Macroeconomics and financial markets

In the US NY stock market on the 24th, the Dow continued to rise by $254 (0.8%) higher than the previous day.

The Wall Street Journal also boosted the market by going one step further and reporting that “the Fed (Federal Reserve) will slow down the pace of interest rate hikes and may discuss a moratorium on rate hikes after this spring.” At the US Federal Open Market Committee (FOMC) held in December last year, the range of interest rate hikes was reduced from 0.75 points for four consecutive meetings to 0.5 points.

Relation:NY Dow continues to rise Bitcoin mining stocks also rise | 24th Financial Tankan

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.45% from the previous day to $23,065.

BTC/USD daily

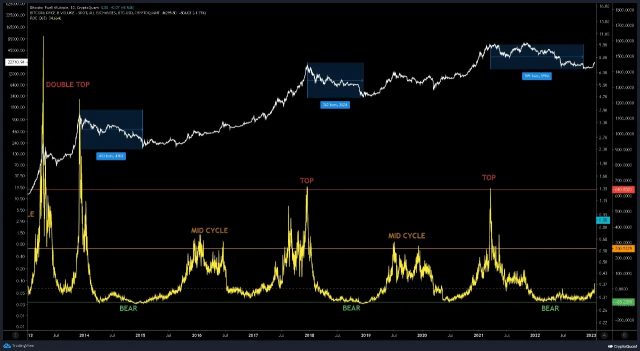

Rekt Capital compares the market to 2019, which was in a post-bubble bear market. He pointed out that the market structure before the breakout and the current market structure are very similar.

Rekt Capital

Also, as the latest price movement, he mentioned that the weekly 200MA (200-day moving average) may function as a resistance. In order to confirm the bullish momentum, the 200MA “recapture” is a prerequisite.

Rekt Capital

On the other hand, bearish Capo continues to look down on the current rally, saying, “The current rally is one of the biggest bull traps in history.” If it falls, we expect a rally from $11,000-12,000.

1) High timeframe.$BTC is still testing major resistance. Weekly close will be key, but there’s no bullish confirmation yet. pic.twitter.com/3nMPjTXzjR

— il Capo Of Crypto (@CryptoCapo_) January 14, 2023

In addition, according to a weekly report from asset management company CoinShares, institutional and accredited investors’ capital flows into digital assets such as cryptocurrency (virtual currency) mutual funds have exceeded inflows of $37 million.

However, 68% of the inflows are inverse financial products that invest in short positions, suggesting a bearish outlook. With the market revitalizing, the weekly trading volume is $1.6 billion, above the past 90-day average.

On-chain data analysis

CryptoQuant Certified Analyst caueconomy notes that the Bitcoin Puell Multiple has broken out of the bearish zone. “The worst may have passed,” he noted.

The puer multiplier is an index of the miner’s rate of return, which is obtained by dividing the total amount of bitcoin issued per day by the annual average. If this number is above the threshold “1.0”, it means that the miner is getting a return rate that exceeds the annual average, and if it is less than “1.0”, it is below the annual average and is in a difficult situation.

According to past market statistics, a puer multiple of 0.5 or less is a good level to buy BTC spot, and a puer multiple of 0.3 or less has shown the bottom of the market.

CryptoQuant

In December 2018, when 1BTC fell to the $3,300 level, the Puer multiple was 0.30. It fell to 0.37 at the time of the corona shock in March 2020 when the entire financial market crashed.

In a CryptoQuant post, Dan Lim pointed out that due to the bankruptcies of FTX and Alameda Research last November, “market participants’ interest continues to wane. As a basis for this, he cited changes in OI (open interest) and leverage ratios in the derivatives market.

Crypto market in 2023

“Looking at the open interest and leverage ratio, they have fallen sharply since the FTX incident, and despite the recent strong rally in #Bitcointhese two indicators still haven’t overheated at all.”

by @DanCoinInvestor

Link  https://t.co/2JueCxIUC5

https://t.co/2JueCxIUC5

— CryptoQuant.com (@cryptoquant_com) January 21, 2023

Virtual currency prices such as Bitcoin and Ethereum have rebounded sharply since the beginning of the year, but even now there is almost no sense of overheating. In particular, OI bottomed out in December last year and has only risen slightly.

As a background, the uncertainty of the recent cryptocurrency market cannot be dispelled, such as the trial results of Ripple, the money laundering reports surrounding Binance, and the future of Genesis’s parent company Digital Currency Group (DCG), which went bankrupt the other day, and many investments have been made. It is conceivable that the house has not lost its skeptical stance.

“2023 may not be a bear market like 2022, but rather a preparation period for the next bull market,” said Dan Lim.

Relation:“Market recovery is U-shaped, not V-shaped” Bitwise predicts the cryptocurrency industry in 2023

Click here for a list of market reports published in the past

The post Bitcoin Maintains $23,000 Level, Minor Indicator “Puer Multiples” Exits Bearish Zone appeared first on Our Bitcoin News.

2 years ago

163

2 years ago

163

English (US) ·

English (US) ·