If Bitcoin (BTC) had a marketing team, the last month could not have been better.

Confidence in Western banks has been devastated and people are frantically looking for alternatives to protect their assets. It’s time for Bitcoin.

Bitcoin is truly decentralized money that is not controlled by anyone and was created for times like these.

Factors behind the rise of Bitcoin

At first glance, the recent banking crisis seems like a factor in Bitcoin’s rise. But if you dig a little deeper into the reasons for the rally, you can see liquidity, or more specifically, “lack of liquidity.”

The story that the banking crisis pushed the Bitcoin price up makes sense, and it actually resulted in a lot of people turning to Bitcoin. But illiquidity has almost certainly contributed to strong price increases.

First of all, I want to congratulate the Bitcoin maximalists. They had little to celebrate these days. But this very moment is what Bitcoin was created for, and for the first time in its history there is a crisis in the credibility of the banking system.

For the first time since 2008, people are starting to realize that their USD holdings are more risky than they thought, making Bitcoin a very attractive portfolio asset.

But as powerful as these stories are for explaining and predicting price movements, the current market structure cannot be ignored.

Liquidity and Volatility

When liquidity is low in any financial market, volatility increases in both directions. And there is less force to support prices, both upwards and downwards. In this case, the story of Bitcoin as a hedge against financial turmoil gave Bitcoin the impetus it needed.

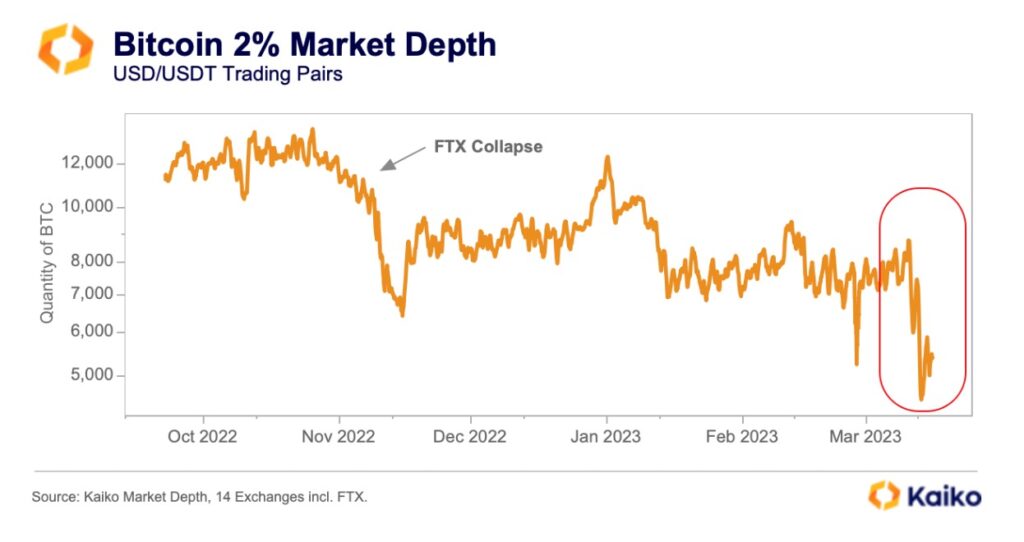

But there was little upward resistance to overcome. Bitcoin market depth, which measures the number of orders waiting to be processed on the order book, hit a 10-month low last week. It was lower than the level after the FTX/Alameda Research bankruptcy.

Kaiko

KaikoThe low level after the FTX/Alameda Research bankruptcy has been dubbed the “Alameda Gap,” and it marks the lack of liquidity in the crypto markets as the largest crypto market makers disappeared.

The liquidity gap has yet to recover and continues to hit record lows after the failures of Silvergate and Signature banks cut the market off from the vital US dollar payment system.

When market makers face such an unprecedented operational crisis, their reaction is to withdraw liquidity from their order books until there is some clarity.

Binance fee recovery

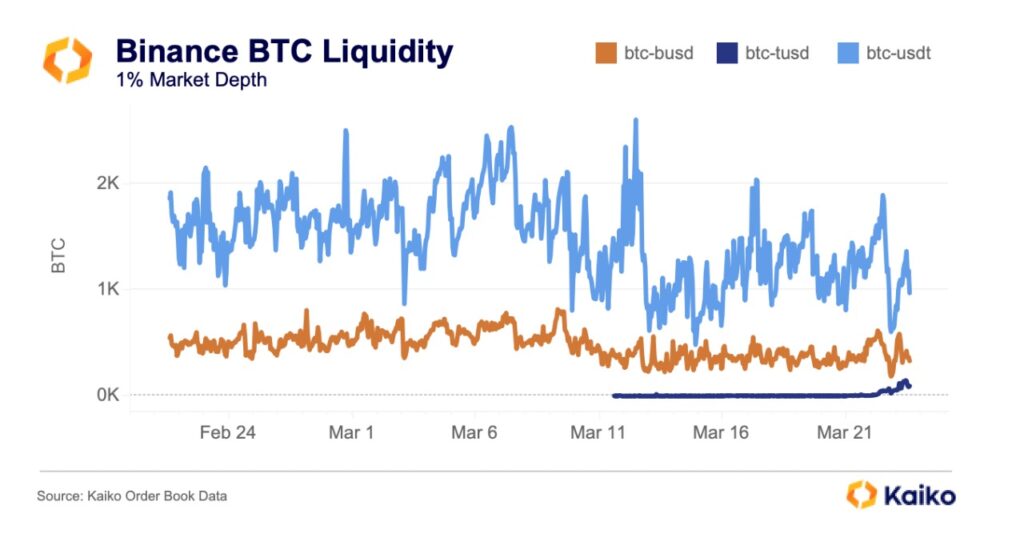

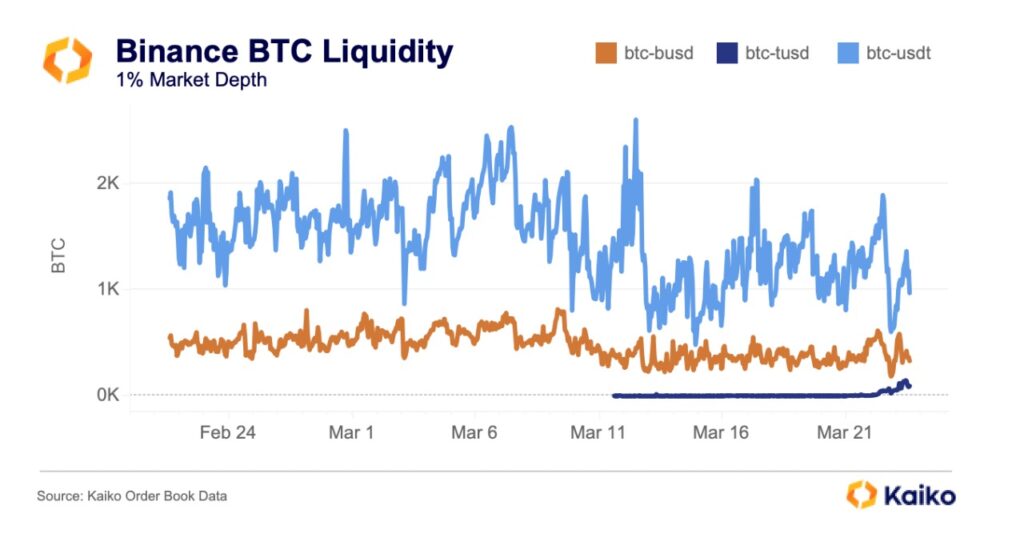

Also of note, cryptocurrency exchange Binance has reinstated commissions on its BTC/Tether (USDT) and BTC/Binance USD (BUSD) trading pairs. Liquidity on these trading pairs has plummeted in recent days as fees have been reimposed.

The fees made it impossible for Binance to justify wide spreads (the difference between the buy and sell prices). This means they have to offer tighter spreads, which impacts Binance’s profitability.

As a result, the liquidity of the BTC/USDT pair on Binance, the most liquid trading pair in crypto, fell by 70% overnight. Currently, the only pair with zero fees is BTC/TrueUSD (TUSD). Without liquidity flowing into the pair, the order book could dry up further in the future.

Kaiko

KaikoWhat this means is that the “size” needed to move the Bitcoin price is getting smaller and smaller today. Volatility can be triggered by more traders being able to influence the price.

Thankfully for investors, the credibility crisis in banks has so far increased buying pressure and pushed prices higher. However, the lack of support on the upside also applies to the downside.

In other words, we also need to watch out for big declines ahead. It is too early for Bitcoin maximalists to celebrate their victory.

Given what has happened in traditional markets over the past two weeks, the influx of capital to Bitcoin is certain. But illiquidity has arguably played the biggest role in pushing up prices.

Mr. Conor Ryder: Research analyst at Kaiko, a crypto asset data company.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: Bitcoin Was a Winner During the US Banking Crisis, but Illiquidity Prevents It From Being a USD Hedge

The post Bitcoin is the winner of the banking crisis, but illiquidity blocks the way to hedge the US dollar[Column]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·