The exit or downsizing of two influential cryptocurrency market makers, Jane Street and Jump Crypto, could undermine the industry’s fragile liquidity. ──. A Kaiko analyst told CoinDesk.

Bloomberg reported on May 9 that the two companies are scaling back their cryptocurrency trading in the United States amid tightening regulations triggered by the FTX bankruptcy in November last year. Jump Crypto’s cryptocurrency arm continues to expand globally, and Jane Street is said to scale back its growth plans.

“This news is not necessarily surprising given the recent developments,” Riyad Carey, an analyst at Silkworm, told CoinDesk.

“The concern is that liquidity has yet to recover from the collapse of Alameda, and the slowdown in two large surviving market makers could further squeeze liquidity. It’s a little surprising that it’s taken so long to fill the hole in Alameda.”

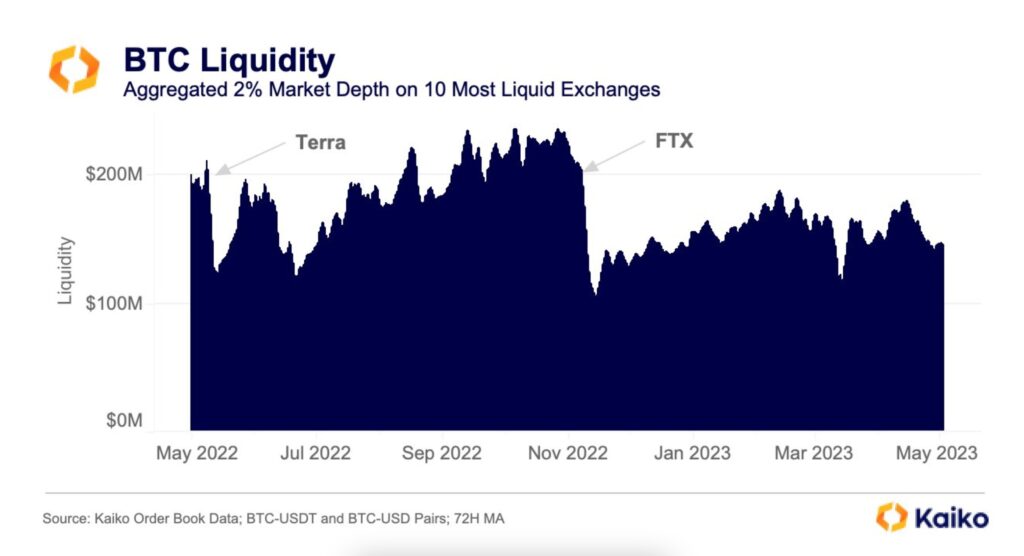

Market Depth, a metric for measuring the liquidity of an exchange by estimating how much capital it takes to move the market, has dropped more than 50% after the FTX collapse, down from year-to-date cryptocurrency prices. Not recovered despite rising.

Are you talking about America?

But for crypto-native market makers, the problem with the two companies seems to be a problem in the US market, and they don’t seem to care much.

Zahreddine Touag, head of trading at Paris-based market maker Woorton, said: “No big impact yet. Liquidity on some exchanges will drop in the short term, but it’s more of a problem. , making it difficult for U.S. counterparties to source OTC (over-the-counter) liquidity,” he told CoinDesk.

He continued, “It could become a problem in the future if brokers, payment providers, etc. that want to source liquidity start to shift offshore or to Europe and Asia.”

America’s strong stance on crypto regulation has already been criticized by Coinbase CEO Brian Armstrong and others, but the long-term impact could be far greater than the short-term. be.

Lack of liquidity leads to higher volatility as less money is needed to move assets. This, combined with the highly leveraged nature of the cryptocurrency market, has the potential to create credit risk that can spread across all sectors of finance.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Kaiko

|Original: Bitcoin Liquidity on the Brink as Market Makers Pare Back in Crypto Markets

The post Bitcoin liquidity is on the verge ── major market makers shrink trading | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

103

2 years ago

103

English (US) ·

English (US) ·