Bitcoin (BTC) fell to a three-week low on the 8th, after US Federal Reserve Chairman Jerome Powell’s hawkish remarks in Congress weighed on him.

Bitcoin fell to $21,871 during Asian trading hours, a three-week low, according to CoinDesk data. Around 22,985 dollars after 18:30 on the 8th Japan time. Ethereum (ETH) is also close to yesterday’s low of $1,535 again.

Mr. Powell said on Wednesday that the Fed was likely to raise interest rates more than previously expected and warned that the process of pushing inflation down to its 2% target was “a long road”. Since last year, the Fed has raised interest rates to 4.5%, impacting crypto assets and other risky assets.

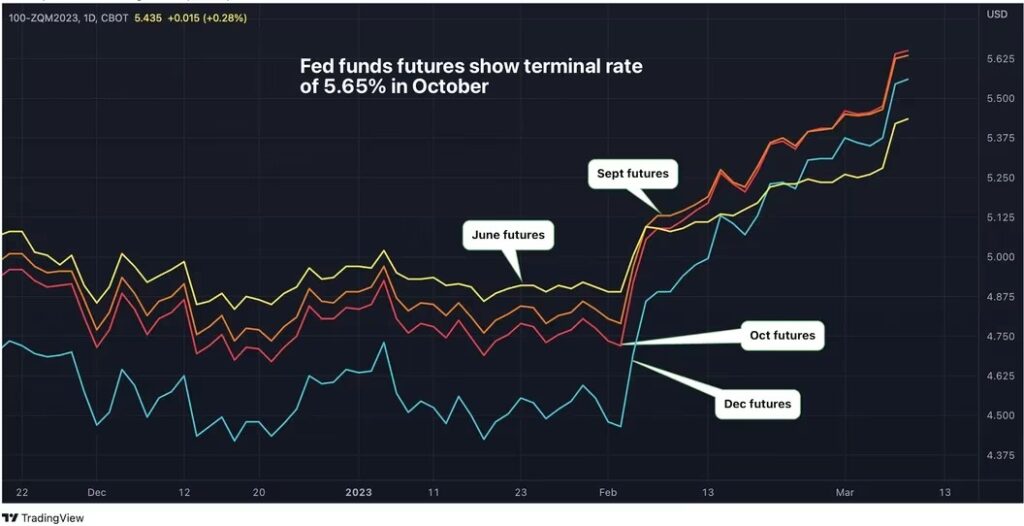

Following Powell’s hawkish remarks, federal funds rate futures traders raised their rate peak forecasts to 5.65% from around 5.47% earlier this week and 4.9% a month ago. In other words, traders still expect tightening to continue in the coming months and the Fed to raise rates by at least another 1%.

(TradingView/CoinDesk)

(TradingView/CoinDesk)A closer look at federal funds rate futures shows that traders have already priced in the Fed’s “high rates, long” approach. Fed funds futures are derivatives contracts that are widely used to represent traders’ interest rate expectations.

What is the impact of rising interest rates?

In another indicator, the market now sees a 70% chance that the Fed will raise rates by 0.5% at the end of the month, re-accelerating tightening from 0.25% in February. Interest-rate-sensitive two-year Treasury yields could climb above 5% for the first time since 2007 and climb to 5.655%.

Rising interest rates/yields could make risky assets less attractive, making it more difficult for Bitcoin to sustain its current price, QCP Capital said. The firm said last month that bitcoin is not in the final stages of its bear market and that the price could fall, if not below the November low of $15,480.

But Geo Chen, a macro trader and author of the popular Fidenza Macro newsletter, doesn’t believe higher yields will lead to a significant drop in risk assets.

“My long-term view is that a return to disinflation will put risk assets in an uptrend, but this could take months,” Chen said.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: CoinDesk

|Original:Bitcoin Slips to 3-Week Low as Market Sees Federal Reserve Lifting Rates to 5.65%

The post Bitcoin, lowest price in 3 weeks ── dropped to near $ 22,000 | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

196

2 years ago

196

English (US) ·

English (US) ·