Long-term Bitcoin (BTC) holders are profitable for the first time in almost a year, according to data. Historically, a recovery in long-term holder profitability portends a big rally in the market.

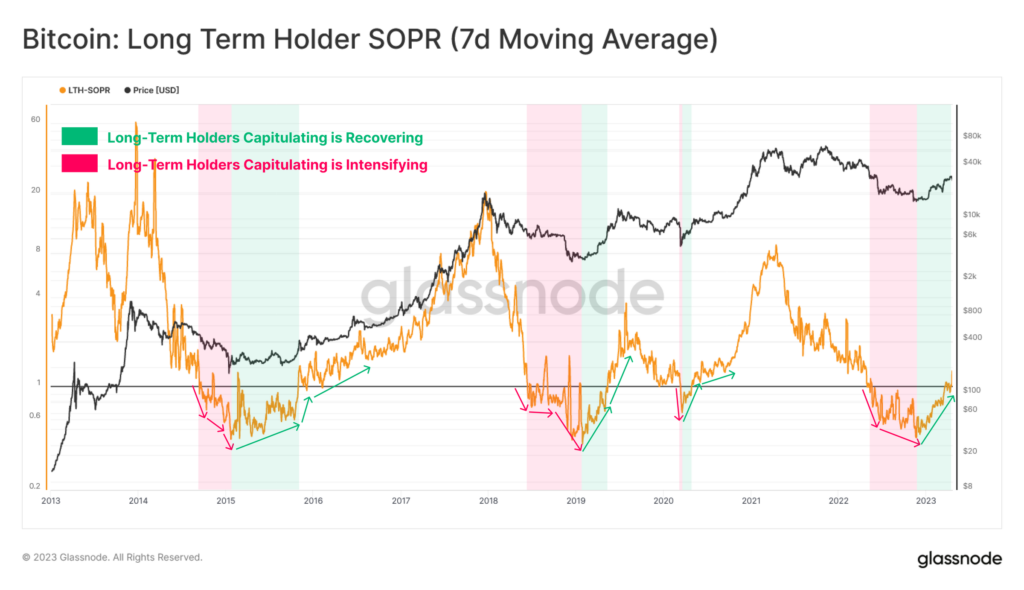

According to blockchain analytics firm Glassnode, the seven-day average of the LTH-SOPR, which measures the rate of return for long-term bitcoin holders, has surpassed 1 for the first time since May 2022.

SOPR (Spent Output Profit Ratio) is the ratio in US dollars between UTXO (Unspent Transaction Output) and the value of the wallet’s on-chain use of UTXO. A UTXO is transaction output that is not used as an input in a new transaction, and can be thought of as the change left in your pocket.

If wallet X sends 1 bitcoin to wallet Y, the former is considered to be spending or selling coins to the latter. If the value of the coin when X moved it to Y was higher than when it was acquired, then X has made a profit. If the SOPR is greater than 1, it means that the coins moved are being sold at a profitable value on average.

LTH-SOPR looks at coins that have moved on-chain and have been held for more than 155 days.

Glassnode analyst James Check said in the latest edition of his weekly notes: “The SOPR of long-term holders tends to reflect macro market changes. After long-term realized losses (LTH-SOPR

LTH-SOPR is above 1 for the first time since May 2022. (James Check/Glassnode)

LTH-SOPR is above 1 for the first time since May 2022. (James Check/Glassnode)

It is only recently that the ratio has risen above 1 as Bitcoin has recovered from a bear market. At $29,500 at the time of writing, Bitcoin is up 90% from its all-time high of $15,460 in November.

The past 1+ crossovers in May 2020, May 2019 and November 2015 coincided with the eventual turn into a multi-year bull market.

On the chart, extremely low ratios below 1 historically mark a time of investor disappointment, coinciding with market troughs. On the other hand, numbers above 10 mark the top of the market.

If the SOPR is above 1, the rise may slow down

An LTH-SOPR above 1 could imply a positive market cycle ahead, but could dampen Bitcoin’s rally in the short term.

“Current long-term holders, many of whom acquired in 2021-22, are likely to remain under the surface and present resistance in the process of market recovery,” said Check. ing.

South Korean crypto-asset analytics firm CryptoQuant echoed a similar sentiment, saying that a return to profitability could inject selling pressure into the market.

“From an on-chain data perspective, the Bitcoin price could come under downward pressure due to increased spending by whales (major investors) and long-term holders profiting at the highest margins in almost a year. There is,” CryptoQuant said in a report provided to CoinDesk.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: James Check/Glassnode

|Original: Long-Term Bitcoin Holders Are Profitable for First Time in 11 Months, Blockchain Data Shows

The post Bitcoin long-term holders profit for the first time in 11 months ── Is it a turning point to a bull market | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

138

2 years ago

138

English (US) ·

English (US) ·