Macroeconomics and financial markets

In the US NY stock market on the 10th, the Dow Jones Industrial Average was higher than the previous day’s 209 dollar (0.62%), and the Nasdaq index was 24 points higher (0.18%).

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, the Bitcoin price rose 1.1% from the previous day to 1 BTC = $ 30,480.

A new research report released by Standard Chartered Bank has shown a bullish price forecast for Bitcoin. We analyzed that it could rise to $50,000 (7 million yen) by the end of this year and $120,000 (17 million yen) by the end of 2024.

Standard Chartered Bank said it expects Bitcoin to drop to $5,000 by the end of 2022, when major cryptocurrency exchange FTX collapsed.

In a research note on Monday, Standard Chartered Bank predicted that the price of bitcoin could rise to $50,000 by the end of 2023 and $120,000 by the end of 2024. It is worth noting that Standard Chartered Bank predicted at the end of 2022 that Bitcoin may fall to $5,000 in…

— Wu Blockchain (@WuBlockchain) July 11, 2023

This forecast highlights the increase in minor profits. He said that as profitability improves, the selling pressure of bitcoins held after mining will be eased, and the decrease in supply will lead to higher prices.

connection:“Bitcoin could rise to $120,000 by the end of 2024,” Standard Chartered Bank revised forecast upwards

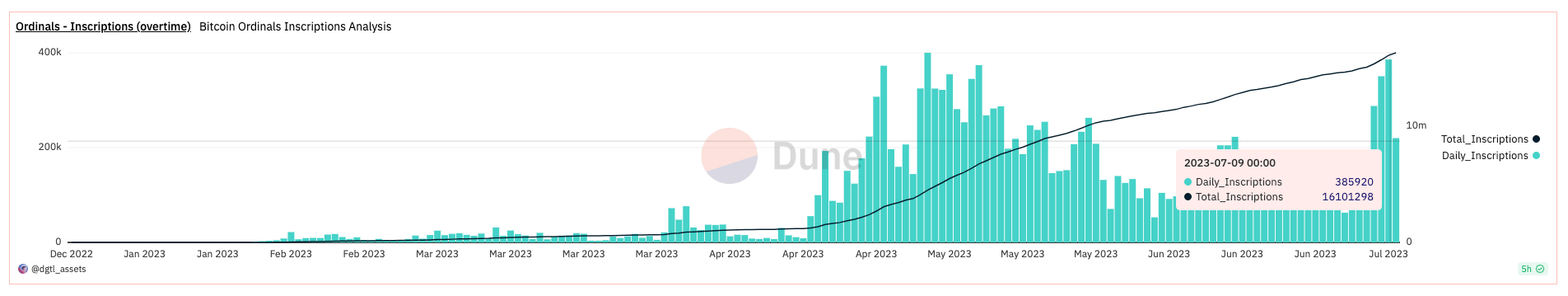

In addition, the rise of Ordinals (Inscriptions) and ERC-20 tokens has been pointed out as a reason for the recent miner activation. Average weekly miner revenue peaked at $33.9 million in May 2023, but fell 25% in early June, according to data from on-chain analytics platform Glassnode.

According to Dune, a blockchain data analysis tool, last weekend Ordinals recorded 385,920 registrations, the second-highest number ever since May 7th.

Dune

In an interview with CNBC, former SEC Chairman Jay Clayton was also well received when he said that a Bitcoin ETF “should be approved.”

JUST IN:  Former SEC Chairman says Spot #Bitcoin ETFs should be approved. pic.twitter.com/szb6vTzpLj

Former SEC Chairman says Spot #Bitcoin ETFs should be approved. pic.twitter.com/szb6vTzpLj

— Watcher.Guru (@WatcherGuru) July 10, 2023

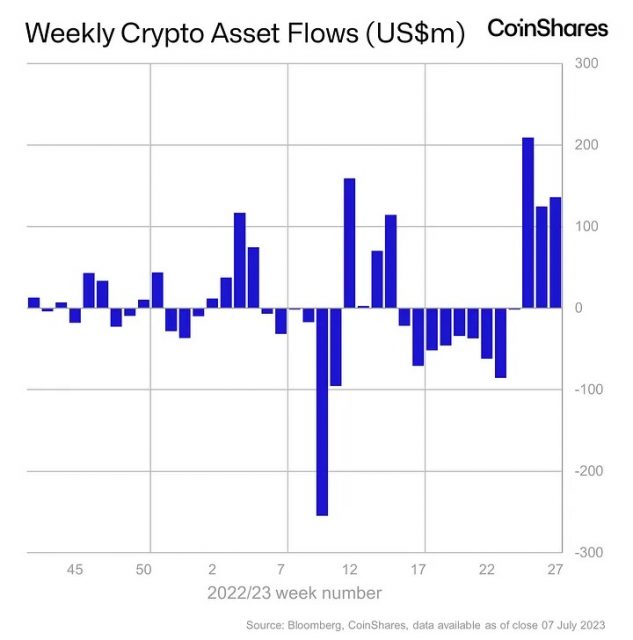

According to the weekly report of CoinShares, an asset management company, the flow of funds from institutional investors to digital assets such as cryptocurrency (virtual currency) investment trusts has been net buying (increased inflow) for the third consecutive week.

Last week’s inflow amounted to $136 million, and the inflow for the past three consecutive weeks reached $470 million. Sentiment has deteriorated sharply due to the impact of the Binance lawsuit, and it looks like it has canceled the total outflow amount of the past 9 weeks, which has become a net selling.

coins

Meanwhile, weekly trading volume slowed to less than 50% compared to the past two weeks. Altcoins saw small inflows to Solana (SOL), XRP, Polygon (MATIC), Litecoin (LTC) and Aave (AAVE).

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin maintains $ 30,000 level Virtual currency fund has a large net purchase for 3 consecutive weeks appeared first on Our Bitcoin News.

1 year ago

122

1 year ago

122

English (US) ·

English (US) ·