Bitcoin (BTC) is currently significantly lower in price than it was in the second half of 2021. Still, the mood in the market is as positive as it was then.

That’s a message from the Funding Rate, a mechanism that synchronizes the price of Bitcoin’s perpetual futures with the spot price. When perpetual futures are trading above spot, the funding rate is positive and holders of bullish long (buy) positions pay for bearish short positions to continue trading. On the other hand, the opposite happens when perpetual futures trade below the spot price.

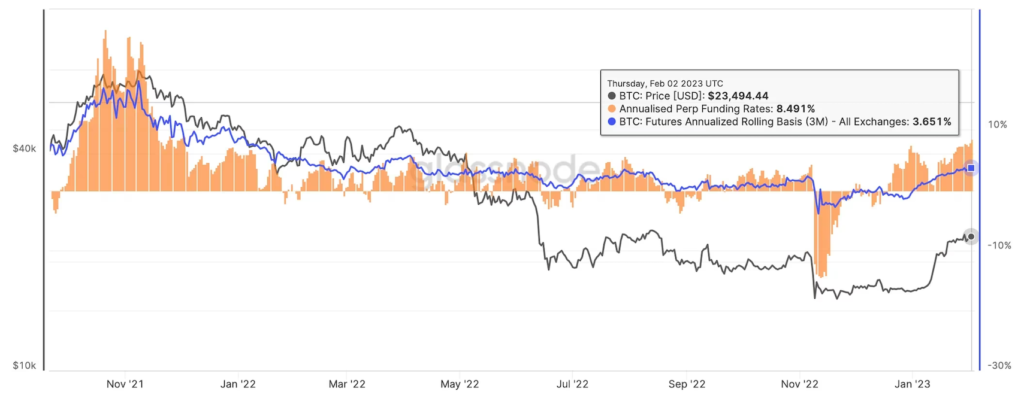

Analysts track funding rates to gauge the mood of leveraged traders. The higher the funding rate, the more excited traders are about the price outlook and the more willing they are to pay a premium to maintain their upside bets.

The spread between the perpetual futures price and the spot price has turned positive, indicating a resurgence of bullish sentiment. (Glassnode)

The spread between the perpetual futures price and the spot price has turned positive, indicating a resurgence of bullish sentiment. (Glassnode)Bitcoin perpetual futures funding rates on major cryptocurrency exchanges, including Binance, stood at 8.491% as of Thursday, according to data from blockchain analytics firm Glassnode. It was the highest since December 3rd.

At that time, the price of 1 bitcoin was about $57,000, 2.5 times the current market rate of $23,400. Bitcoin hits all-time high of $69,000 in November 2021.

In mid-December last year, the funding rate turned positive, indicating seller fatigue. Bitcoin surged more than 40% after attracting strong buying at the start of the year.

Dessislava Laneva, a research analyst at Kaiko, a Paris-based cryptocurrency data firm, said in a tweet referring to the US Consumer Price Index (CPI), “(December) CPI announcement There has been a clear shift in market sentiment afterward, with funding rates well into positive territory and volatility rising.”

The CPI fell to 6.5% in December, marking the sixth straight month of slowing inflation. The data convinced the market that the US Federal Reserve (Fed) is likely to shift its focus to liquidity-enhancing interest rate cuts later this year.

Fed Chairman Jerome Powell acknowledged that inflation is easing, adding to speculation about a future rate cut.

Focus on U.S. nonfarm payrolls

US Nonfarm Payrolls (NFP) report due to be released at 1:30 p.m. UTC on February 3, according to Reuters forecasts obtained from FXStreet is likely to report an increase of 185,000 jobs in January, following an increase of 223,000 in December.

The unemployment rate is expected to rise slightly to 3.6%, and average hourly wages, which indicate wage growth, are expected to rise 4.9% year-on-year, following a 4.6% year-on-year increase in December.

In addition to a significant increase in average hourly wages, which is also a potential indicator of inflation, a significant increase in employment could also encourage investors to expect the Fed to keep interest rates higher for a longer period of time and take a bullish position in risk assets, including cryptocurrencies. I might reconsider the possibility of shrinking.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: Glassnode

|Original: Bitcoin Market Sentiment Is Most Bullish in 14 Months With US Jobs Report Due

The post Bitcoin is the most bullish in the past 14 months ── Focus on US employment statistics | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

113

2 years ago

113

English (US) ·

English (US) ·