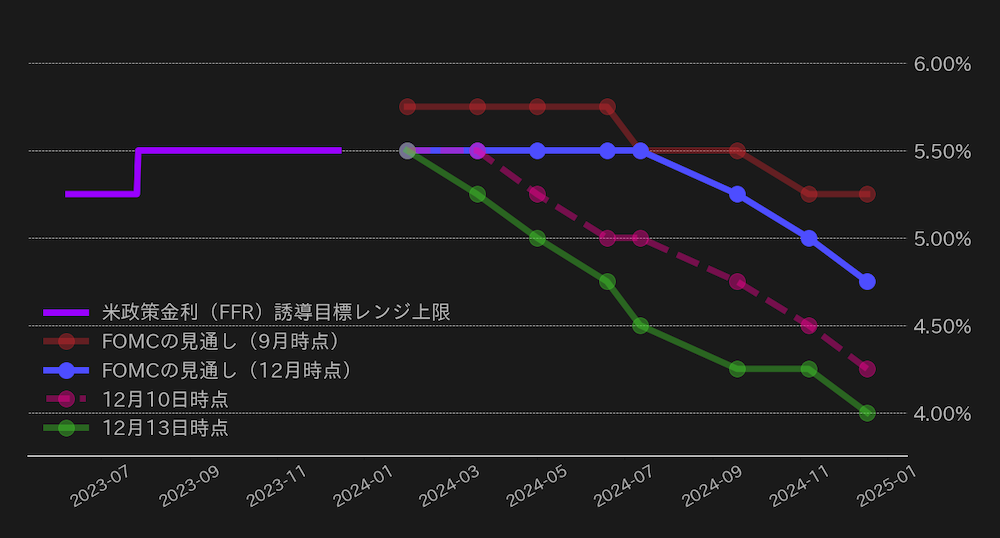

On the 13th, the FOMC decided to leave interest rates unchanged for the third consecutive meeting and lowered its outlook for interest rates in its economic outlook. Additionally, the meeting came as a dovish surprise for the market, with Federal Reserve Chairman Jerome Powell noting in his post-meeting press conference that there had been discussion about when to cut interest rates.

Another notable point from the FOMC is that the phrase “economic activity expanded at a strong pace” at the beginning of the November statement was replaced with “economic activity has slowed from a strong pace of expansion.” Chairman Powell made the following statement at a press conference: “Meeting participants expressed concerns about the economy from keeping interest rates too high for too long,” indicating that the Fed’s attention to the economy has been at an all-time high this year. It seemed like he had become the strongest.

The FRB’s start of interest rate cut discussions and signs of consideration for the economy are positive factors for risk assets including BTC, but after the meeting, the FF interest rate futures market will be It has factored in six 25bp rate cuts.

Figure 2: BTC vs. Yen, Bitcoin hash rate, miner net position change (30) Source: Created from bitbank.cc, Glassnode

The FOMC’s forecast was for the federal funds rate to land at 4.75% at the end of 2024, but the market has priced it at 4%, and as was pointed out last week, the market is overly pricing in a rapid rate cut. The situation I’m in hasn’t changed.

It is true that there are currently no signs that the U.S. economy is rapidly expanding, but if the pace of deceleration is slow, there is still a possibility that the Fed will postpone the timing of interest rate cuts while keeping an eye on the situation. However, we should continue to be wary of the possibility that market optimism may reverse.

Well, BTC started this week on a correction trend, but it showed resilience and remained firm at the psychological turning point of $40,000. However, the market has no momentum to return to last week’s high of $45,000, and has been lacking in direction since the second half of the week. We think there is room for the price to test the upside due to technical factors, but it seems that additional material will be needed for the price to break above $45,000.

Next week, the final third quarter GDP growth rate for the US and the personal consumption expenditure (PCE) price index for November will be announced in the second half of the week, and until then, the market will continue to trade between $40,000 and $45,000. mosquito.

connection:bitbank_markets official website

Previous report:Bitcoin soared to 6.5 million yen this week, but be wary of price range adjustment risk

The post Bitcoin is on a correction trend, does it need more material to break above $45,000? | Contributed by a bitbank analyst appeared first on Our Bitcoin News.

1 year ago

114

1 year ago

114

English (US) ·

English (US) ·